Mining

Beginner

Updated 1/15/2025

What is

Algorithm?

A precise set of instructions for solving a problem or performing a computation. In crypto, refers to mining algorithms (like Autolykos) or cryptographic algorithms.

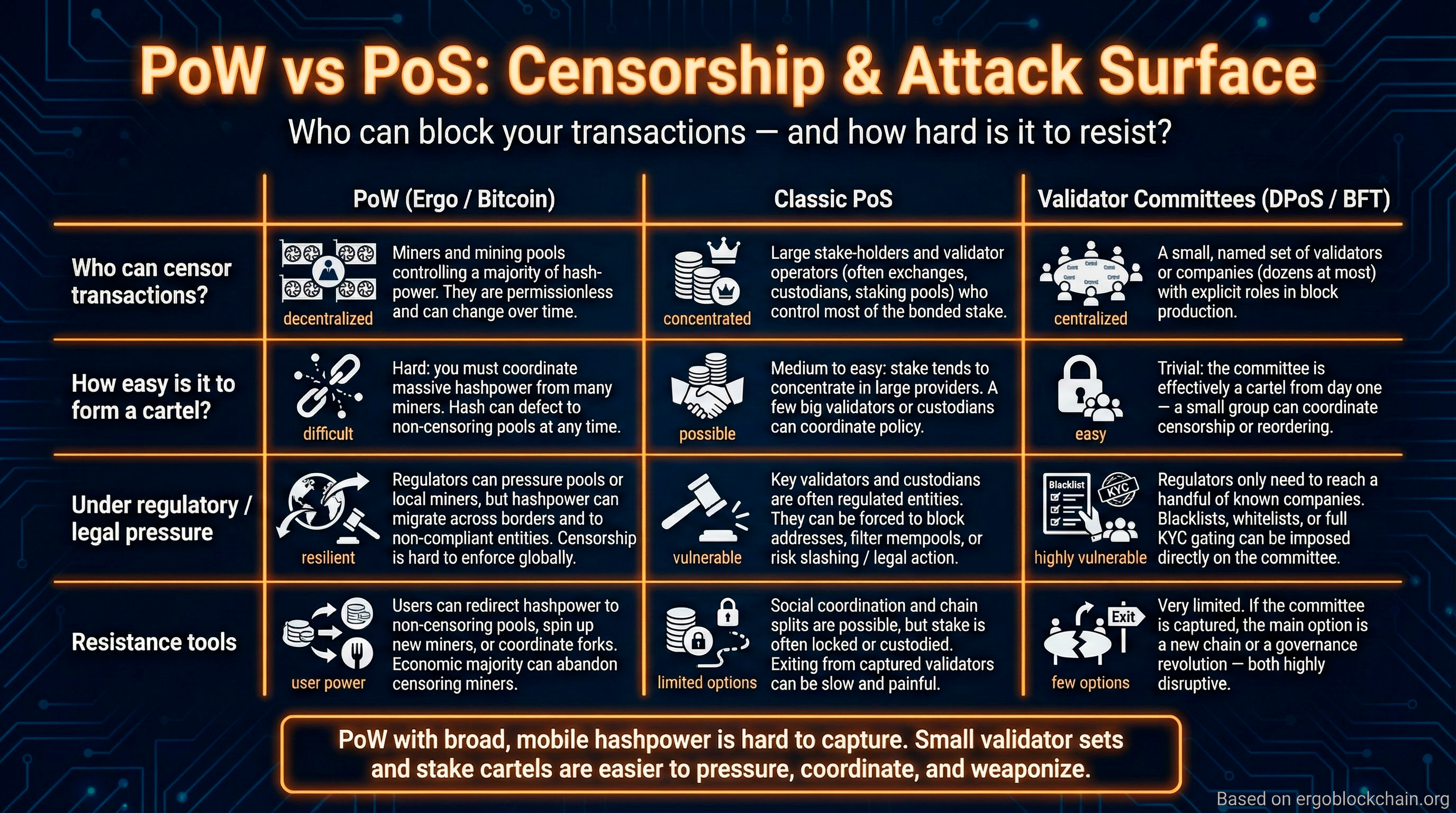

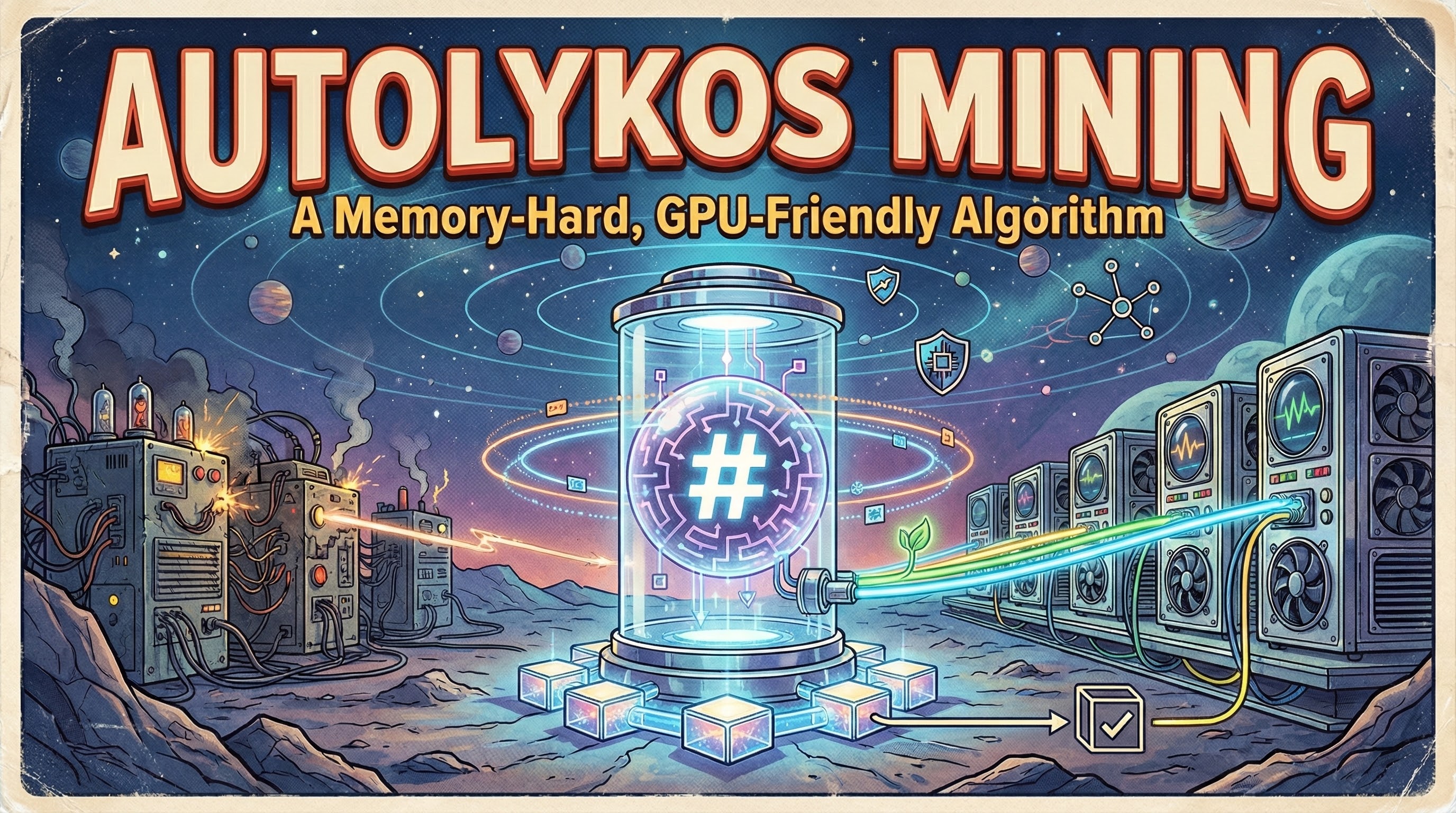

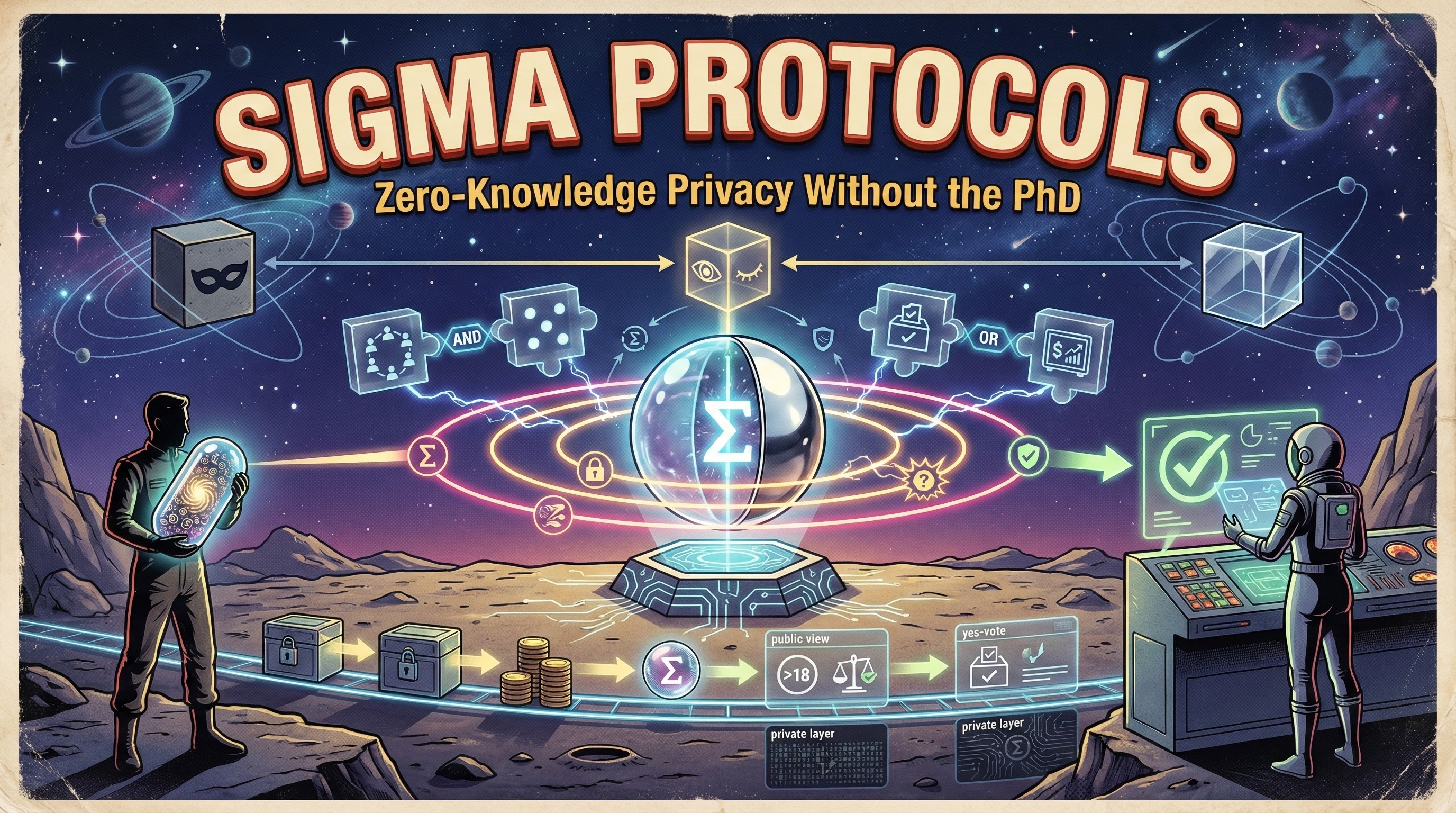

An algorithm is a step-by-step procedure for solving a problem or accomplishing a task. In cryptocurrency, algorithms are fundamental to everything from mining (Proof-of-Work algorithms like Autolykos), to cryptographic security (hashing algorithms like Blake2b), to consensus mechanisms. Ergo uses the Autolykos 2 algorithm for mining - a memory-hard, ASIC-resistant algorithm that enables fair GPU mining. The choice of algorithm significantly impacts a blockchain's security, decentralization, and energy efficiency.

Key Points

- Step-by-step instructions for computation

- Mining algorithms determine how blocks are created

- Ergo uses Autolykos 2 - memory-hard, ASIC-resistant

- Cryptographic algorithms secure transactions and wallets

- Algorithm choice affects decentralization and security

- Different algorithms suit different hardware (GPU vs ASIC)

Use Cases

1

Understanding how Ergo mining works

2

Comparing mining algorithms across blockchains

3

Evaluating ASIC-resistance claims

4

Understanding cryptographic security foundations

Technical Details

Ergo's Autolykos 2 algorithm requires miners to solve memory-hard puzzles using GPU VRAM (minimum 4GB). It uses Blake2b256 for hashing and requires significant memory bandwidth, making ASIC development economically impractical. The algorithm adjusts difficulty every epoch to maintain ~2 minute block times. For cryptographic operations, Ergo uses Sigma protocols built on discrete logarithm assumptions.

Related Infographics

Related Articles

Frequently Asked Questions

Questions about Algorithm

Common questions about this topic

How to get started with Ergo?

Start by getting a wallet (Nautilus for browser, Terminus for mobile). Back up your seed phrase securely offline. Get some ERG from an exchange (Gate.io, KuCoin) or DEX (Spectrum). Make a test transaction. Then explore: try DeFi on Spectrum, check out NFTs, or dive into the technology if you're a builder.

How-to

Getting Started

How to use Spectrum DEX on Ergo?

Connect your Nautilus wallet to Spectrum Finance, select tokens to swap, review the rate and slippage, then confirm. Spectrum uses AMM liquidity pools for instant trades. You can also provide liquidity to earn fees. All trades are atomic - they complete fully or not at all, with no front-running possible.

How-to

DeFi

Why does Ergo's fair launch matter?

Ergo had no pre-mine, no ICO, no VC allocation. 100% of ERG comes from mining. This means no insiders dumping on you, no VCs controlling governance, no foundation with majority stake. Fair launch creates genuine decentralization - the network belongs to miners and users, not early investors seeking exit liquidity.

Philosophy

Philosophy

Is Ergo a good investment?

This is not financial advice. Ergo has strong fundamentals: fair launch (no VC dump risk), innovative technology (eUTXO, Sigma Protocols, NiPoPoWs), active development, and a cypherpunk ethos. It's a smaller market cap project with higher risk/reward than established chains. Research thoroughly, understand the technology, and never invest more than you can afford to lose.

Comparison

Getting Started