E

vsR

Ergo vs Ravencoin

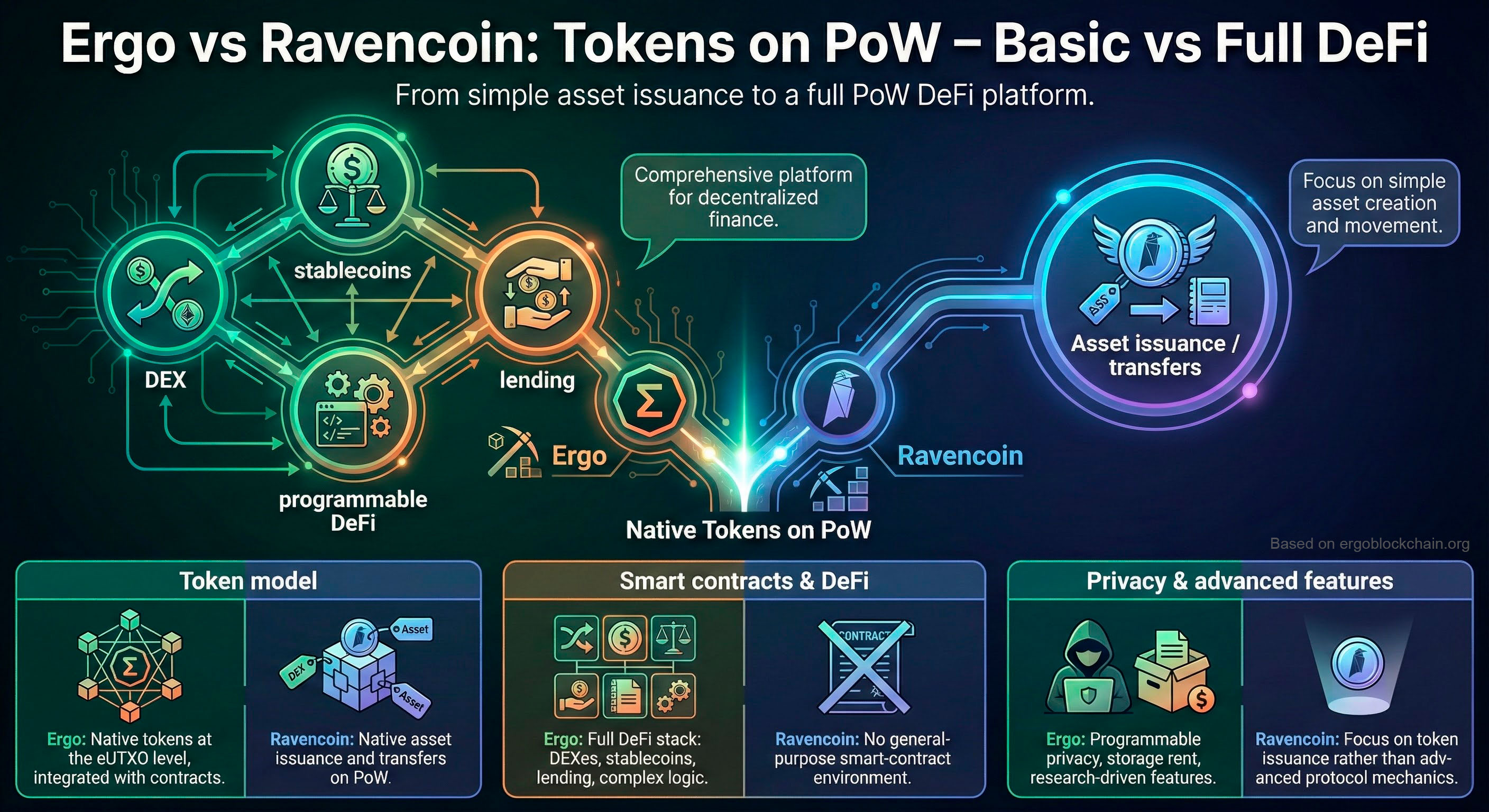

Full DeFi Platform vs Asset-Focused Chain

Smart Contracts

Ergo has Turing-incomplete but powerful ErgoScript; Ravencoin has limited asset scripts

DeFi Capabilities

Ergo supports DEXs, lending, stablecoins; Ravencoin is asset issuance only

Privacy

Ergo has Sigma Protocols; Ravencoin has no privacy features

Sustainability

Ergo has storage rent; Ravencoin has no long-term security mechanism

Feature Comparison

| Feature | Ergo | Ravencoin |

|---|---|---|

| Consensus | Autolykos PoW | KAWPOW PoW |

| Smart Contracts | Full (ErgoScript) | Limited (asset scripts) |

| Token Focus | General purpose + tokens | Asset issuance focused |

| DeFi | Active ecosystem | None |

| Privacy | Sigma Protocols, ErgoMixer | None |

| State Model | eUTXO | UTXO + asset layer |

| Long-term Security | Storage rent | Fees only |

| Fair Launch | Yes | Yes |

| Messaging | Via contracts | Native messaging |

indicates advantage in that category. Last updated: 2025-01-01

Deep Dive

Smart Contract Power

Ravencoin was designed specifically for asset issuance with limited scripting. Ergo's ErgoScript enables complex DeFi: DEXs, stablecoins, lending protocols, and more. If you need more than token transfers, Ergo is the choice.

Ergo Advantage

Full DeFi capabilities vs simple asset transfers.

Token Capabilities

Both support native tokens without smart contracts. Ravencoin has unique features like messaging and restricted assets. Ergo tokens can participate in complex DeFi protocols and smart contracts.

Ergo Advantage

Tokens can be used in DeFi, not just transferred.

Privacy Features

Ravencoin has no privacy features. Ergo provides Sigma Protocols for zero-knowledge proofs and ErgoMixer for transaction mixing, enabling private transfers when needed.

Ergo Advantage

Optional privacy for sensitive transactions.

Long-term Viability

Both face the post-emission challenge. Ergo's storage rent provides sustainable miner income. Ravencoin must rely entirely on transaction fees, which may not sustain security.

Ergo Advantage

Storage rent ensures long-term security budget.

Related Articles

Related Infographics

Frequently Asked Questions

More Comparisons

Ready to Experience Ergo?

Join thousands of users who chose decentralization, security, and financial freedom.