Economics

Beginner

What is

Transaction Fees?

Small payments to miners for processing and including transactions in blocks.

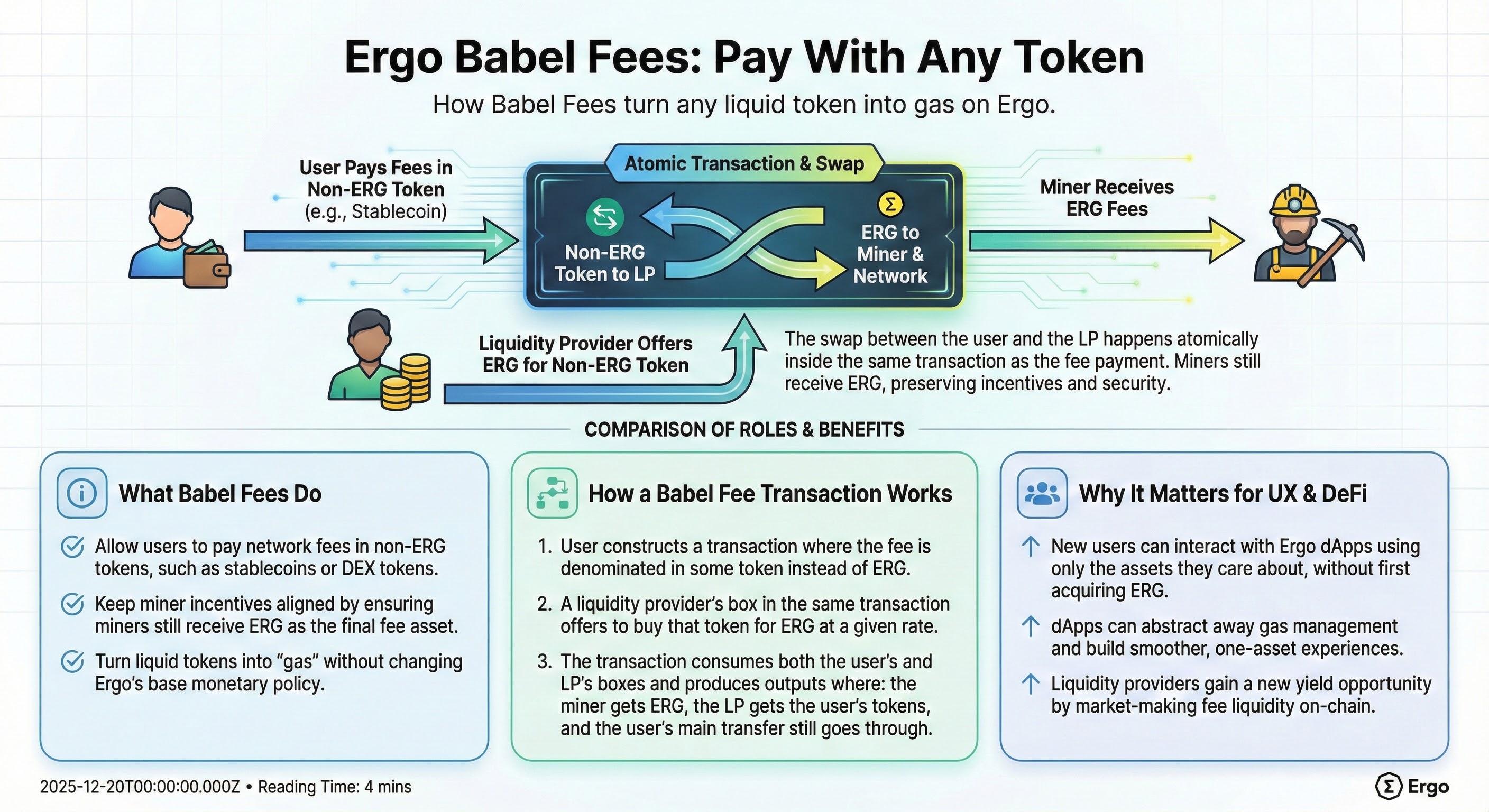

Transaction fees compensate miners for computational resources and block space. Ergo fees are predictable and low (typically ~0.001 ERG), calculated based on transaction size rather than gas auctions. This prevents fee spikes and MEV extraction common on account-based chains.

Key Points

- Typically ~$0.01 or less

- Based on transaction size, not auctions

- No gas price bidding wars

- Predictable before sending

- Go to miners as reward

- Babel fees allow paying in tokens

Related Infographics

Related Articles

Frequently Asked Questions

Questions about Transaction Fees

Common questions about this topic

How to use Spectrum DEX on Ergo?

Connect your Nautilus wallet to Spectrum Finance, select tokens to swap, review the rate and slippage, then confirm. Spectrum uses AMM liquidity pools for instant trades. You can also provide liquidity to earn fees. All trades are atomic - they complete fully or not at all, with no front-running possible.

How-to

DeFi

Is Ergo better than Ethereum for DeFi?

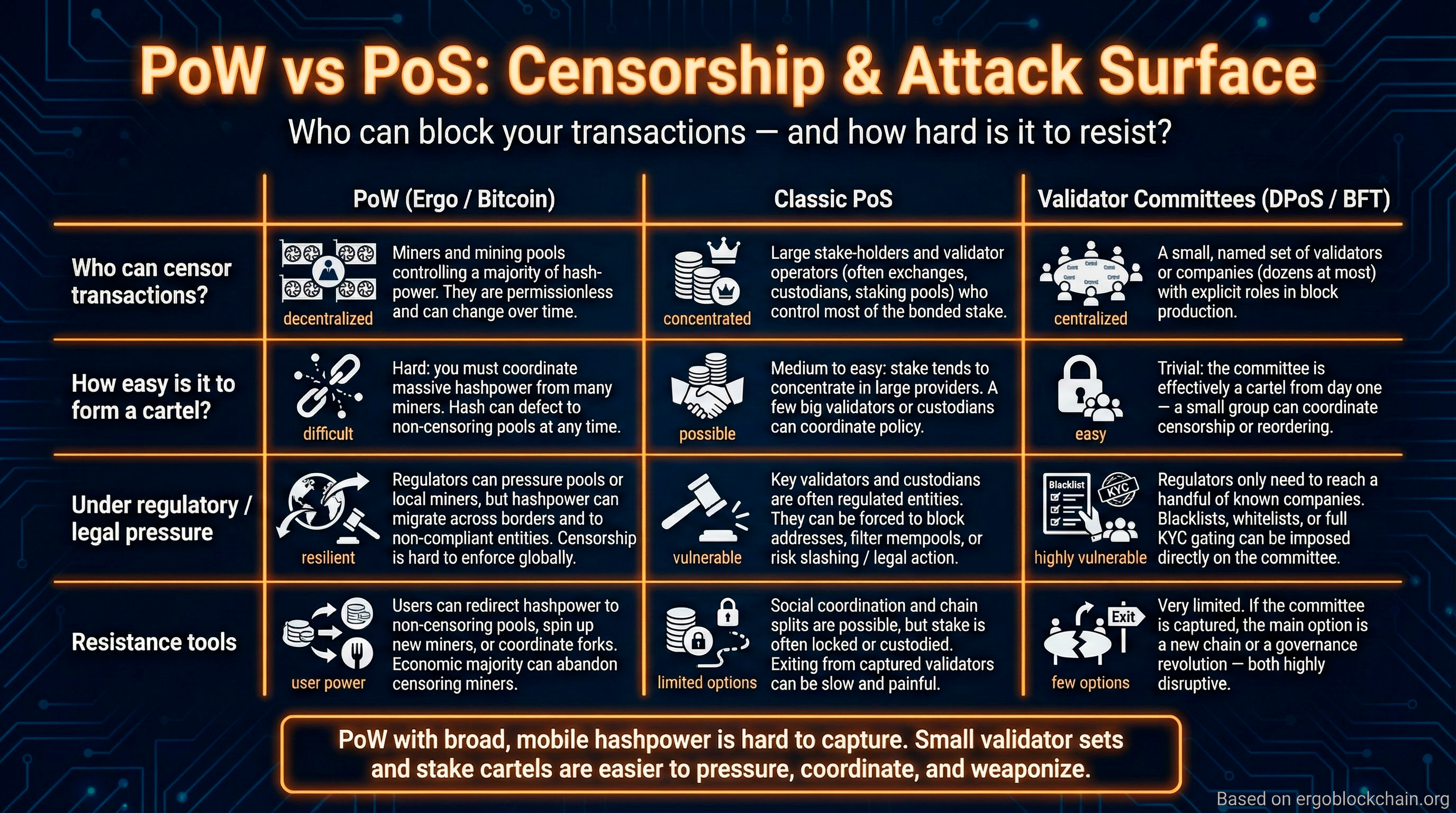

Ergo offers structural advantages for DeFi: no MEV extraction, deterministic gas costs, and no reentrancy attacks due to eUTXO. Ethereum has larger ecosystem and liquidity. Choose Ergo for security-critical applications, fair trading, and predictable costs. Choose Ethereum for maximum composability with existing protocols.

Comparison

DeFi

What is storage rent on Ergo?

Storage rent is Ergo's mechanism for long-term sustainability. Boxes (UTXOs) that remain unspent for ~4 years pay a small fee, which goes to miners. This prevents state bloat, recirculates lost coins, and ensures miners have income even after emission ends. It's like paying rent for blockchain storage space.

Explainer

Technology

What happens when all ERG is mined?

When emission ends (~2045), miners will continue earning from transaction fees and storage rent. Unlike Bitcoin which relies solely on fees, Ergo's storage rent provides a sustainable income stream by recycling coins from inactive boxes. The network remains secure without depending on ever-increasing transaction volume.

Explainer

Technology