General

Intermediate

Updated 1/15/2025

What is

EIP (Ergo Improvement Proposal)?

A formal specification document for proposing changes to Ergo's protocol, standards, or ecosystem. Similar to Bitcoin's BIPs or Ethereum's EIPs.

An Ergo Improvement Proposal (EIP) is a design document providing information to the Ergo community about proposed changes to the protocol, new standards, or ecosystem improvements. EIPs follow a structured format including motivation, specification, rationale, and backwards compatibility considerations. They enable transparent, community-driven development where anyone can propose improvements. Notable EIPs include token standards, wallet formats, and protocol upgrades. The process ensures changes are well-documented and reviewed before implementation.

Key Points

- Formal specification for protocol changes

- Community-driven proposal process

- Includes motivation, spec, and rationale

- Similar to Bitcoin BIPs, Ethereum EIPs

- Covers protocol, standards, and ecosystem

- Ensures transparent development process

Use Cases

1

Proposing protocol improvements

2

Standardizing token and NFT formats

3

Defining wallet interoperability standards

4

Documenting best practices

5

Community governance participation

Technical Details

EIPs are hosted on GitHub and follow a template including: Abstract, Motivation, Specification, Rationale, Backwards Compatibility, and Reference Implementation. They go through Draft, Review, and Final stages. Examples include EIP-4 (asset standard), EIP-24 (token verification), and various wallet and dApp standards. Protocol EIPs may require soft forks activated through miner voting.

Related Infographics

Related Articles

Frequently Asked Questions

Questions about EIP (Ergo Improvement Proposal)

Common questions about this topic

Is Ergo a good investment?

This is not financial advice. Ergo has strong fundamentals: fair launch (no VC dump risk), innovative technology (eUTXO, Sigma Protocols, NiPoPoWs), active development, and a cypherpunk ethos. It's a smaller market cap project with higher risk/reward than established chains. Research thoroughly, understand the technology, and never invest more than you can afford to lose.

Comparison

Getting Started

How to get started with Ergo?

Start by getting a wallet (Nautilus for browser, Terminus for mobile). Back up your seed phrase securely offline. Get some ERG from an exchange (Gate.io, KuCoin) or DEX (Spectrum). Make a test transaction. Then explore: try DeFi on Spectrum, check out NFTs, or dive into the technology if you're a builder.

How-to

Getting Started

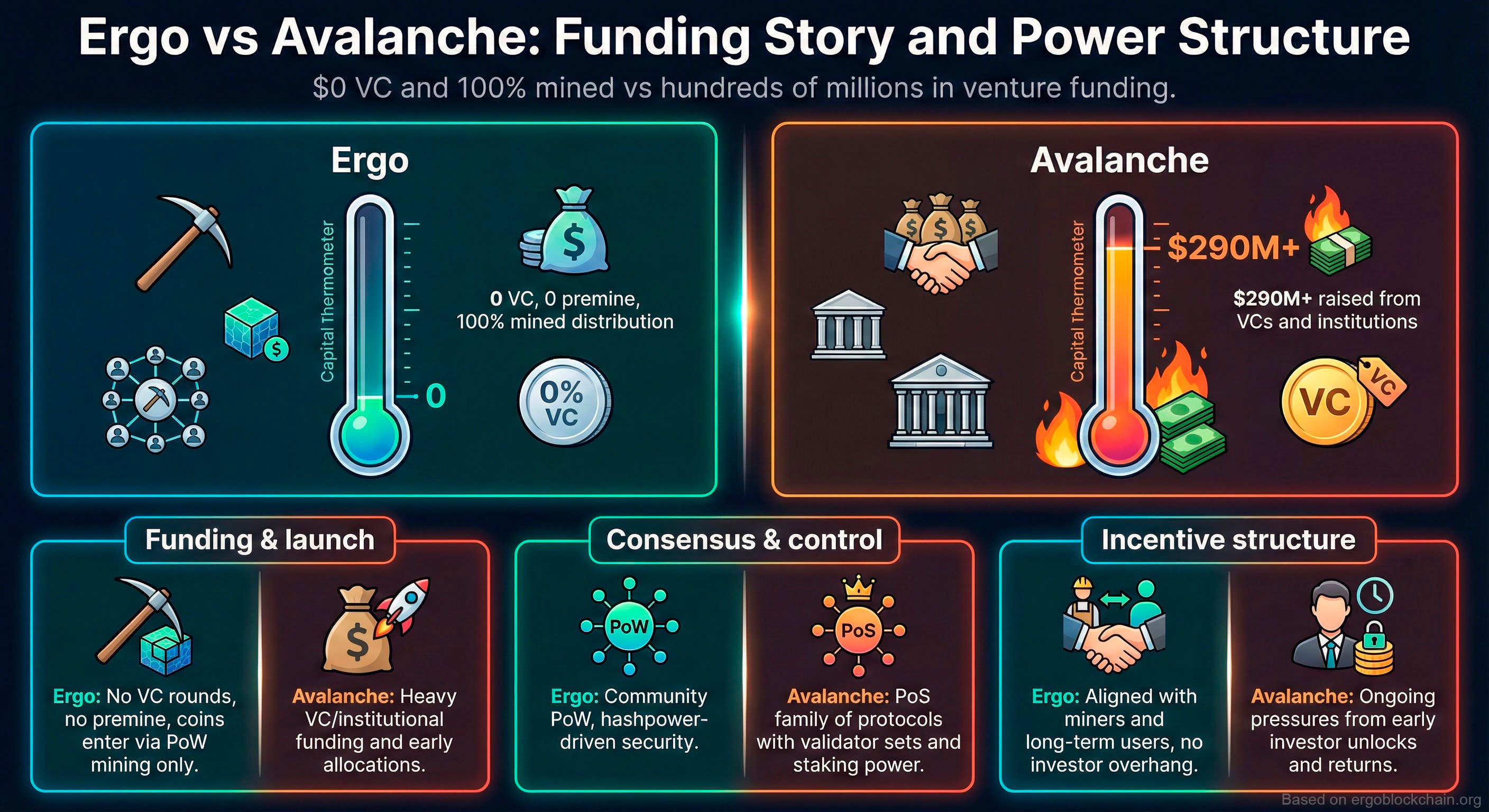

Why does Ergo's fair launch matter?

Ergo had no pre-mine, no ICO, no VC allocation. 100% of ERG comes from mining. This means no insiders dumping on you, no VCs controlling governance, no foundation with majority stake. Fair launch creates genuine decentralization - the network belongs to miners and users, not early investors seeking exit liquidity.

Philosophy

Philosophy

What is MEV resistance and why does Ergo have it?

MEV (Maximal Extractable Value) is profit extracted by reordering, inserting, or censoring transactions - think front-running and sandwich attacks. Ergo's eUTXO model provides structural MEV resistance: transactions reference specific boxes (UTXOs), making reordering attacks much harder. There's no shared global state to exploit like in account-based chains.

Explainer

Technology