E

vsV

Ergo vs VC-Funded Chains

Built for Users, Not Investors

Fair Distribution

All ERG is mined - no insider allocation, no ICO, no premine

Aligned Incentives

No VCs demanding returns, pivots, or token unlocks

Community Governance

Decisions made by users and miners, not boardrooms

Long-term Focus

Building sustainable technology, not pumping for exits

Feature Comparison

| Feature | Ergo | VC-Funded Chains |

|---|---|---|

| Consensus | PoW (Autolykos v2, GPU-friendly) | PoS/DPoS variants |

| Launch & Distribution | Fair launch: No ICO, no premine, no VC | 40-60% insider/VC allocation |

| State / Accounting Model | eUTXO (Programmable UTXO) | Account-based (various) |

| Smart Contracts | ErgoScript + Sigma Protocols | EVM-compatible typically |

| L1 Privacy | Programmable privacy (Sigma Protocols) | None typically |

| Demurrage / Storage Rent | Storage rent on inactive boxes (~4+ years) | None typically |

| MEV Resistance | MEV-aware design (eUTXO + local ordering) | High MEV typically |

| Fees & Finality | ~$0.01 fees; ~2 min blocks; stable PoW finality | Variable; often subsidized initially |

| Light Clients | NiPoPoWs (trustless, ~1MB proofs) | Typically trust-based |

| Censorship Resistance | Strong (PoW, no validators to pressure) | Weak (often centralized validators) |

| Native Assets | Native L1 tokens (no wrapper contracts) | Usually ERC-20 style |

indicates advantage in that category. Last updated: 2025-11-26

Deep Dive

Token Distribution

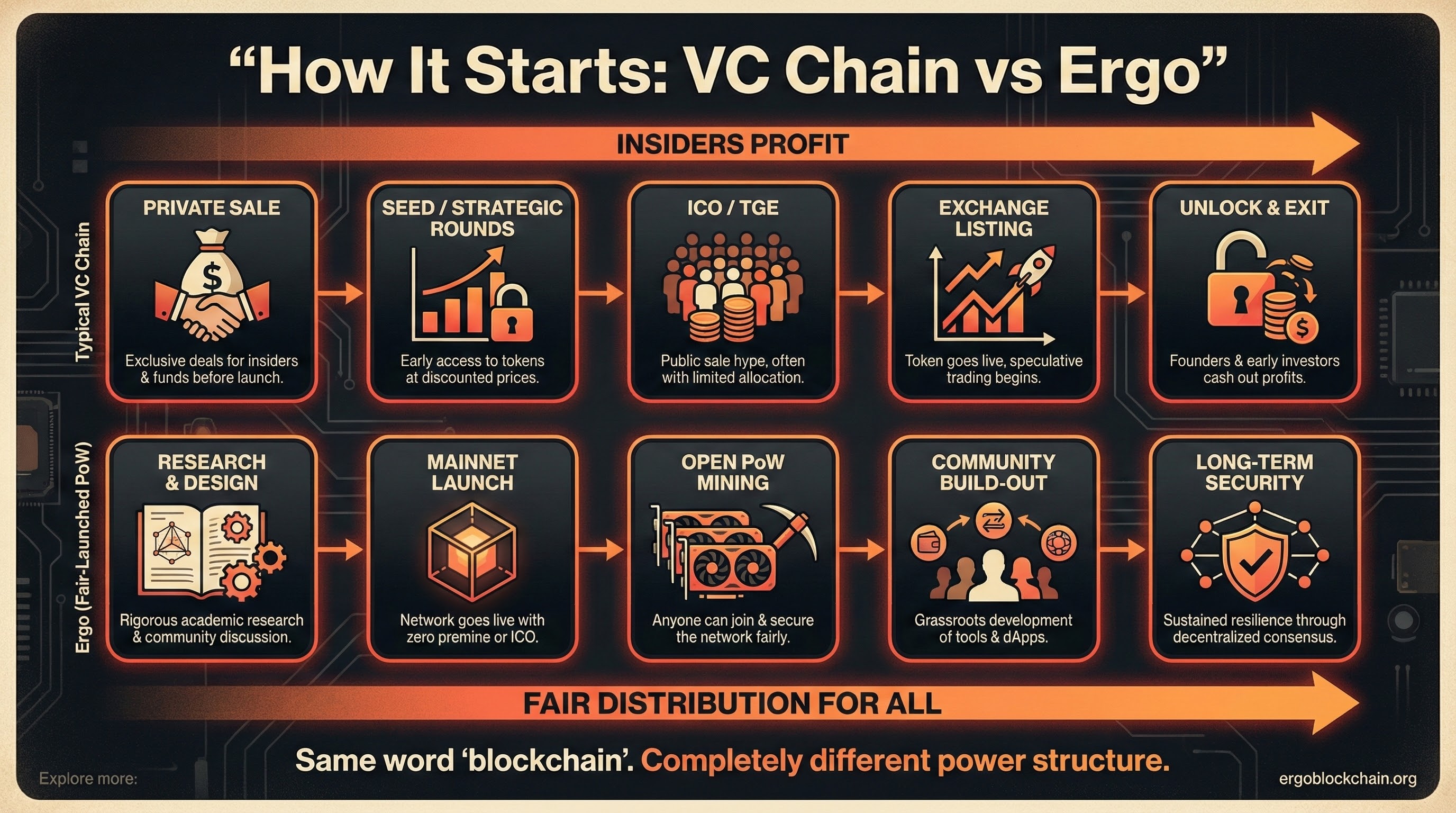

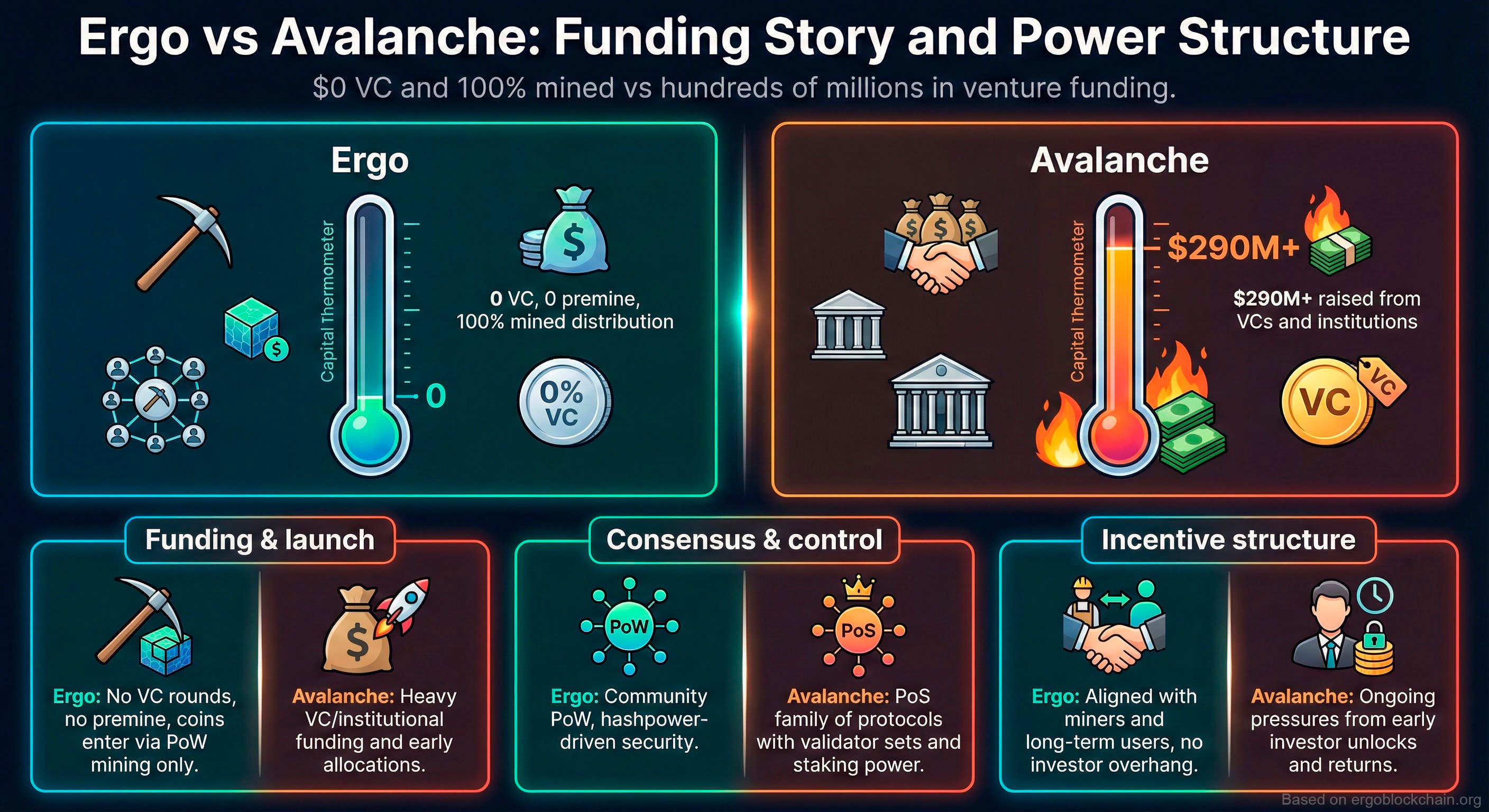

Typical VC chains allocate 40-60% of tokens to insiders: founders, team, advisors, and VCs. These tokens unlock over time, creating constant sell pressure. Ergo has zero insider allocation - all ERG is mined through PoW.

Ergo Advantage

No token unlocks, no insider dumps. Supply is predictable and fair.

Incentive Alignment

VC-funded projects must deliver returns to investors. This often means prioritizing token price over technology, rushing to market, or pivoting away from original vision. Ergo's only stakeholders are users and miners.

Ergo Advantage

Development focused on technology and users, not investor returns.

Governance Reality

Despite 'decentralized governance' claims, VC chains are typically controlled by foundations holding large token stakes. Ergo's governance emerges from community consensus and miner signaling.

Ergo Advantage

Real decentralization in decision-making, not theater.

Related Articles

Related Infographics

Frequently Asked Questions

More Comparisons

Ready to Experience Ergo?

Join thousands of users who chose decentralization, security, and financial freedom.