Smart Contracts

Intermediate

Updated 11/26/2025

What is

eUTXO?

Extended Unspent Transaction Output - Ergo's programmable UTXO model that combines Bitcoin's security with smart contract capabilities.

eUTXO (Extended Unspent Transaction Output) is Ergo's state model that extends Bitcoin's simple UTXO design with programmable 'boxes' containing data, tokens, and smart contract logic. Unlike account-based models (Ethereum), eUTXO transactions consume specific outputs and create new ones, enabling parallel processing, deterministic execution, and elimination of reentrancy attacks.

Key Points

- Each 'box' contains ERG, tokens, and arbitrary data (registers R0-R9)

- Transactions consume boxes and create new ones atomically

- Enables parallel transaction validation (no shared state)

- Eliminates reentrancy attacks by design

- Deterministic - you know the exact outcome before submitting

- Native multi-asset support without wrapper contracts

Use Cases

1

DEXs with atomic swaps (no front-running possible)

2

Multi-signature wallets with complex spending conditions

3

Time-locked contracts with predictable execution

4

Privacy-preserving DeFi applications

Technical Details

Ergo boxes have registers R0-R9 where R0 holds the monetary value, R1 the protecting script (ErgoScript), R2 the tokens, R3 the creation info, and R4-R9 are available for arbitrary data. Scripts can access box contents, context (block height, headers), and perform cryptographic operations via Sigma protocols.

Related Infographics

Related Articles

Frequently Asked Questions

Questions about eUTXO

Common questions about this topic

How is Ergo different from Bitcoin?

Ergo extends Bitcoin's model with smart contracts. Both use PoW and UTXO, but Ergo adds: eUTXO for programmable boxes, ErgoScript for smart contracts, Sigma Protocols for privacy, storage rent for sustainability, and NiPoPoWs for light clients. Think of Ergo as 'Bitcoin with smart contracts done right.'

Comparison

Technology

Is Ergo a good investment?

This is not financial advice. Ergo has strong fundamentals: fair launch (no VC dump risk), innovative technology (eUTXO, Sigma Protocols, NiPoPoWs), active development, and a cypherpunk ethos. It's a smaller market cap project with higher risk/reward than established chains. Research thoroughly, understand the technology, and never invest more than you can afford to lose.

Comparison

Getting Started

What's the difference between Ergo and Cardano?

Both use eUTXO, but differ in consensus and philosophy. Ergo: PoW (Autolykos), fair launch, no VC funding, storage rent. Cardano: PoS (Ouroboros), VC-funded, larger ecosystem. Ergo prioritizes decentralization and sustainability; Cardano prioritizes academic rigor and institutional adoption.

Comparison

Technology

How to build DeFi on Ergo?

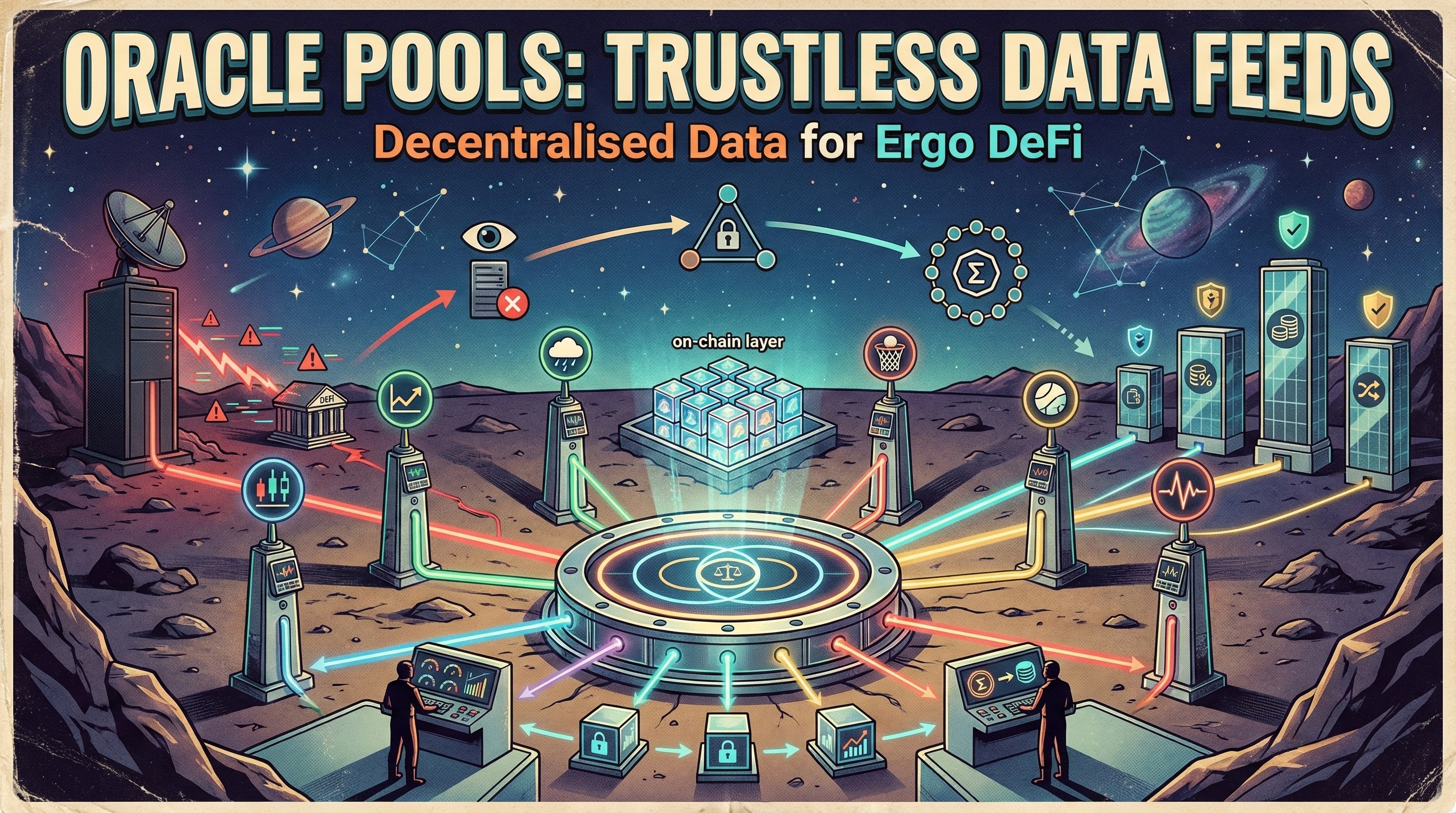

Building DeFi on Ergo starts with understanding the eUTXO model and ErgoScript. Unlike account-based chains, Ergo's box model provides deterministic execution, no MEV by design, and predictable gas costs. Use Oracle Pools for price feeds, and leverage existing patterns from Spectrum Finance and SigmaUSD.

How-to

DeFi