Consensus & Mining

Intermediate

What is

Proof-of-stake (PoS)?

A consensus mechanism in which validators are chosen to create new blocks and secure a blockchain network based on the number of tokens they hold and 'stake.

A consensus mechanism in which validators are chosen to create new blocks and secure a blockchain network based on the number of tokens they hold and 'stake.'

Related Infographics

Related Articles

Frequently Asked Questions

Questions about Proof-of-stake (PoS)

Common questions about this topic

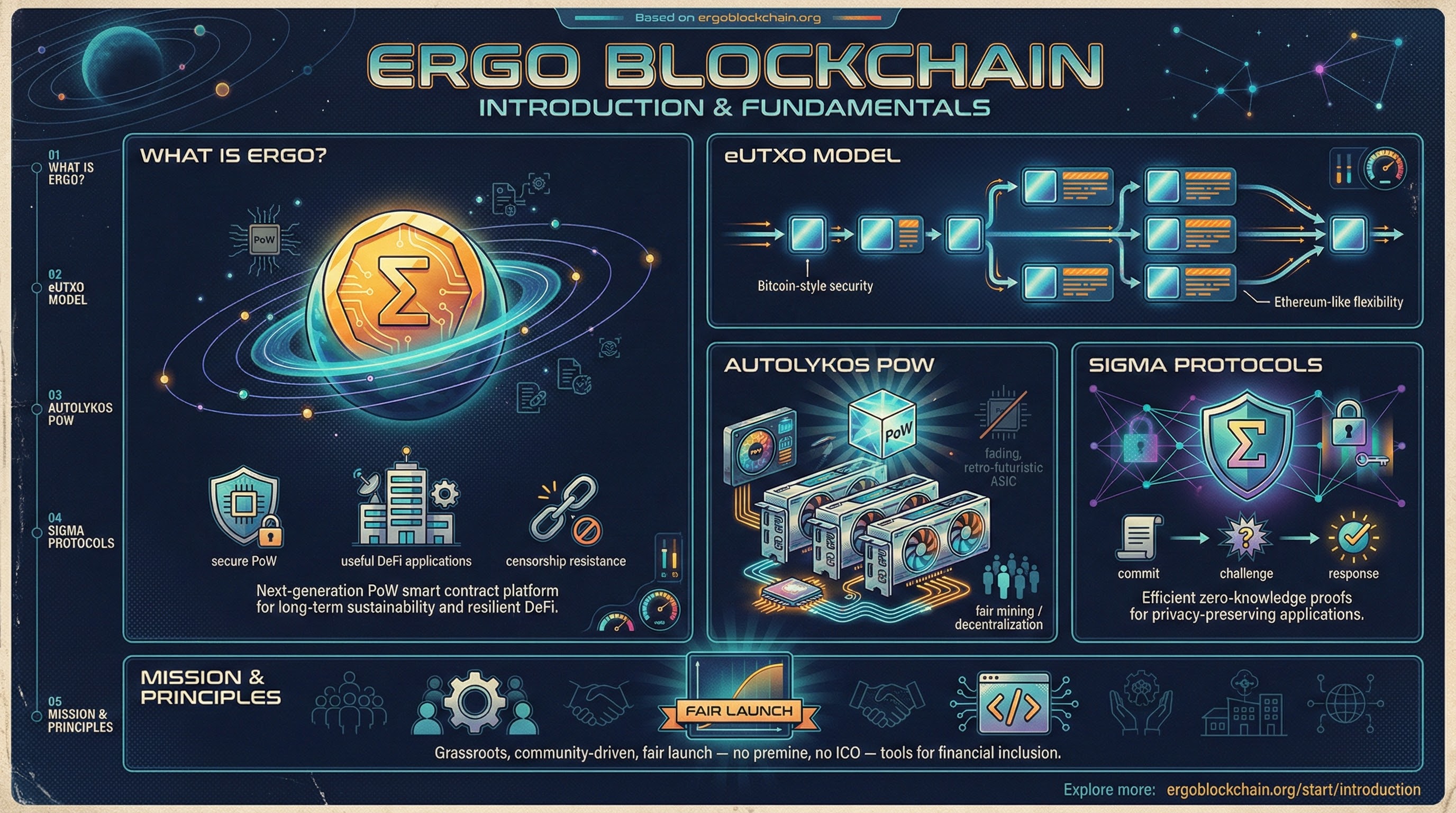

How to get started with Ergo?

Start by getting a wallet (Nautilus for browser, Terminus for mobile). Back up your seed phrase securely offline. Get some ERG from an exchange (Gate.io, KuCoin) or DEX (Spectrum). Make a test transaction. Then explore: try DeFi on Spectrum, check out NFTs, or dive into the technology if you're a builder.

How-to

Getting Started

Is Ergo a good investment?

This is not financial advice. Ergo has strong fundamentals: fair launch (no VC dump risk), innovative technology (eUTXO, Sigma Protocols, NiPoPoWs), active development, and a cypherpunk ethos. It's a smaller market cap project with higher risk/reward than established chains. Research thoroughly, understand the technology, and never invest more than you can afford to lose.

Comparison

Getting Started

How to provide liquidity on Ergo?

On Spectrum Finance, select a pool, deposit equal value of both tokens, and receive LP tokens representing your share. You earn a portion of all trading fees. Withdraw anytime by returning LP tokens. Be aware of impermanent loss if token prices diverge significantly.

How-to

DeFi

How to build DeFi on Ergo?

Building DeFi on Ergo starts with understanding the eUTXO model and ErgoScript. Unlike account-based chains, Ergo's box model provides deterministic execution, no MEV by design, and predictable gas costs. Use Oracle Pools for price feeds, and leverage existing patterns from Spectrum Finance and SigmaUSD.

How-to

DeFi