Economics

Intermediate

Updated 11/26/2025

What is

Расписание эмиссии?

Расписание эмиссии — правила, по которым новые монеты появляются в сети (обычно через награды за блок).

Эмиссия определяет темп выпуска новых монет и влияет на инфляцию, стимулы майнеров и долгосрочную экономику. В разных сетях эмиссия может быть фиксированной, уменьшающейся, адаптивной или сочетать несколько механизмов.

Key Points

- Определяет темп выпуска новых монет

- Влияет на инфляцию и стимулы майнеров

- Может быть фиксированной, уменьшающейся или адаптивной

- Важно для долгосрочного бюджета безопасности

Use Cases

1

Оценка инфляции и предложения

2

Понимание стимулов майнинга

3

Моделирование долгосрочной экономики сети

Technical Details

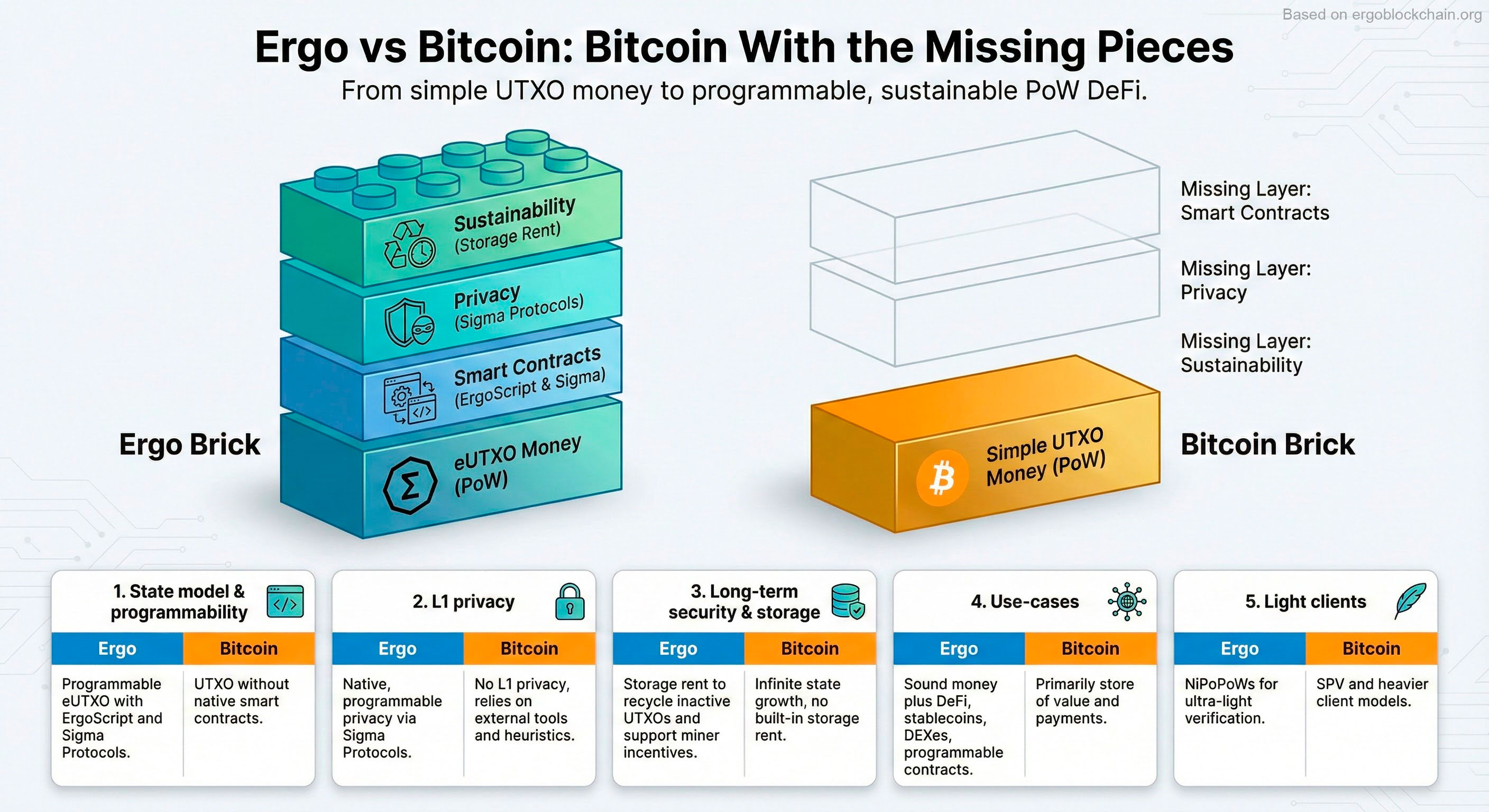

Ergo's emission started at 75 ERG/block, decreasing by 3 ERG every 3 months after the first 2 years. Treasury receives 7.5% of block rewards (decreasing over time). After primary emission ends (~8 years), storage rent provides ongoing miner revenue from dormant UTXOs.

Related Infographics

Related Articles

Frequently Asked Questions

Questions about Расписание эмиссии

Common questions about this topic

What is storage rent on Ergo?

Storage rent is Ergo's solution to state bloat. Boxes (UTXOs) that remain unspent for 4+ years can have a small fee deducted by miners. This incentivizes cleaning up unused state, provides long-term miner revenue after emission ends, and keeps the blockchain sustainable. Lost coins eventually return to circulation instead of being locked forever.

Explainer

Technology

Is Ergo a good investment?

This is not financial advice. Ergo has strong fundamentals: fair launch (no VC dump risk), innovative technology (eUTXO, Sigma Protocols, NiPoPoWs), active development, and a cypherpunk ethos. It's a smaller market cap project with higher risk/reward than established chains. Research thoroughly, understand the technology, and never invest more than you can afford to lose.

Comparison

Getting Started

How do miners earn money on Ergo?

Ergo miners earn from three sources: block rewards (newly minted ERG), transaction fees, and storage rent. Block rewards decrease over time according to the emission schedule, but storage rent ensures long-term income even after all ERG is mined. Most miners use pools for consistent payouts.

How-to

Mining

How to use Spectrum DEX on Ergo?

Connect your Nautilus wallet to Spectrum Finance, select tokens to swap, review the rate and slippage, then confirm. Spectrum uses AMM liquidity pools for instant trades. You can also provide liquidity to earn fees. All trades are atomic - they complete fully or not at all, with no front-running possible.

How-to

DeFi