Smart Contracts

Intermediate

Updated 11/26/2025

What is

Oracle Pools?

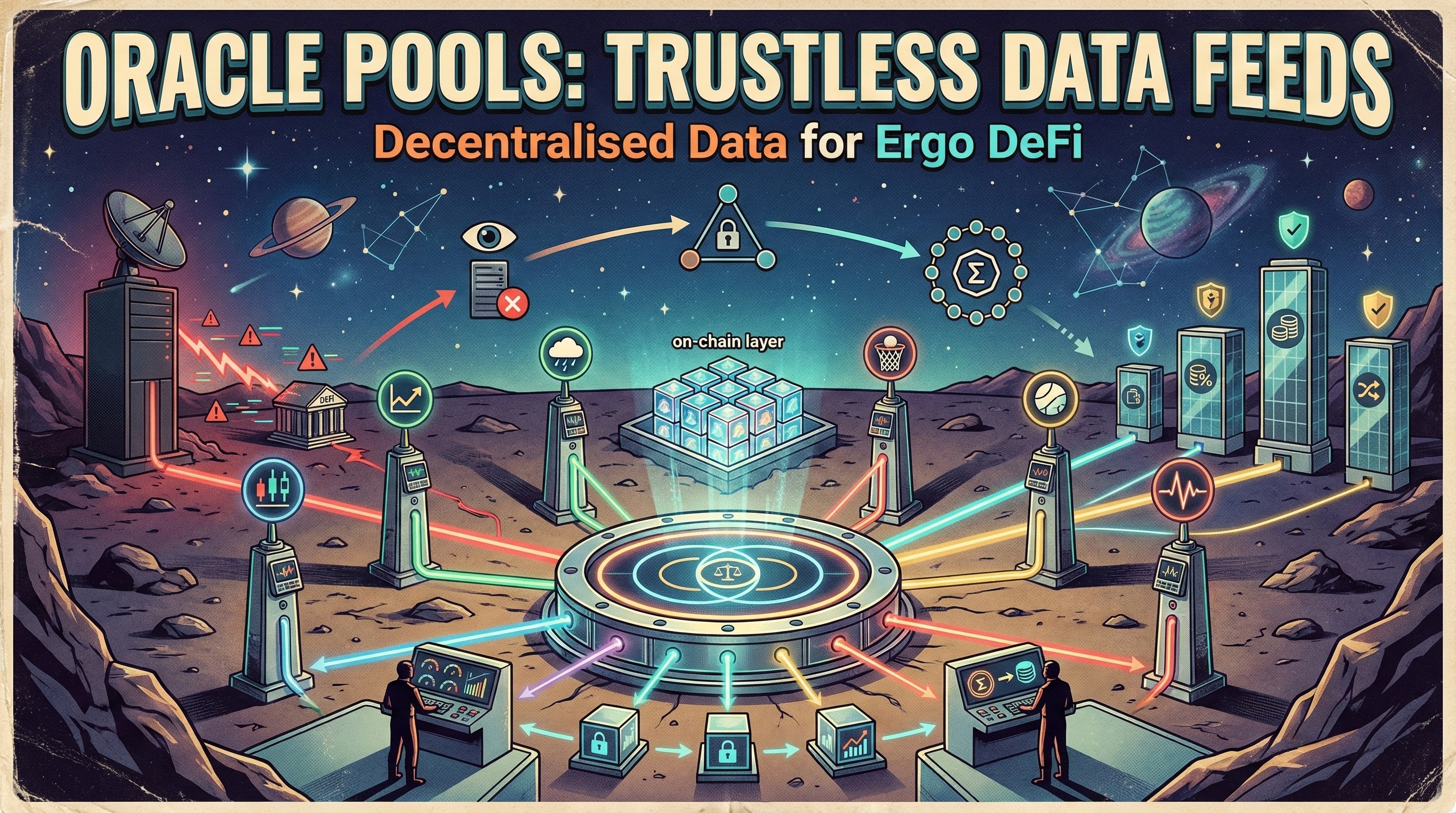

Decentralized data feeds on Ergo where multiple oracles post data on-chain, aggregated into reliable price feeds for DeFi applications.

Oracle Pools are Ergo's native solution for bringing off-chain data (prices, events, etc.) onto the blockchain. Multiple independent oracles post data to a shared pool, which aggregates and publishes consensus values. This decentralized design avoids single points of failure and manipulation risks of centralized oracles.

Key Points

- Multiple independent oracles post data

- On-chain aggregation (median, average)

- Permissionless participation with staking

- Native eUTXO design - data stored in boxes

- Powers SigmaUSD, DEXs, and DeFi protocols

- Transparent and auditable on-chain

Use Cases

1

ERG/USD price feeds for stablecoins

2

Cross-chain asset prices for DEXs

3

Sports/event outcomes for prediction markets

4

Weather data for parametric insurance

Technical Details

Oracle pools use a hierarchical box structure: individual oracles post to 'datapoint boxes', which are aggregated into 'pool boxes' containing the consensus value. Oracles stake tokens and are rewarded for accurate data. The aggregation logic (median, weighted average) is encoded in ErgoScript.

Related Infographics

Related Articles

Frequently Asked Questions

Questions about Oracle Pools

Common questions about this topic

How to build DeFi on Ergo?

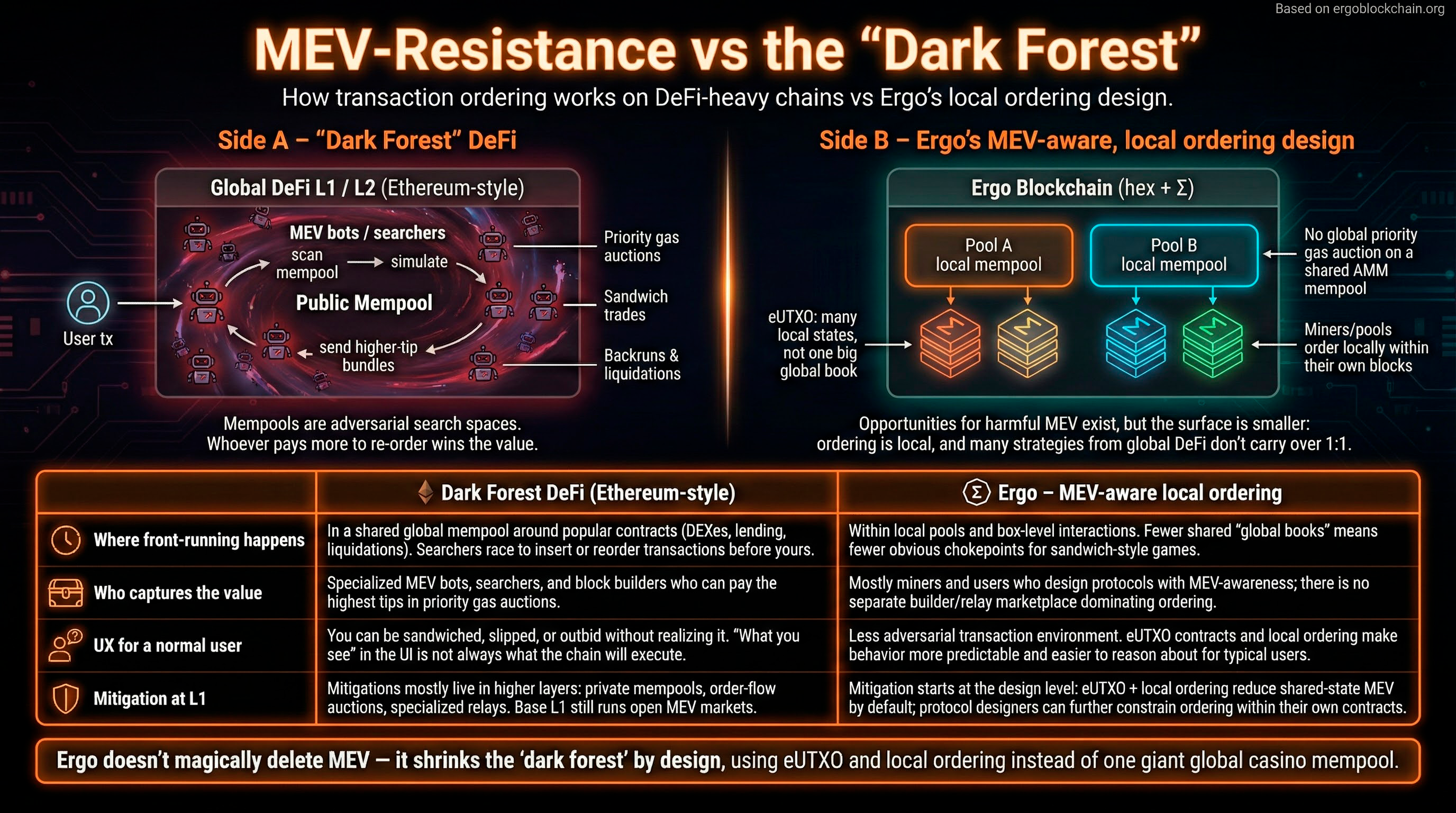

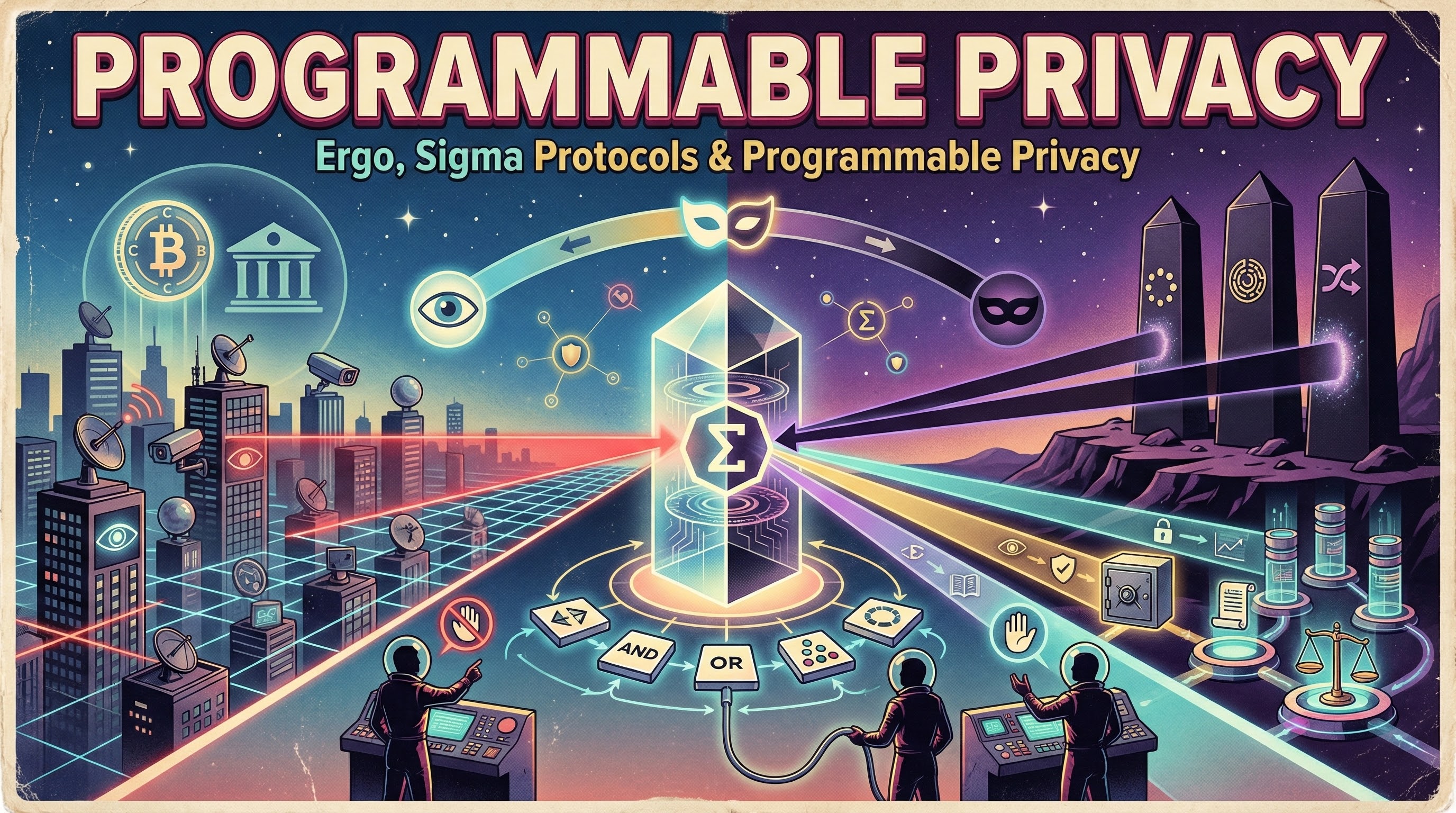

Building DeFi on Ergo starts with understanding the eUTXO model and ErgoScript. Unlike account-based chains, Ergo's box model provides deterministic execution, no MEV by design, and predictable gas costs. Use Oracle Pools for price feeds, and leverage existing patterns from Spectrum Finance and SigmaUSD.

How-to

DeFi

How to get started with Ergo?

Start by getting a wallet (Nautilus for browser, Terminus for mobile). Back up your seed phrase securely offline. Get some ERG from an exchange (Gate.io, KuCoin) or DEX (Spectrum). Make a test transaction. Then explore: try DeFi on Spectrum, check out NFTs, or dive into the technology if you're a builder.

How-to

Getting Started

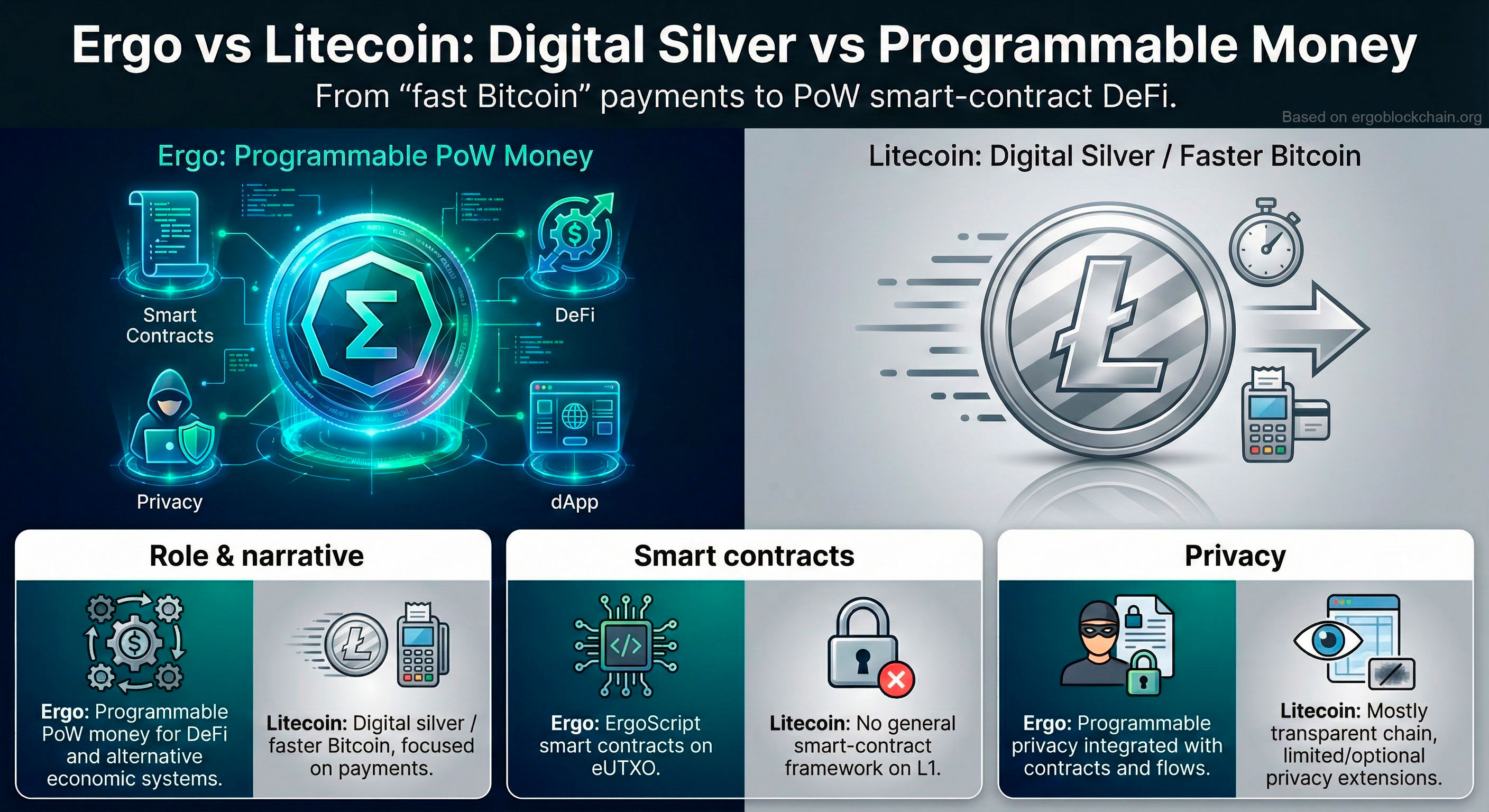

Is Ergo a good investment?

This is not financial advice. Ergo has strong fundamentals: fair launch (no VC dump risk), innovative technology (eUTXO, Sigma Protocols, NiPoPoWs), active development, and a cypherpunk ethos. It's a smaller market cap project with higher risk/reward than established chains. Research thoroughly, understand the technology, and never invest more than you can afford to lose.

Comparison

Getting Started

How to use Spectrum DEX on Ergo?

Connect your Nautilus wallet to Spectrum Finance, select tokens to swap, review the rate and slippage, then confirm. Spectrum uses AMM liquidity pools for instant trades. You can also provide liquidity to earn fees. All trades are atomic - they complete fully or not at all, with no front-running possible.

How-to

DeFi