Smart Contracts

Beginner

Updated 11/26/2025

What is

Stablecoins?

Cryptocurrencies designed to maintain a stable value, typically pegged to fiat currencies like USD.

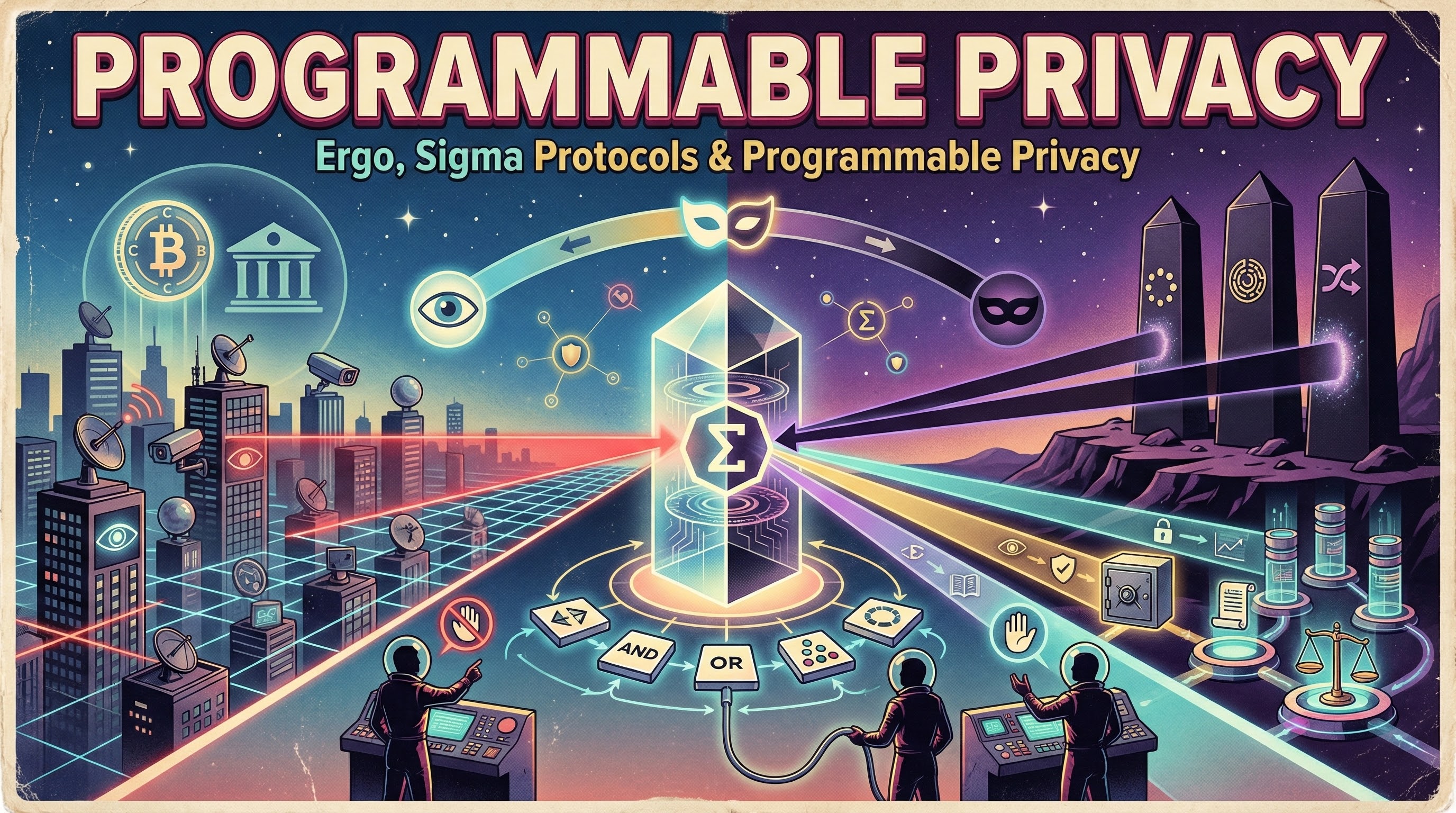

Stablecoins are cryptocurrencies designed to maintain a stable value, usually pegged to fiat currencies like USD. On Ergo, SigmaUSD is an algorithmic stablecoin backed by ERG reserves. Stablecoins enable DeFi, payments, and value storage without volatility, while remaining censorship-resistant unlike bank deposits.

Key Points

- Stable value (usually $1 USD)

- SigmaUSD is Ergo's native stablecoin

- Algorithmic (no centralized reserves)

- Over-collateralized with ERG

- Essential for DeFi trading pairs

- Censorship-resistant unlike bank USD

Use Cases

1

Stable value storage on Ergo

2

Trading pairs on DEXs

3

Payments without volatility

4

Hedging ERG price movements

5

DeFi collateral

Technical Details

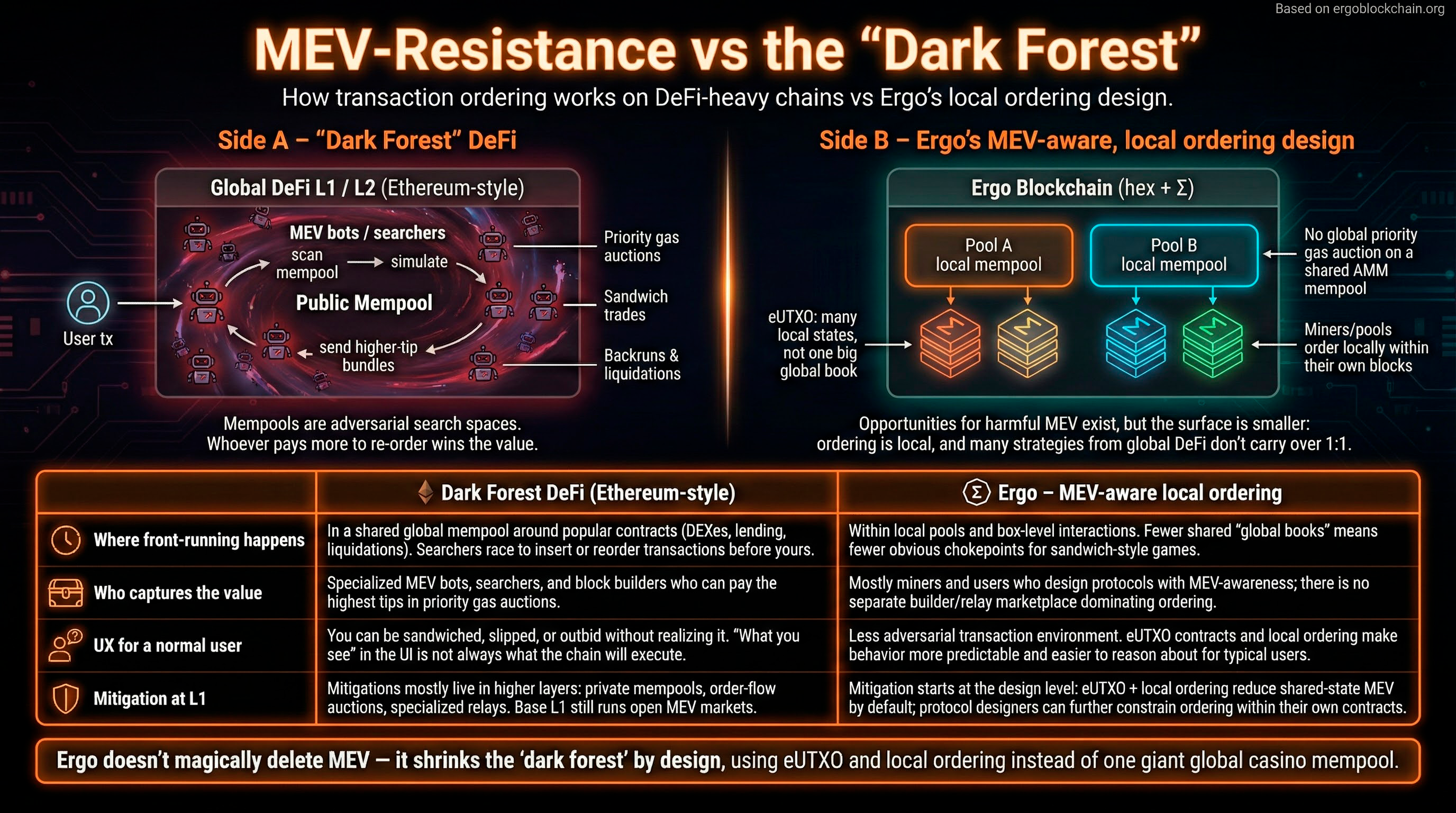

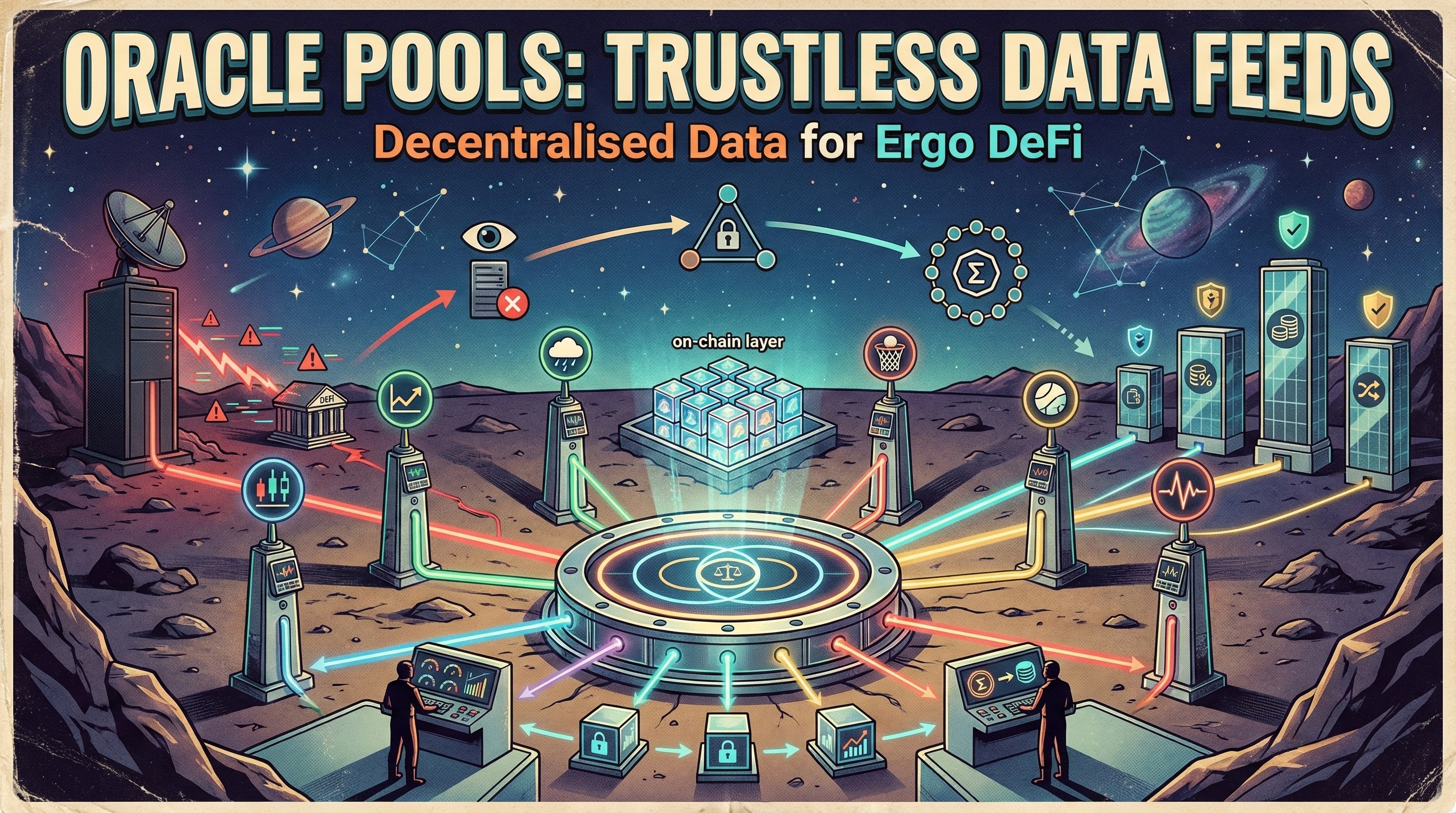

SigmaUSD uses the AgeUSD protocol with ERG as collateral. Users mint SigmaUSD by locking ERG, or mint SigmaRSV to provide reserve backing. The reserve ratio (typically 400-800%) ensures stability. Oracle pools provide the ERG/USD price feed.

Related Infographics

Related Articles

Frequently Asked Questions

Questions about Stablecoins

Common questions about this topic

How to get started with Ergo?

Start by getting a wallet (Nautilus for browser, Terminus for mobile). Back up your seed phrase securely offline. Get some ERG from an exchange (Gate.io, KuCoin) or DEX (Spectrum). Make a test transaction. Then explore: try DeFi on Spectrum, check out NFTs, or dive into the technology if you're a builder.

How-to

Getting Started

What can I do with Ergo?

Ergo supports a full ecosystem: trade on Spectrum DEX, use SigmaUSD stablecoin, mix transactions with ErgoMixer, collect NFTs on SkyHarbor, mine with GPUs, lend/borrow on DuckPools, bridge to other chains via Rosen, and build dApps with ErgoScript. It's a complete platform for decentralized finance and applications.

Explainer

Getting Started

Is Ergo a good investment?

This is not financial advice. Ergo has strong fundamentals: fair launch (no VC dump risk), innovative technology (eUTXO, Sigma Protocols, NiPoPoWs), active development, and a cypherpunk ethos. It's a smaller market cap project with higher risk/reward than established chains. Research thoroughly, understand the technology, and never invest more than you can afford to lose.

Comparison

Getting Started

What is SigmaUSD and how does it work?

SigmaUSD is Ergo's algorithmic stablecoin, pegged to USD and backed by ERG reserves. It uses the AgeUSD protocol: users mint SigUSD by depositing ERG, while SigRSV holders provide reserve backing and absorb volatility. The reserve ratio (400-800%) ensures stability. No centralized issuer, no bank accounts - pure crypto collateral.

Explainer

DeFi