Jan 20, 20255 min readVC-Chains & NarrativesBeginner

Fair & Secure: VC Chain vs Ergo at a Glance

How Ergo

Ergo

fair launch

VC chain

tokenomics

Autolykos

Proof-of-Work

decentralization

security

Click to Enlarge

About This Infographic

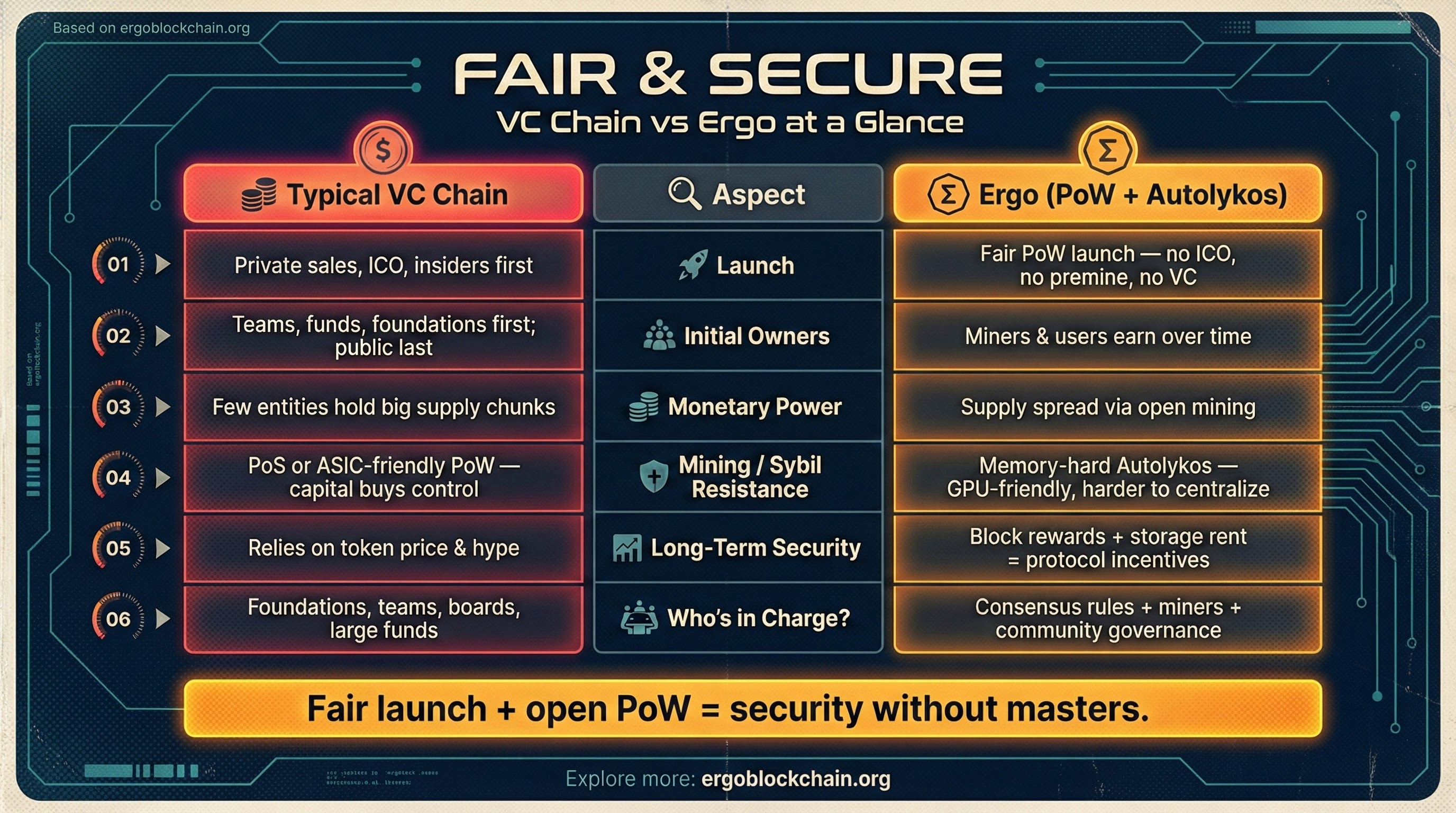

This infographic contrasts a typical VC chain with Ergo at a glance. On the left side, it shows how VC chains usually launch via private sales, ICOs and large insider allocations, putting teams, funds and foundations first and the public last. A few entities tend to control big chunks of the supply, and networks are often based on PoS or ASIC-friendly PoW where capital can simply buy control.

On the right side, the Ergo column explains how a fair Proof-of-Work launch with no ICO, no premine and no VC created a different dynamic. Miners and users earn coins over time through open mining, which drives wide supply distribution. Ergo's memory-hard Autolykos algorithm is GPU-friendly and harder to centralize.

Long-term security is anchored in block rewards and storage rent as protocol-level incentives. Governance emerges from consensus rules, miners and community participation instead of corporate control. The bottom line of the infographic reads: 'Fair launch + open PoW = security without masters.'

Systems Compared

Typical VC Chain

Private sales, ICO, insider allocations

Venture-backed chains

- Private sales, ICOs, large insider allocations

- Teams, funds, foundations first; public last

- Few entities control large supply chunks

- Often PoS or ASIC-friendly PoW; capital buys control

- Relies on token price and narrative for security

Ergo (PoW + Autolykos)

Fair launch, no ICO, no premine, no VC

Cypherpunk PoW

- Fair PoW launch: no ICO, no premine, no VC allocation

- Miners and users earning coins over time

- Supply widely distributed via open mining

- Memory-hard Autolykos – GPU-friendly, harder to centralize

- Block rewards plus storage rent provide protocol-level incentives

Key Points

Typical VC chains launch with private sales, ICOs and large insider allocations.

In VC chains, teams, funds and foundations are first in line; the public is last.

Supply and decision-making in VC chains are often concentrated in a few entities.

Many VC chains rely on PoS or ASIC-friendly PoW where capital can buy control.

Ergo launched with a fair PoW distribution: no ICO, no premine, no VC allocation.

On Ergo, miners and users earn coins over time through open, permissionless mining.

Ergo's Autolykos algorithm is memory-hard and GPU-friendly, making centralization harder.

Ergo's long-term security is driven by block rewards and storage rent at the protocol level.

Consensus rules, miners and community governance set the direction of Ergo, not foundations or VCs.

Fair launch plus open PoW provide 'security without masters'.

How to Read This Infographic

01.

Title: Fair & Secure: VC Chain vs Ergo at a Glance.

02.

Left column header: Typical VC Chain.

03.

Middle column header: Aspect.

04.

Right column header: Ergo (PoW + Autolykos).

05.

Row 1 — Aspect: Launch. VC: Private sales, ICO, large insider allocations. Ergo: Fair PoW launch. No ICO, no premine, no VC.

06.

Row 2 — Aspect: Initial Owners. VC: Teams, funds, foundations, public in last in line. Ergo: Miners and users earning coins over time.

07.

Row 3 — Aspect: Monetary Power. VC: A few entities control large chunks of supply. Ergo: Supply widely distributed via open mining.

08.

Row 4 — Aspect: Mining/Sybil Resistance. VC: Often PoS or ASIC-friendly PoW. Capital buys control. Ergo: Memory-hard Autolykos – GPU-friendly, harder to centralize.

09.

Row 5 — Aspect: Long-Term Security. VC: Relies on token price and narrative to keep validators around. Ergo: Block rewards plus storage rent provide protocol-level incentives.

10.

Row 6 — Aspect: Who's in Charge? VC: Foundations, teams, boards and large funds. Ergo: Consensus rules plus miners and community governance.

11.

Footer text: Fair launch + open PoW = security without masters.

Related Topics

Ergo fair launch

Autolykos mining

Ergo monetary policy

Ergo vs VC chains

Usage Guidelines

- • You can use this infographic in presentations, blog posts, or educational materials

- • Please keep the attribution link to ergoblockchain.org

- • For custom branding or editable files, contact the Ergo community

Embed this infographic

Copy the code below to use this infographic in your blog or website.

Please keep the link to ergoblockchain.org.

<a href="https://ergoblockchain.org/infographics/vc-chain-vs-ergo-fair-launch?utm_source=embed&utm_medium=referral" target="_blank" rel="noopener noreferrer">

<img

src="https://ergoblockchain.org/infographics/vc-chain-vs-ergo-fair-launch.png"

alt="Infographic comparing a typical VC-funded chain with Ergo across launch, ownership, mining, security and governance."

style="max-width:100%; height:auto; border:0;"

loading="lazy"

/>

</a>

<p style="font-size:12px; color:#888;">

Source: <a href="https://ergoblockchain.org/infographics/vc-chain-vs-ergo-fair-launch?utm_source=embed&utm_medium=referral" target="_blank" rel="noopener noreferrer">ergoblockchain.org</a>

</p>Explore More Ergo Infographics

Discover visual guides to Ergo's PoW, eUTXO smart contracts, storage rent, privacy and more.

Browse All Infographics