Mar 25, 20257 min readVC-Chains & NarrativesBeginner

Money Without Masters

Open, programmable, censorship-resistant finance. Built on Ergo.

Ergo

money without masters

traditional banking

VC crypto

fair launch

Proof-of-Work

eUTXO

Sigma Protocols

financial sovereignty

cypherpunk ethos

Click to Enlarge

About This Infographic

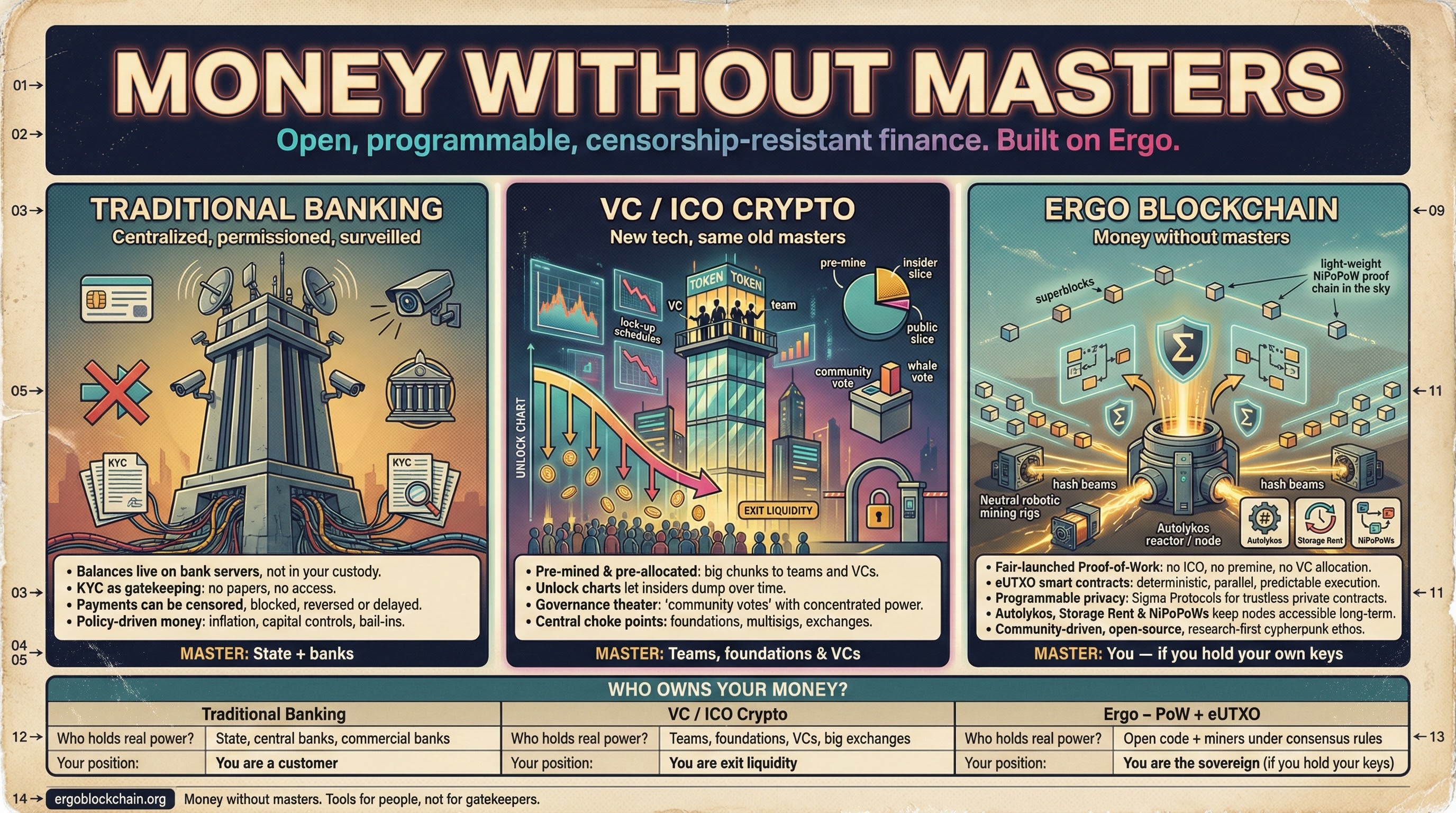

This infographic, titled "Money Without Masters", compares three financial systems side by side: traditional banking, VC / ICO-style crypto and the Ergo blockchain. It asks a simple but uncomfortable question: "Who actually owns your money?"

On the left, Traditional Banking is shown as a centralized, permissioned and surveilled stack where balances live on bank servers, KYC acts as gatekeeping and payments can be censored, frozen or reversed. In the middle, VC / ICO Crypto highlights how pre-mines, unlock charts, governance theater and centralized choke points often recreate the same power dynamics with new branding.

On the right, Ergo Blockchain – Money without masters presents an alternative: fair-launched Proof-of-Work with no ICO, no premine and no VC allocation; eUTXO smart contracts with deterministic execution; programmable privacy via Sigma Protocols; and protocol-level sustainability through Autolykos, Storage Rent and NiPoPoWs. A bottom table, "Who Owns Your Money?", reframes the user: from "customer" in banks and "exit liquidity" on VC chains to "sovereign — if you hold your own keys" on Ergo.

Systems Compared

Traditional Banking

Centralized, permissioned, surveilled.

Legacy finance

- Balances live on bank servers, not directly in your custody.

- KYC as gatekeeping: without the right papers, accounts can be denied or closed.

- Payments can be censored, blocked, reversed or delayed.

- Policy-driven money: inflation, capital controls and bail-ins decided from above.

- Master: State + banks.

VC / ICO Crypto

New tech, same old masters.

Speculative chains

- Pre-mined and pre-allocated: large chunks of supply to teams, foundations and VCs.

- Unlock charts that let insiders dump on the market over time.

- Governance theater where "community votes" mask concentrated voting power.

- Central choke points (foundations, multisigs, exchanges) can stall upgrades or listings.

- Master: Teams, foundations and VCs.

Ergo Blockchain

Money without masters.

Cypherpunk PoW + eUTXO

- Fair-launched Proof-of-Work: no ICO, no premine, no VC allocation.

- eUTXO smart contracts with deterministic, parallel and predictable execution.

- Programmable privacy using Sigma Protocols — privacy-preserving contracts without trusted third parties.

- Protocol-level sustainability via Autolykos, Storage Rent and NiPoPoWs to keep nodes accessible.

- Master: You — if you hold your own keys.

Key Points

Traditional banking is centralized and permissioned, with account balances held by banks and subject to KYC, censorship, freezes and policy-driven money decisions.

In VC / ICO crypto, large pre-mines and allocations give teams, foundations and VCs outsized control over supply and governance.

Unlock charts and central choke points like foundations, multisigs and exchanges can turn users into exit liquidity and limit true decentralization.

Ergo uses a fair-launched Proof-of-Work model with no ICO, no premine and no VC allocation.

eUTXO smart contracts on Ergo provide deterministic, parallel and predictable execution for financial applications.

Sigma Protocols enable programmable privacy, allowing privacy-preserving contracts without trusted third parties.

Long-term sustainability is supported by Autolykos, Storage Rent and NiPoPoWs, keeping nodes accessible beyond just data centers.

Ergo emphasizes a community-driven, open-source and research-first cypherpunk ethos.

The infographic's comparison table frames traditional banking users as customers, VC/ICO users as exit liquidity, and Ergo users as sovereigns if they hold their own keys.

The core message is that money without masters is possible when control is pushed to users rather than states, banks or VC teams.

How to Read This Infographic

01.

Main title: Money Without Masters.

02.

Subtitle: Open, programmable, censorship-resistant finance. Built on Ergo.

03.

Left panel heading: Traditional Banking – Centralized, permissioned, surveilled.

04.

Left panel bullets: Account-based system: balances live on bank servers, not in your custody. KYC as gatekeeping: no papers, no access. Accounts can be denied or closed. Censorship & freezes: payments can be blocked, reversed, or delayed. Policy-driven money: inflation, capital controls, and bail-ins decided from above.

05.

Left panel footer: Master: State + banks.

06.

Middle panel heading: VC / ICO Crypto – New tech, same old masters.

07.

Middle panel bullets: Pre-mined & pre-allocated: large chunks of supply to teams, foundations, and VCs. Unlock charts: early insiders dump on the market over time. Governance theater: "community votes" with concentrated voting power. Central choke points: foundations, multisigs, and exchanges can stall upgrades or listings.

08.

Middle panel footer: Master: Teams, foundations, and VCs.

09.

Right panel heading: Ergo Blockchain – Money without masters.

10.

Right panel bullets: Fair-launched Proof-of-Work: no ICO, no premine, no VC allocation. eUTXO smart contracts: deterministic, parallel, predictable execution. Programmable privacy: Sigma Protocols enable privacy-preserving contracts. Long-term sustainability: Autolykos, Storage Rent, and NiPoPoWs keep nodes accessible. Community-driven: open-source, research-first, cypherpunk ethos.

11.

Right panel footer: Master: You — if you hold your own keys.

12.

Bottom section heading: Who Owns Your Money?

13.

Bottom table rows: Traditional Banking – Who holds real power? State, central banks, commercial banks. Your position: You are a customer. VC / ICO Crypto – Who holds real power? Teams, foundations, VCs, big exchanges. Your position: You are exit liquidity. Ergo (PoW + eUTXO) – Who holds real power? Open code + miners under consensus rules. Your position: You are the sovereign (if you hold your keys).

14.

Footer URL: ergoblockchain.org.

Related Topics

Ergo philosophy and ethos

Fair launch vs VC chains

eUTXO and financial sovereignty

Programmable privacy on Ergo

Cypherpunk narratives in crypto

Usage Guidelines

- • You can use this infographic in presentations, blog posts, or educational materials

- • Please keep the attribution link to ergoblockchain.org

- • For custom branding or editable files, contact the Ergo community

Embed this infographic

Copy the code below to use this infographic in your blog or website.

Please keep the link to ergoblockchain.org.

<a href="https://ergoblockchain.org/infographics/money-without-masters-ergo-vs-banks-and-vc-crypto?utm_source=embed&utm_medium=referral" target="_blank" rel="noopener noreferrer">

<img

src="https://ergoblockchain.org/infographics/money-without-masters-ergo-vs-banks-and-vc-crypto.png"

alt="Infographic titled Money Without Masters comparing traditional banking and VC/ICO crypto to the Ergo blockchain in terms of control, censorship and who really owns your money."

style="max-width:100%; height:auto; border:0;"

loading="lazy"

/>

</a>

<p style="font-size:12px; color:#888;">

Source: <a href="https://ergoblockchain.org/infographics/money-without-masters-ergo-vs-banks-and-vc-crypto?utm_source=embed&utm_medium=referral" target="_blank" rel="noopener noreferrer">ergoblockchain.org</a>

</p>Explore More Ergo Infographics

Discover visual guides to Ergo's PoW, eUTXO smart contracts, storage rent, privacy and more.

Browse All Infographics