Economics

Intermediate

Updated 1/15/2025

What is

Market Maker ('MM')?

An entity that provides liquidity by continuously quoting buy and sell prices, profiting from the spread while enabling smooth trading for others.

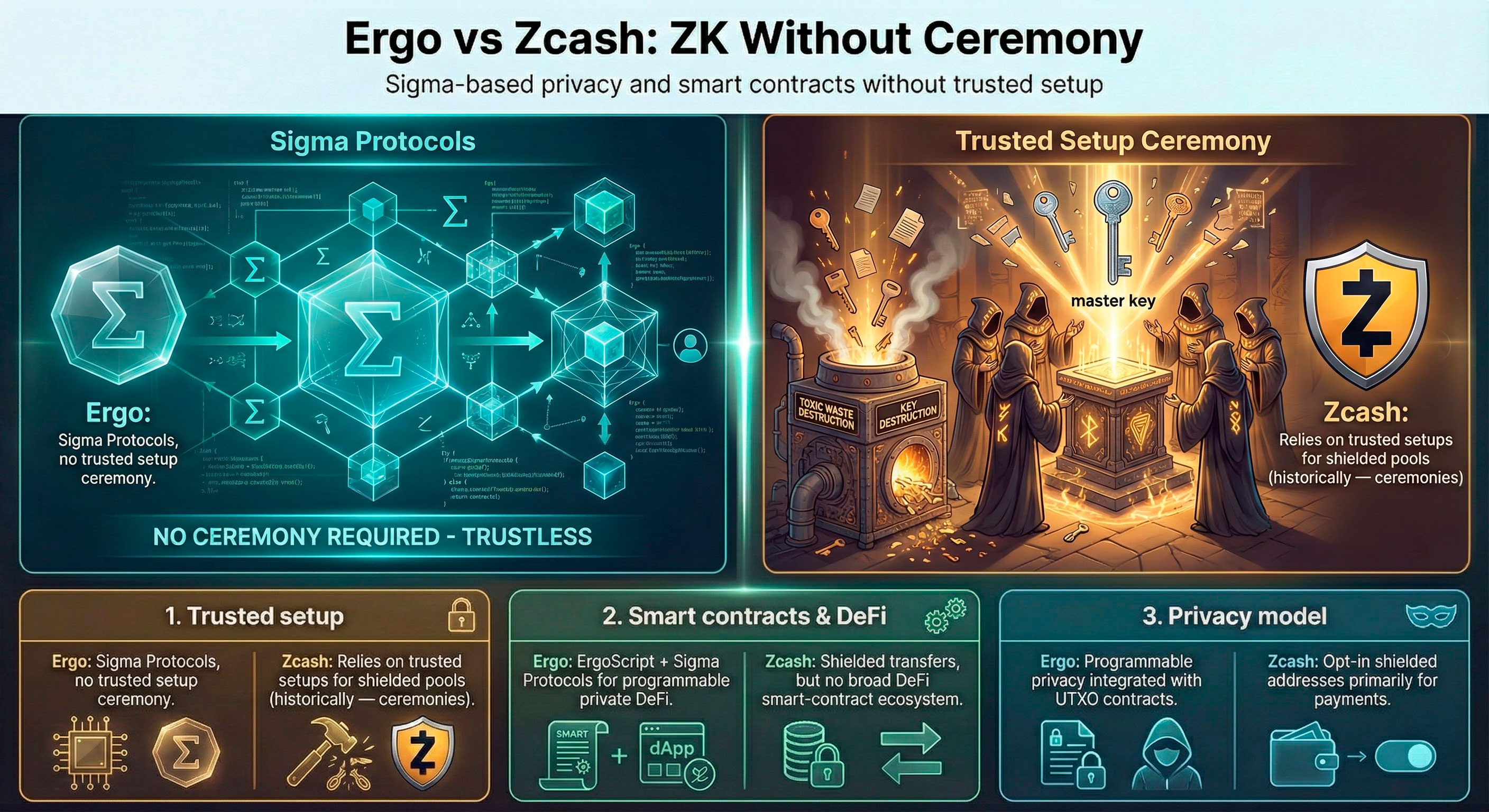

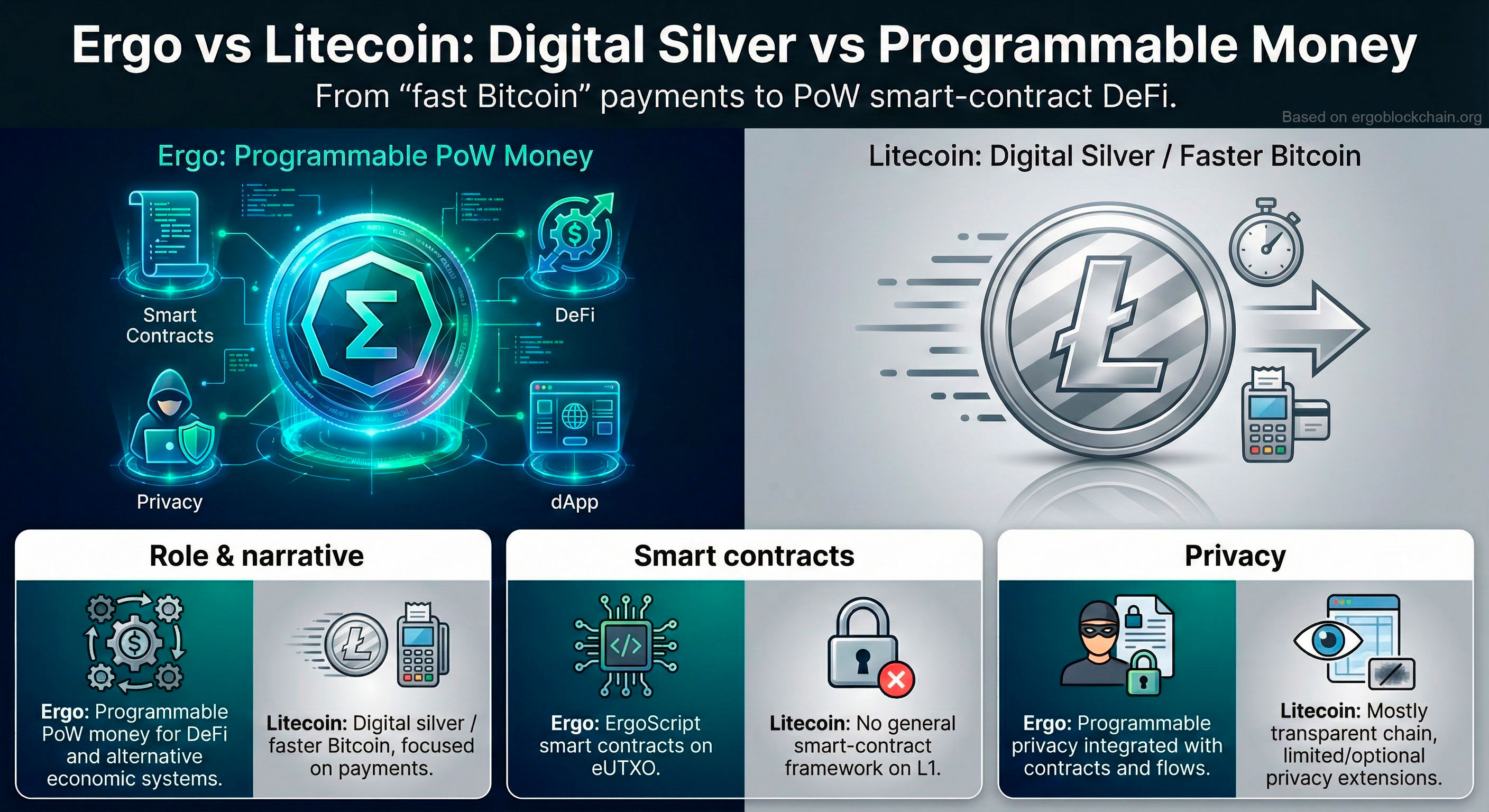

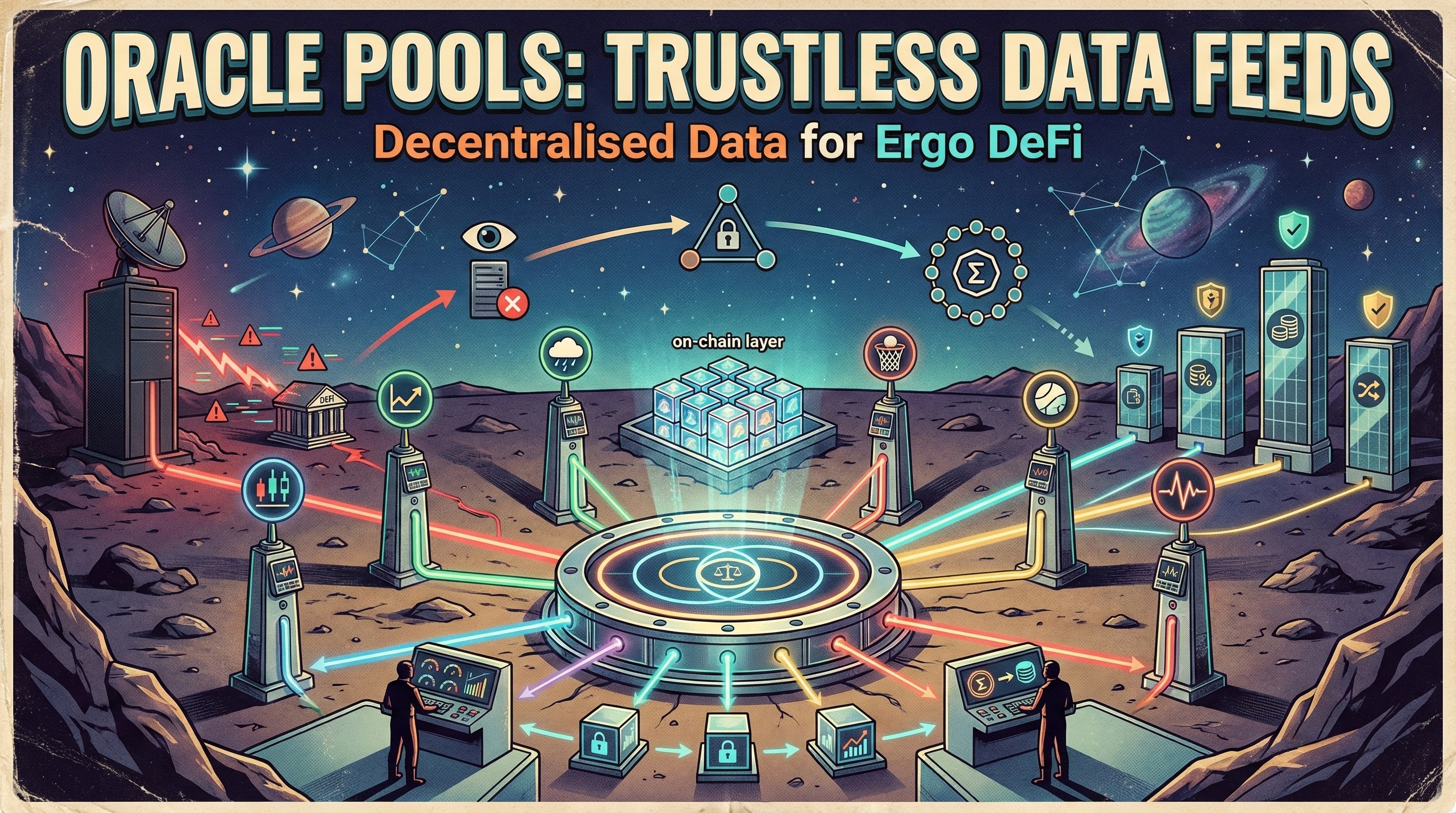

A market maker is a participant who provides liquidity to a market by continuously offering to buy and sell an asset, profiting from the bid-ask spread. In traditional finance, these are typically large institutions. In DeFi, Automated Market Makers (AMMs) like those on Spectrum Finance replace human market makers with smart contracts and liquidity pools. Anyone can become a liquidity provider on Ergo DEXs, earning trading fees in exchange for depositing assets into pools.

Key Points

- Provides liquidity by quoting buy and sell prices

- Profits from the spread between bid and ask

- In DeFi, replaced by Automated Market Makers (AMMs)

- Anyone can be a liquidity provider on Ergo DEXs

- Enables trading without waiting for counterparties

- Essential for healthy, liquid markets

Use Cases

1

Providing liquidity on Spectrum Finance

2

Understanding DEX mechanics and trading

3

Earning passive income from trading fees

4

Evaluating market health and liquidity depth

Technical Details

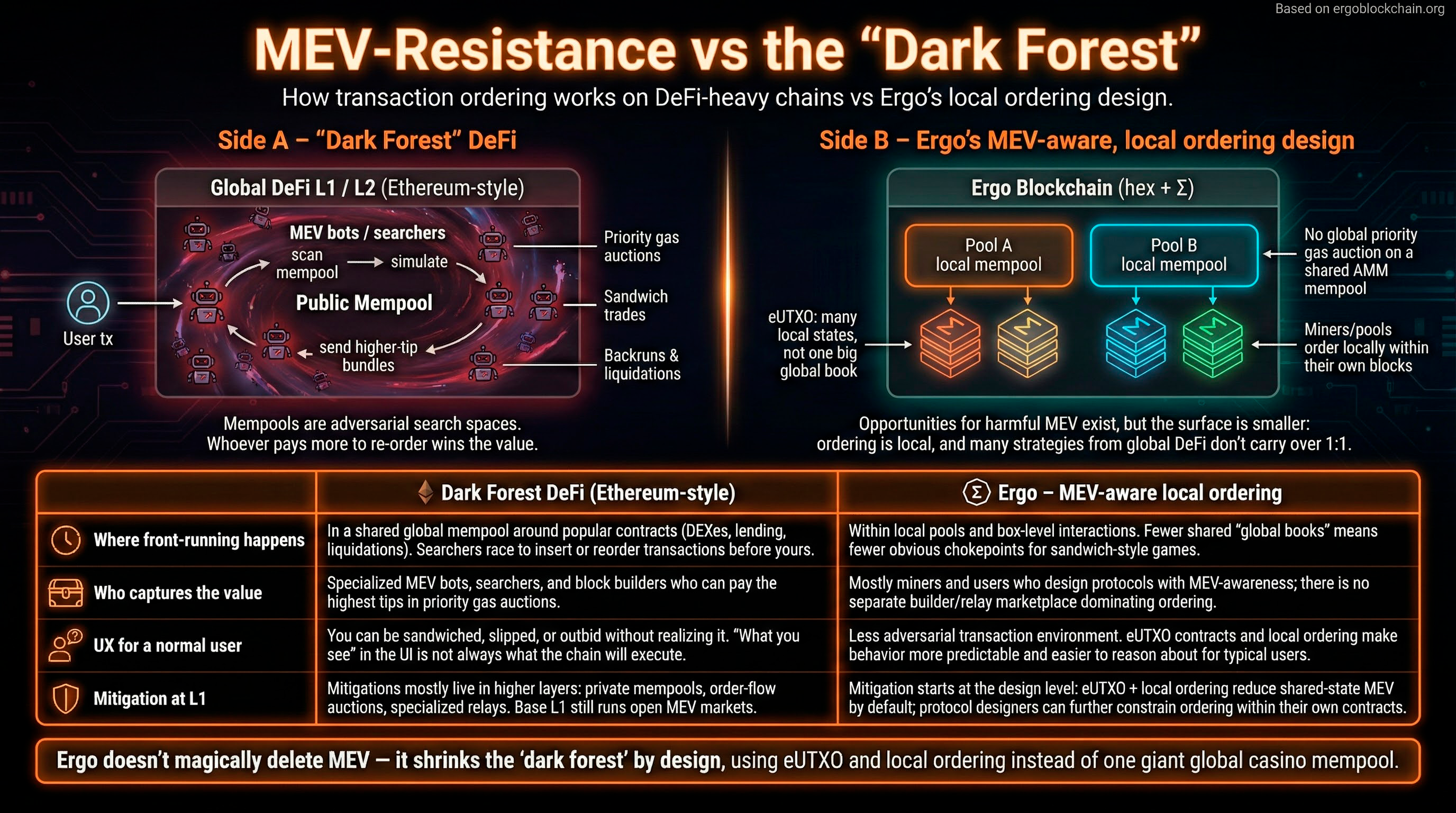

Traditional market makers manage order books with limit orders. DeFi AMMs use mathematical formulas (like x*y=k) to determine prices based on pool ratios. On Ergo's Spectrum Finance, liquidity providers deposit token pairs into pools and receive LP tokens. When trades occur, the pool rebalances and fees (typically 0.3%) are distributed to LPs. Ergo's eUTXO model enables unique AMM designs with features like concentrated liquidity.

Related Infographics

Related Articles

Frequently Asked Questions

Questions about Market Maker ('MM')

Common questions about this topic

How to get started with Ergo?

Start by getting a wallet (Nautilus for browser, Terminus for mobile). Back up your seed phrase securely offline. Get some ERG from an exchange (Gate.io, KuCoin) or DEX (Spectrum). Make a test transaction. Then explore: try DeFi on Spectrum, check out NFTs, or dive into the technology if you're a builder.

How-to

Getting Started

Is Ergo a good investment?

This is not financial advice. Ergo has strong fundamentals: fair launch (no VC dump risk), innovative technology (eUTXO, Sigma Protocols, NiPoPoWs), active development, and a cypherpunk ethos. It's a smaller market cap project with higher risk/reward than established chains. Research thoroughly, understand the technology, and never invest more than you can afford to lose.

Comparison

Getting Started

What can I do with Ergo?

Ergo supports a full ecosystem: trade on Spectrum DEX, use SigmaUSD stablecoin, mix transactions with ErgoMixer, collect NFTs on SkyHarbor, mine with GPUs, lend/borrow on DuckPools, bridge to other chains via Rosen, and build dApps with ErgoScript. It's a complete platform for decentralized finance and applications.

Explainer

Getting Started

How to use Spectrum DEX on Ergo?

Connect your Nautilus wallet to Spectrum Finance, select tokens to swap, review the rate and slippage, then confirm. Spectrum uses AMM liquidity pools for instant trades. You can also provide liquidity to earn fees. All trades are atomic - they complete fully or not at all, with no front-running possible.

How-to

DeFi