Используйте SigmaUSD в качестве криптовалюты

Защитите свою криптовалютную ценность с помощью алгоритмической стабилизации, поддерживаемой ERG

SigmaUSD is a crypto-native dollar hedge backed by ERG reserves. No bank accounts, no centralized custodians - just math and smart contracts keeping your value stable.

Проблема

Centralized stablecoins like USDT and USDC can freeze your funds, require KYC, and depend on traditional banking. You need a truly decentralized alternative.

Решение

SigmaUSD uses an overcollateralized reserve pool of ERG to maintain its peg. Mint SigUSD when you want stability, redeem for ERG when you

Пошаговое руководство

SigmaUSD uses a reserve pool of ERG. SigUSD holders have a claim on the dollar value, while SigRSV holders absorb volatility in exchange for fees. The system maintains 400-800% collateralization.

Related Resources

Articles

Babel Fees: Pay Ergo Transaction Fees in Any Token

Ergo's Babel Fees turn gas payments into an on-chain market, letting users pay transaction fees in almost any token while miners still receive ERG.

Dec 14, 20259 min read

Ergo Oracle Pools: A Trust-Minimised Oracle Model Explained

Learn how Ergo's decentralized oracle pools minimize trust assumptions through on-chain aggregation, permissionless participation, and transparent data storage in eUTXOs.

Dec 11, 202512 min read

Infographics

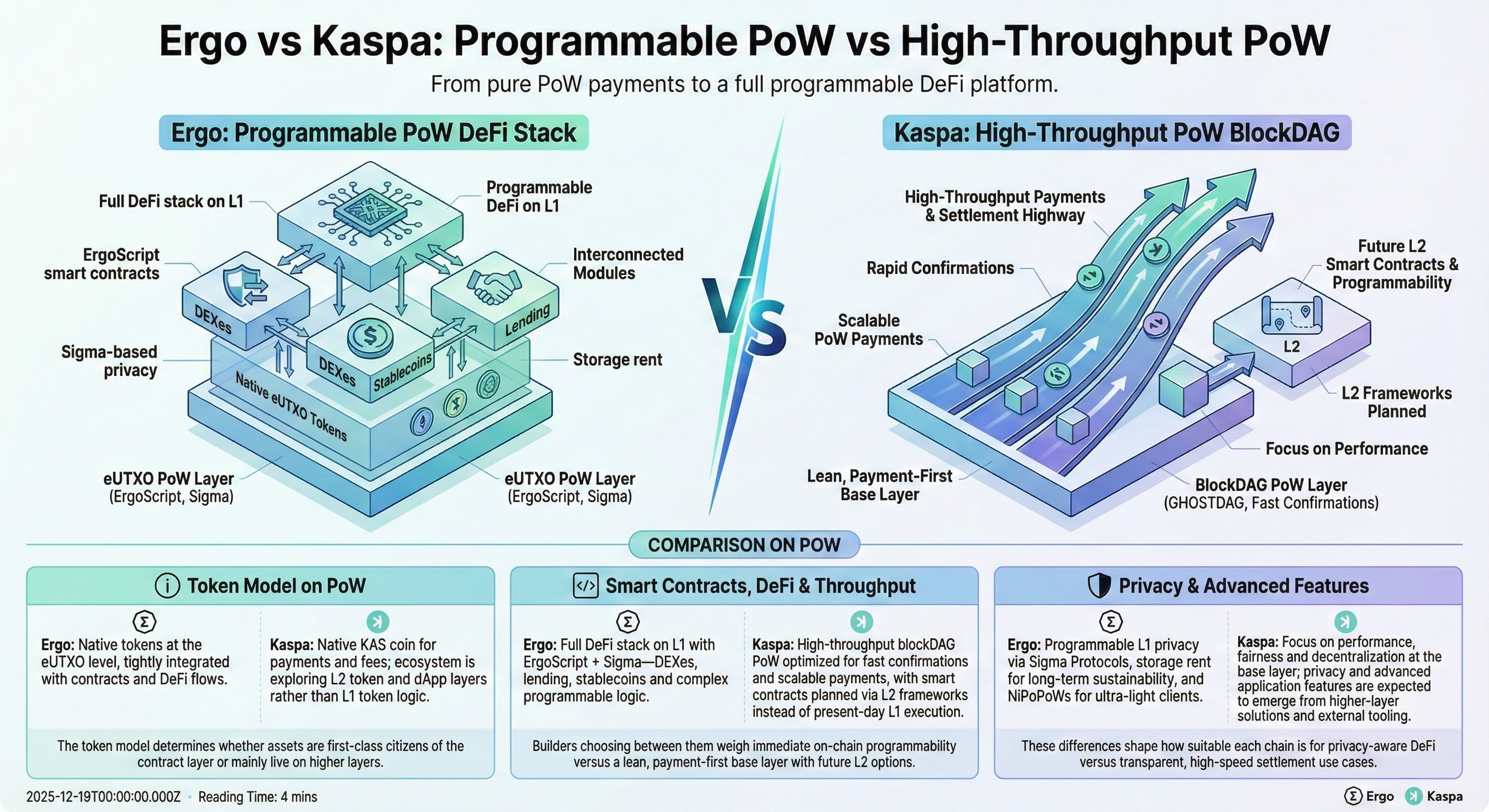

Ergo vs Kaspa: Programmable PoW vs High-Throughput PoW

Infographic comparing Ergo’s programmable eUTXO DeFi stack with Kaspa’s high-throughput PoW payments layer built on a BlockDAG.

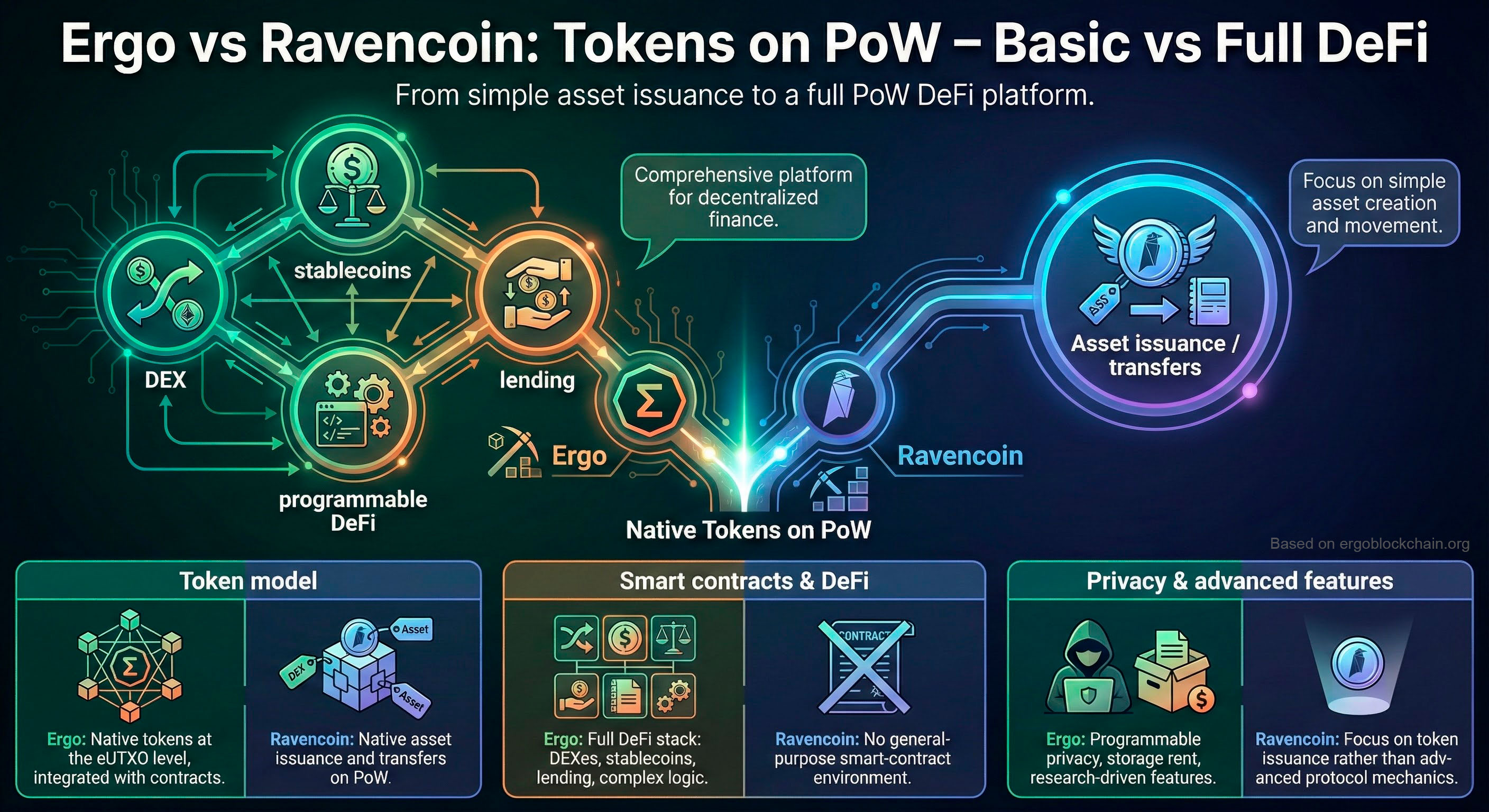

Ergo vs Ravencoin: Tokens on PoW – Basic vs Full DeFi

Infographic comparing Ergo and Ravencoin as PoW token platforms, from simple asset issuance to a full programmable DeFi stack with privacy and advanced features.

Готовы начать?

Complete this playbook and join the Ergo community.