Dec 15, 20254 min readComparisons & MatricesIntermediate

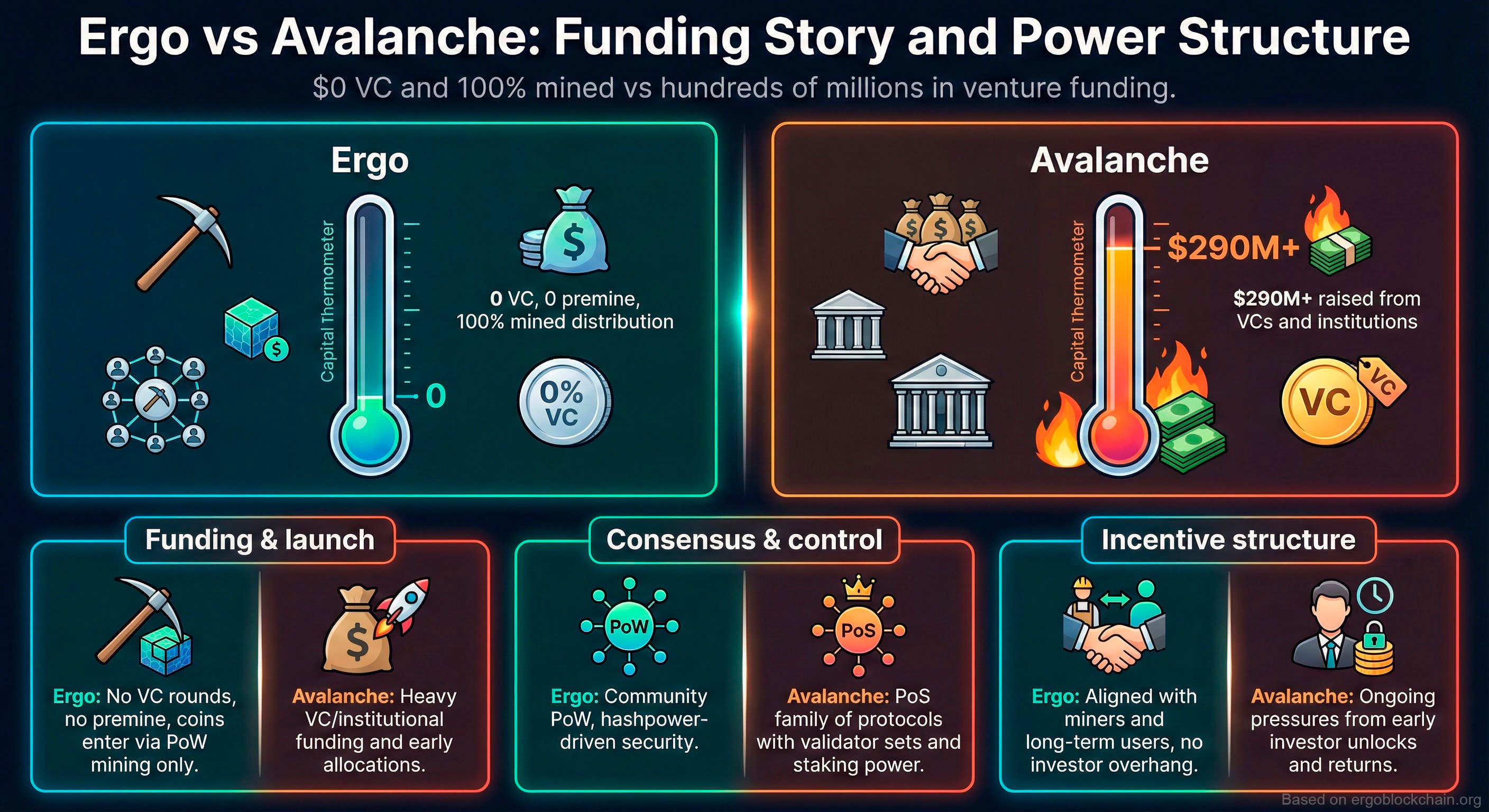

Ergo vs Avalanche: Funding Story and Power Structure

$0 VC and 100% mined vs hundreds of millions in venture funding.

Ergo

Avalanche

VC funding

fair launch

PoW vs PoS

token distribution

governance

incentive structure

Click to Enlarge

About This Infographic

This infographic focuses on the capital and governance stories behind Ergo and Avalanche rather than just raw tech specs.

Ergo is presented as a fair-launch PoW chain with 0 VC funding, 0 premine and 100% mined distribution, emphasizing community-driven security and alignment with long-term users and miners.

Avalanche is shown as a PoS ecosystem that has raised over $290M from VCs and institutions, with validator sets and staking power shaped by large early investors and ongoing capital flows.

Funding & Launch

- Ergo: No VC rounds, no premine; coins enter the economy via PoW mining only.

- Avalanche: Heavy VC and institutional funding with early allocations at launch.

- Launch structure defines who holds power from day one and how neutral the chain appears to new participants.

Consensus & Control

- Ergo: Community PoW with hashpower-driven security and permissionless miner entry.

- Avalanche: PoS family of protocols where validator sets and staking power can be capital-concentrated.

- The consensus choice affects how easily new actors can join security and how much influence early capital can exert.

Incentive Structure

- Ergo: Incentives are aligned with miners and long-term users, with no investor overhang from large VC positions.

- Avalanche: Ongoing pressures from early investor unlocks, returns and institutional expectations.

- These incentive differences influence governance debates, upgrade decisions and the long-term culture of each ecosystem.

Key Points

Ergo launched with no VC rounds, no premine and coins entering the system only via PoW mining.

Avalanche raised hundreds of millions of dollars from VCs and institutions, with early allocations playing a key role.

Ergo’s consensus is community PoW, where hashpower—not venture stakes—secures the network.

Avalanche uses PoS with validator sets and staking power influenced by capital concentration.

Incentives on Ergo are aligned with miners and long-term users, while Avalanche faces ongoing pressures from early investor unlocks and expected returns.

How to Read This Infographic

01.

Start with the large panels at the top: compare the capital thermometer and icons for Ergo versus Avalanche to grasp the funding contrast at a glance.

02.

Then move to the three comparison blocks—funding & launch, consensus & control, and incentive structure—to see how capital origin ties into who controls the network and why.

03.

Use these sections to think about how different funding stories can shape long-term governance, decentralization and user alignment on each chain.

Related Topics

fair-launch vs VC-funded blockchains

Ergo vs Avalanche

PoW vs PoS governance

token distribution and decentralization

investor unlocks and overhang

Usage Guidelines

- • You can use this infographic in presentations, blog posts, or educational materials

- • Please keep the attribution link to ergoblockchain.org

- • For custom branding or editable files, contact the Ergo community

Embed this infographic

Copy the code below to use this infographic in your blog or website.

Please keep the link to ergoblockchain.org.

<a href="https://ergoblockchain.org/infographics/ergo-vs-avalanche-funding-story-and-power-structure?utm_source=embed&utm_medium=referral" target="_blank" rel="noopener noreferrer">

<img

src="https://ergoblockchain.org/og/infographics/ergo-vs-avalanche-funding-story-and-power-structure.png"

alt="Infographic titled “Ergo vs Avalanche: Funding Story and Power Structure”. On the left, Ergo shows a cold capital thermometer at zero and icons for mining and community PoW. On the right, Avalanche shows a red-hot thermometer labeled $290M+ with burning stacks of cash, VC coins and banks, plus comparison blocks for funding & launch, consensus & control, and incentive structure."

style="max-width:100%; height:auto; border:0;"

loading="lazy"

/>

</a>

<p style="font-size:12px; color:#888;">

Source: <a href="https://ergoblockchain.org/infographics/ergo-vs-avalanche-funding-story-and-power-structure?utm_source=embed&utm_medium=referral" target="_blank" rel="noopener noreferrer">ergoblockchain.org</a>

</p>Explore More Ergo Infographics

Discover visual guides to Ergo's PoW, eUTXO smart contracts, storage rent, privacy and more.

Browse All Infographics