Smart Contracts

Beginner

Updated 11/26/2025

What is

DeFi?

Decentralized Finance - financial services built on blockchain without traditional intermediaries like banks.

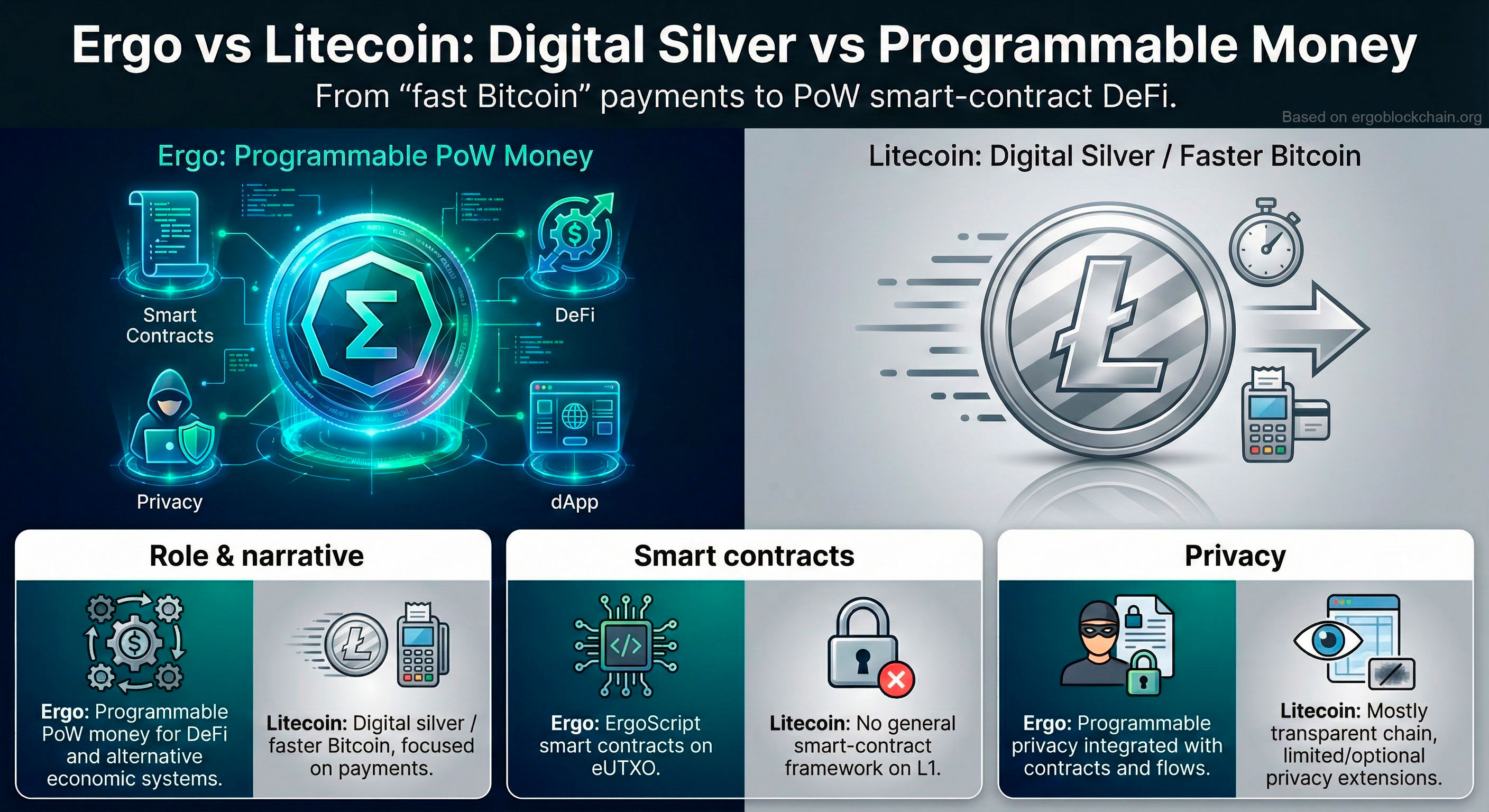

DeFi (Decentralized Finance) refers to financial applications built on blockchain that operate without centralized intermediaries. On Ergo, DeFi leverages the eUTXO model for secure, deterministic smart contracts. Applications include DEXs, lending protocols, stablecoins, and more - all permissionless and censorship-resistant.

Key Points

- Financial services without banks

- Permissionless and open to all

- Smart contract-powered automation

- Ergo's eUTXO provides security advantages

- No KYC or geographical restrictions

- 24/7 availability

Use Cases

1

Trading on decentralized exchanges (DEXs)

2

Earning yield through liquidity provision

3

Borrowing and lending without banks

4

Stablecoin usage for stable value

5

Derivatives and synthetic assets

Technical Details

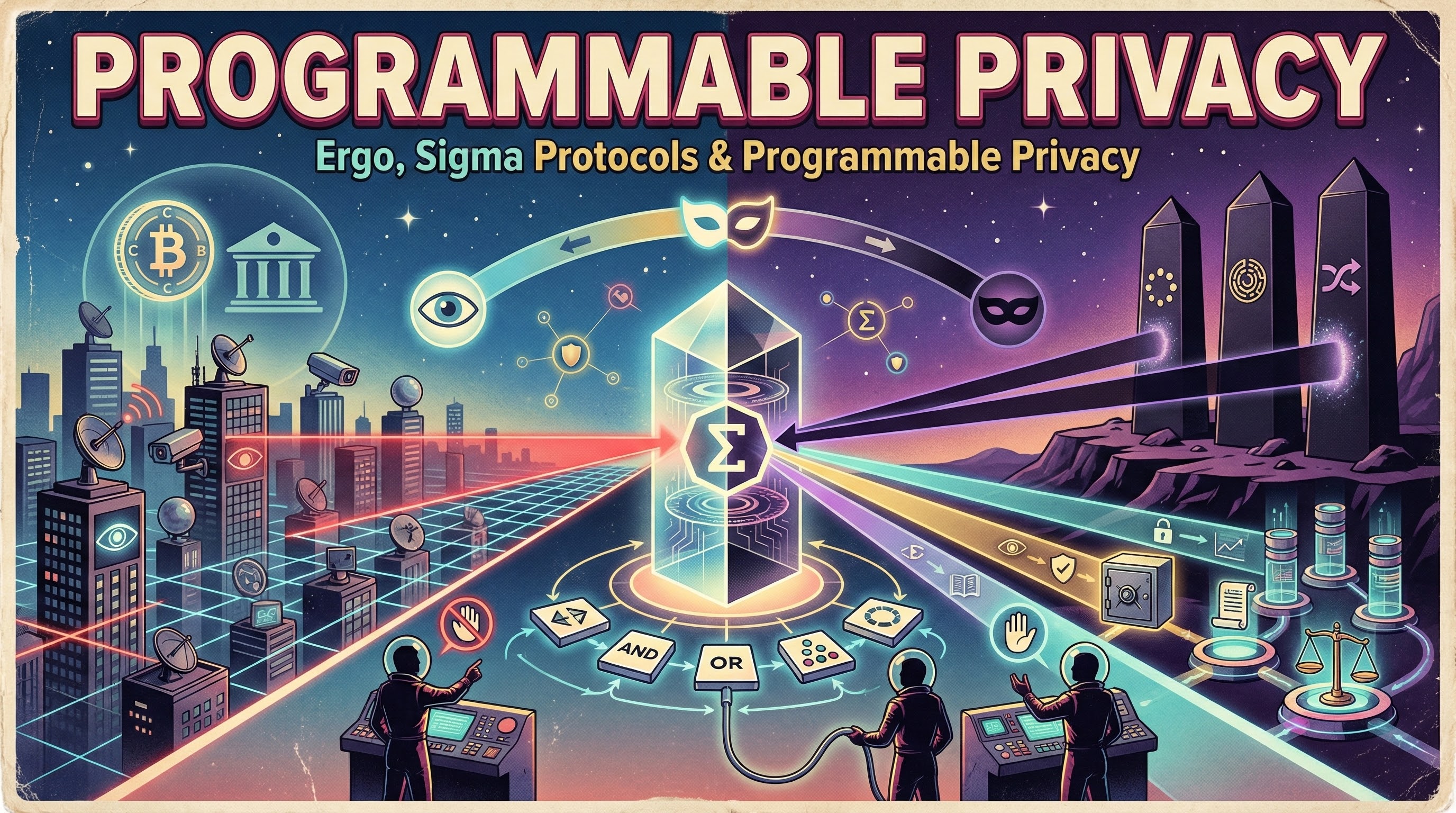

Ergo DeFi benefits from eUTXO's deterministic execution (no failed transactions with lost fees), native multi-asset support (efficient token swaps), and Sigma Protocols (privacy-preserving DeFi). Popular protocols include Spectrum DEX, SigmaUSD stablecoin, and various lending platforms.

Related Infographics

Related Articles

Frequently Asked Questions

Questions about DeFi

Common questions about this topic

What can I do with Ergo?

Ergo supports a full ecosystem: trade on Spectrum DEX, use SigmaUSD stablecoin, mix transactions with ErgoMixer, collect NFTs on SkyHarbor, mine with GPUs, lend/borrow on DuckPools, bridge to other chains via Rosen, and build dApps with ErgoScript. It's a complete platform for decentralized finance and applications.

Explainer

Getting Started

How to use Spectrum DEX on Ergo?

Connect your Nautilus wallet to Spectrum Finance, select tokens to swap, review the rate and slippage, then confirm. Spectrum uses AMM liquidity pools for instant trades. You can also provide liquidity to earn fees. All trades are atomic - they complete fully or not at all, with no front-running possible.

How-to

DeFi

How to get started with Ergo?

Start by getting a wallet (Nautilus for browser, Terminus for mobile). Back up your seed phrase securely offline. Get some ERG from an exchange (Gate.io, KuCoin) or DEX (Spectrum). Make a test transaction. Then explore: try DeFi on Spectrum, check out NFTs, or dive into the technology if you're a builder.

How-to

Getting Started

How to build DeFi on Ergo?

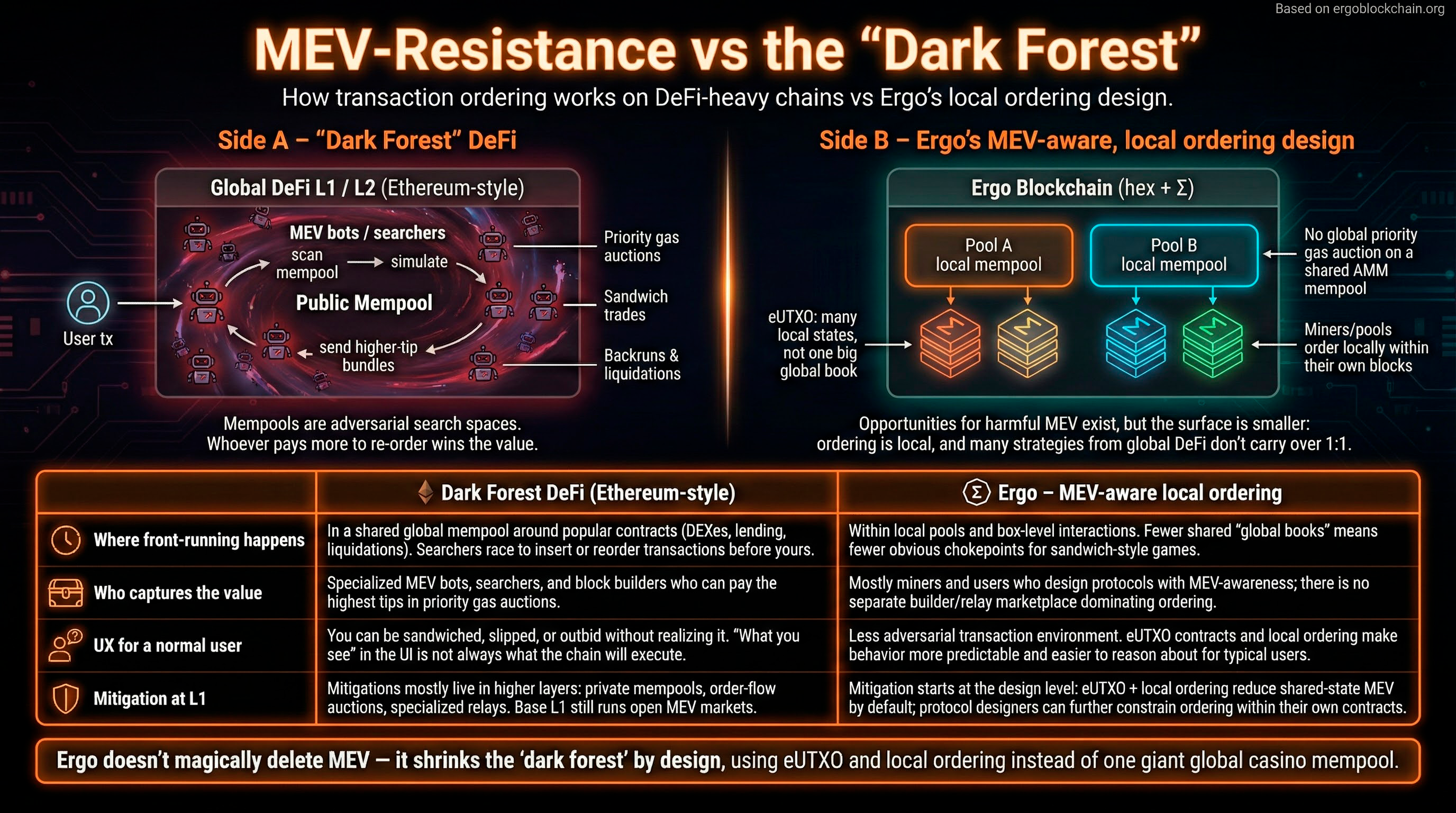

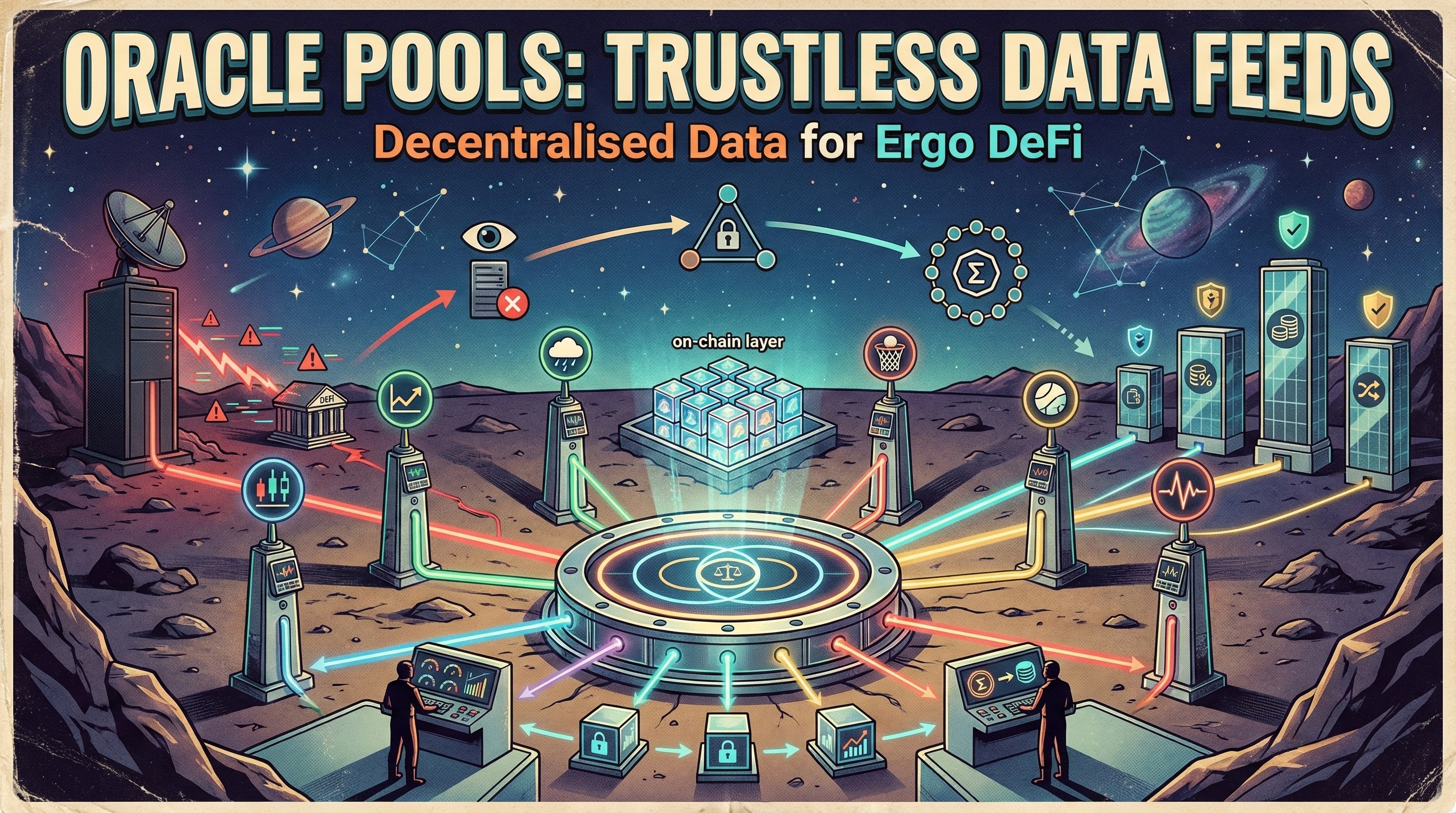

Building DeFi on Ergo starts with understanding the eUTXO model and ErgoScript. Unlike account-based chains, Ergo's box model provides deterministic execution, no MEV by design, and predictable gas costs. Use Oracle Pools for price feeds, and leverage existing patterns from Spectrum Finance and SigmaUSD.

How-to

DeFi