E

vsA

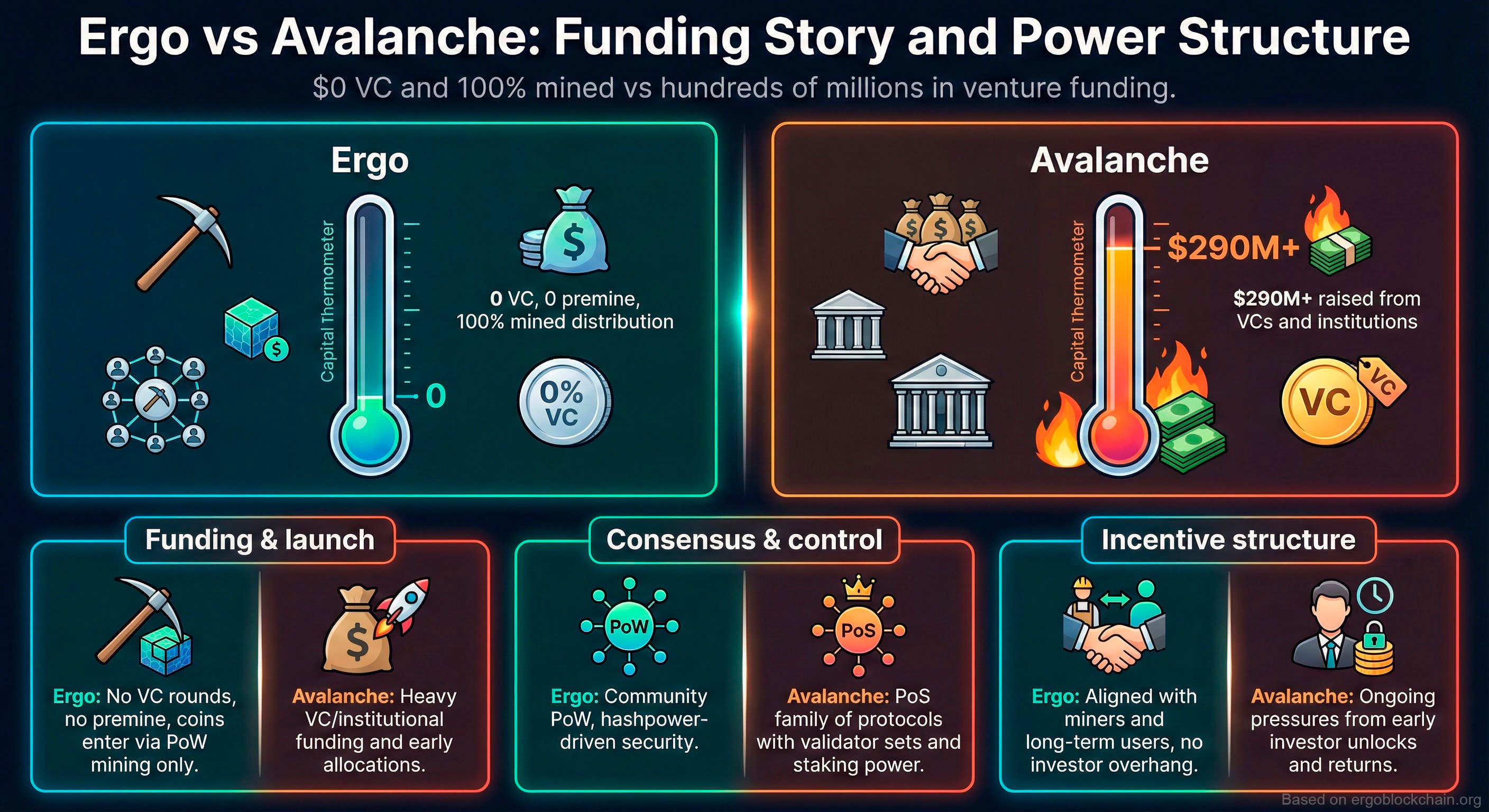

Ergo vs Avalanche

Grassroots PoW vs VC-Backed PoS

Token Distribution

Ergo: 100% mined, no pre-mine. Avalanche: 50% to insiders/team/foundation

Consensus

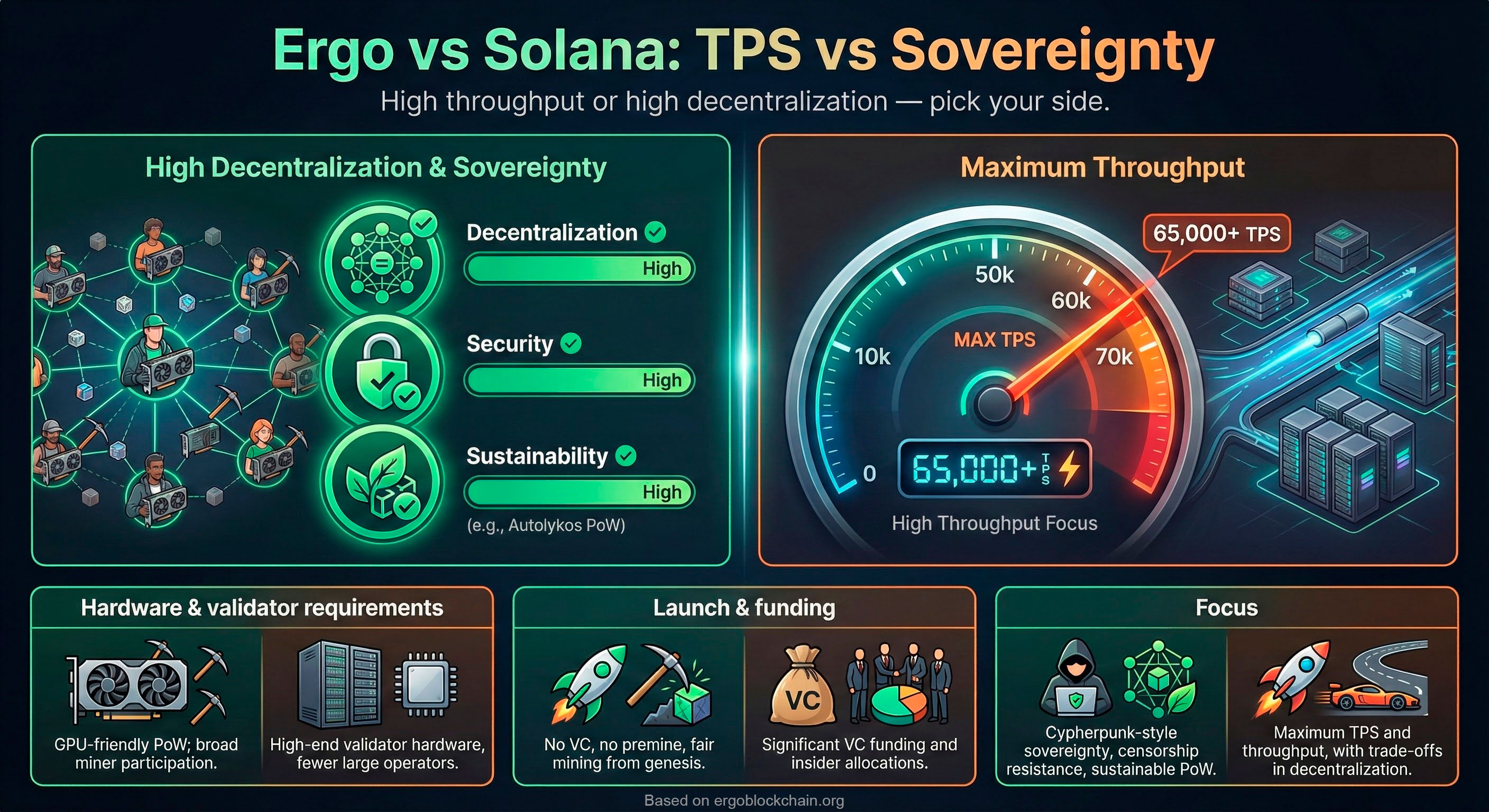

Ergo: GPU-mineable PoW. Avalanche: PoS requiring 2000 AVAX ($50K+) to validate

Censorship Resistance

Ergo: permissionless mining. Avalanche: validators can be identified and pressured

MEV Protection

Ergo: no front-running by design. Avalanche: MEV extraction is possible

Feature Comparison

| Feature | Ergo | Avalanche |

|---|---|---|

| Consensus | Autolykos PoW | Avalanche PoS |

| Token Distribution | 100% mined | ~50% insider allocation |

| VC Funding | None | $290M+ raised |

| Validator Requirements | GPU (any) | 2000 AVAX (~$50K) |

| Smart Contracts | ErgoScript (eUTXO) | Solidity (EVM) |

| MEV | Resistant by design | Present |

| Privacy | Sigma Protocols | None native |

| TPS (claimed) | ~47 (scaling via L2) | 4500+ |

| Finality | ~10 min (probabilistic) | ~1 second |

| Decentralization | Thousands of miners | ~1200 validators |

indicates advantage in that category. Last updated: 2025-01-01

Deep Dive

Token Distribution & Fairness

Avalanche conducted multiple funding rounds, raising over $290M from VCs including Andreessen Horowitz, Polychain, and Three Arrows Capital. Approximately 50% of tokens went to team, foundation, and investors. Ergo had zero pre-mine, zero ICO - every ERG was mined through PoW, ensuring no insider advantage.

Ergo Advantage

True fair launch with no insider allocation or VC influence.

Consensus & Censorship Resistance

Avalanche uses Proof-of-Stake where validators must stake 2000 AVAX (worth $50,000+). This creates barriers to entry and validators are identifiable, making them targets for regulatory pressure. Ergo's PoW allows anyone with a GPU to mine anonymously.

Ergo Advantage

Permissionless, anonymous participation in consensus.

MEV & Front-Running

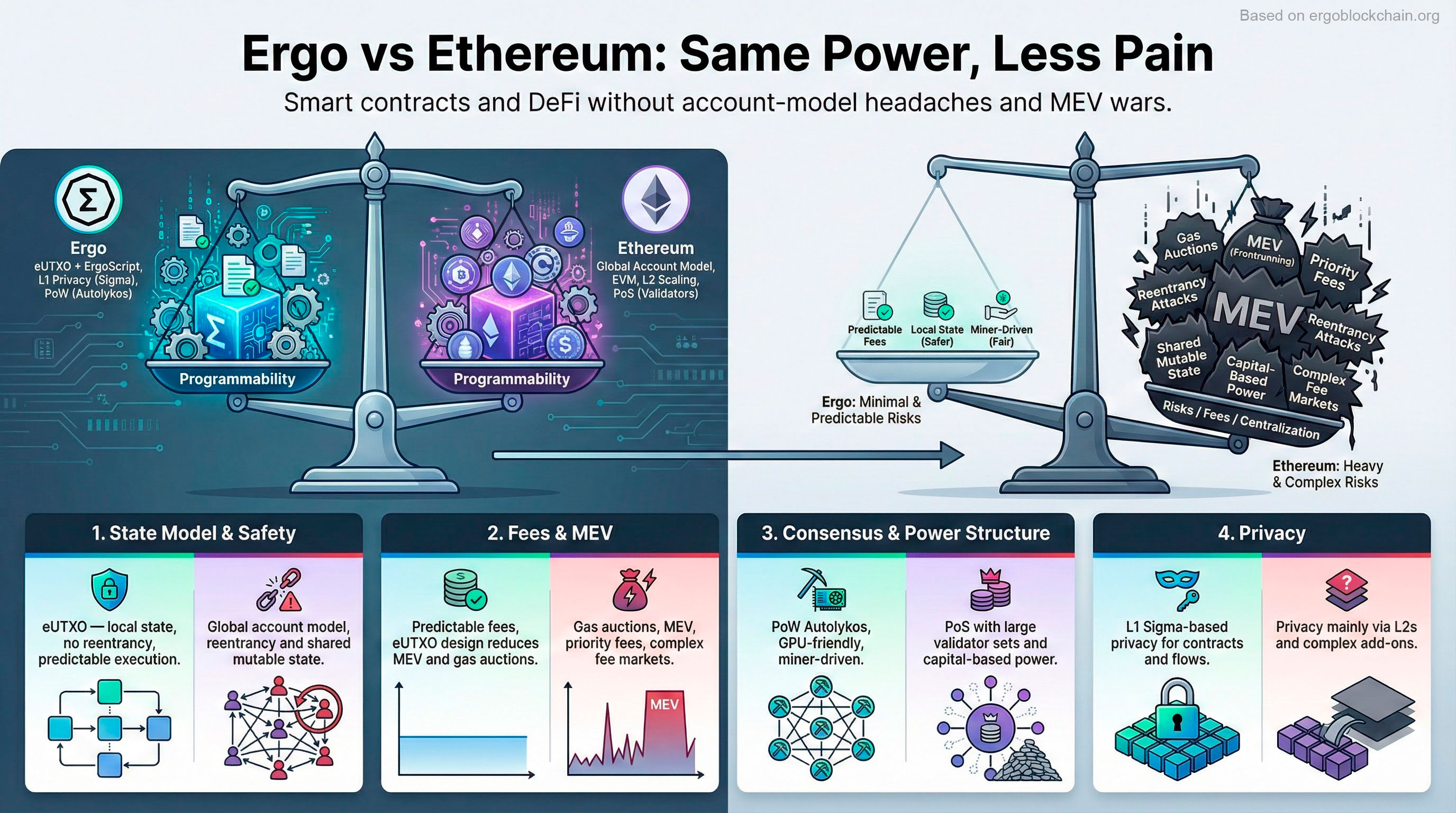

Avalanche's account model and fast finality enable MEV extraction - validators and bots can front-run user transactions for profit. Ergo's eUTXO model makes front-running structurally impossible because transaction outputs are deterministic.

Ergo Advantage

No MEV extraction means fairer trading for users.

Smart Contract Model

Avalanche uses the EVM with Solidity - familiar to developers but with known issues (reentrancy, MEV). Ergo's ErgoScript on eUTXO is different but offers unique benefits: deterministic execution, parallel processing, and no reentrancy attacks.

Ergo Advantage

Safer smart contract execution model.

Related Articles

Related Infographics

Frequently Asked Questions

More Comparisons

Ready to Experience Ergo?

Join thousands of users who chose decentralization, security, and financial freedom.