Smart Contracts

Intermediate

What is

Sandwich Attack?

A MEV attack that places transactions before and after a victim's trade to extract profit.

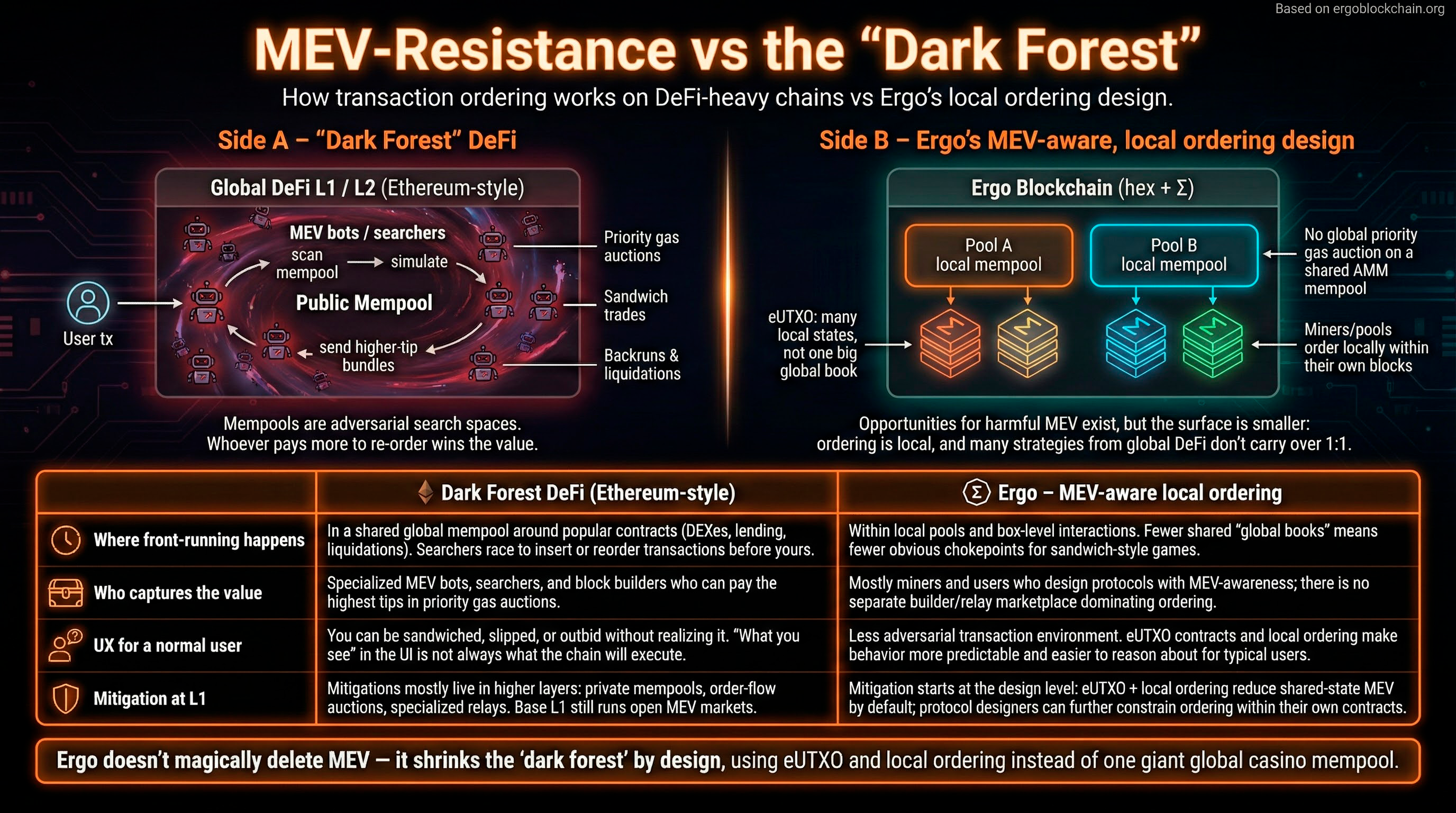

In a sandwich attack, an attacker sees your pending DEX trade, buys before you (raising the price), lets your trade execute at the worse price, then sells after (profiting from the price impact). This is a major problem on Ethereum. Ergo's eUTXO model makes sandwiching impractical.

Key Points

- Buy before victim, sell after

- Extracts value from traders

- Requires seeing pending transactions

- Very common on Ethereum

- eUTXO prevents this attack

- Part of 'dark forest' problem

Related Infographics

Related Articles

Frequently Asked Questions

Questions about Sandwich Attack

Common questions about this topic

How to use Spectrum DEX on Ergo?

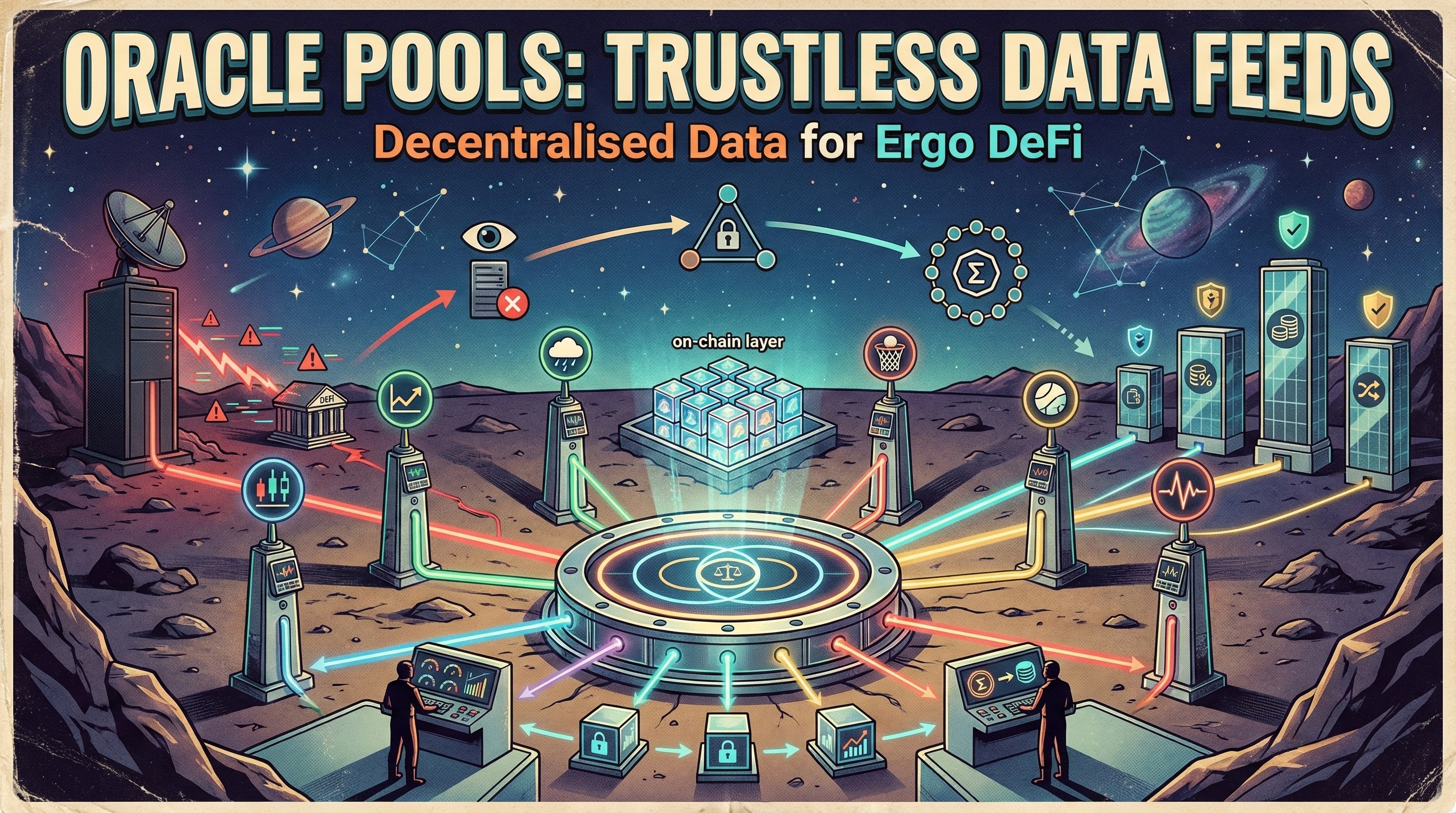

Connect your Nautilus wallet to Spectrum Finance, select tokens to swap, review the rate and slippage, then confirm. Spectrum uses AMM liquidity pools for instant trades. You can also provide liquidity to earn fees. All trades are atomic - they complete fully or not at all, with no front-running possible.

How-to

DeFi

What can I do with Ergo?

Ergo supports a full ecosystem: trade on Spectrum DEX, use SigmaUSD stablecoin, mix transactions with ErgoMixer, collect NFTs on SkyHarbor, mine with GPUs, lend/borrow on DuckPools, bridge to other chains via Rosen, and build dApps with ErgoScript. It's a complete platform for decentralized finance and applications.

Explainer

Getting Started

Is Ergo better than Ethereum for DeFi?

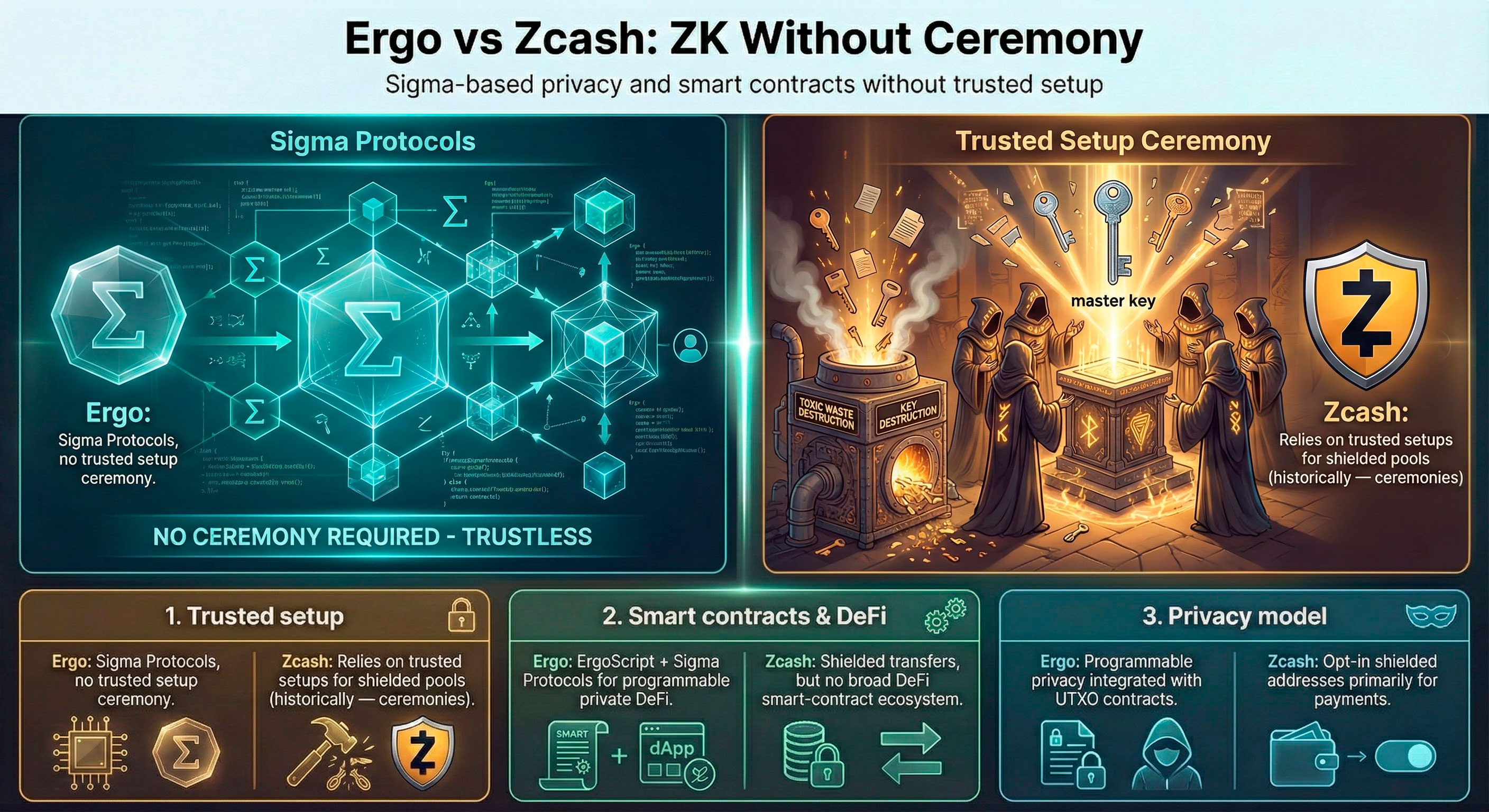

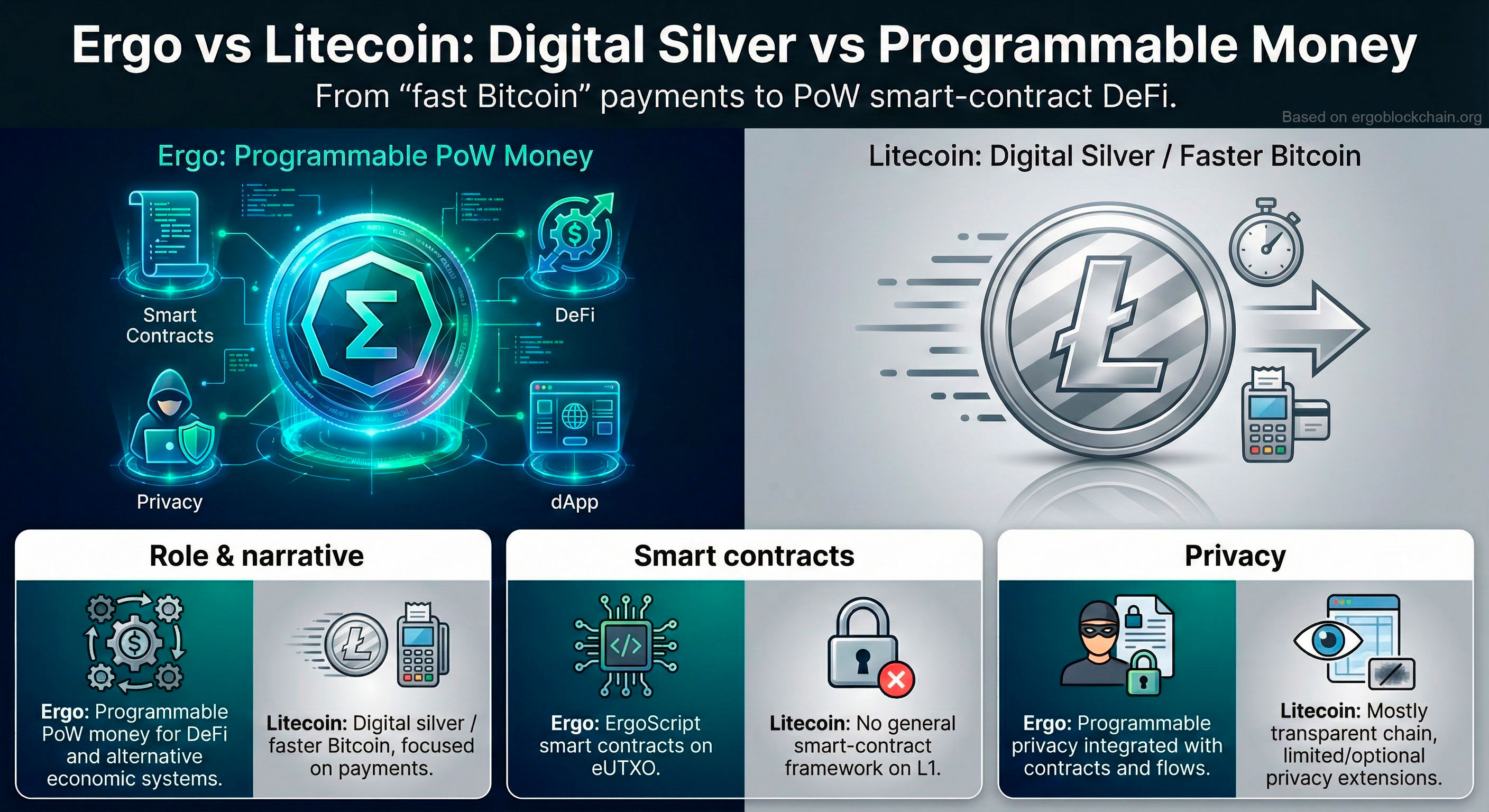

Ergo offers structural advantages for DeFi: no MEV extraction, deterministic gas costs, and no reentrancy attacks due to eUTXO. Ethereum has larger ecosystem and liquidity. Choose Ergo for security-critical applications, fair trading, and predictable costs. Choose Ethereum for maximum composability with existing protocols.

Comparison

DeFi

How to get started with Ergo?

Start by getting a wallet (Nautilus for browser, Terminus for mobile). Back up your seed phrase securely offline. Get some ERG from an exchange (Gate.io, KuCoin) or DEX (Spectrum). Make a test transaction. Then explore: try DeFi on Spectrum, check out NFTs, or dive into the technology if you're a builder.

How-to

Getting Started