General

Beginner

Updated 1/15/2025

What is

Coins?

Native cryptocurrencies that operate on their own blockchain (like ERG on Ergo, BTC on Bitcoin), as opposed to tokens which run on another blockchain.

In cryptocurrency terminology, 'coins' specifically refers to native cryptocurrencies that operate on their own independent blockchain. ERG is the native coin of the Ergo blockchain, just as BTC is Bitcoin's native coin and ETH is Ethereum's. Coins are used to pay transaction fees, reward miners/validators, and serve as the primary medium of exchange on their network. This distinguishes them from 'tokens' which are created on top of existing blockchains (like ERC-20 tokens on Ethereum or native tokens on Ergo).

Key Points

- Native currency of a blockchain (ERG, BTC, ETH)

- Operates on its own independent blockchain

- Used to pay transaction fees

- Rewards miners/validators

- Different from tokens (which run on other chains)

- ERG is Ergo's native coin

Use Cases

1

Understanding cryptocurrency terminology

2

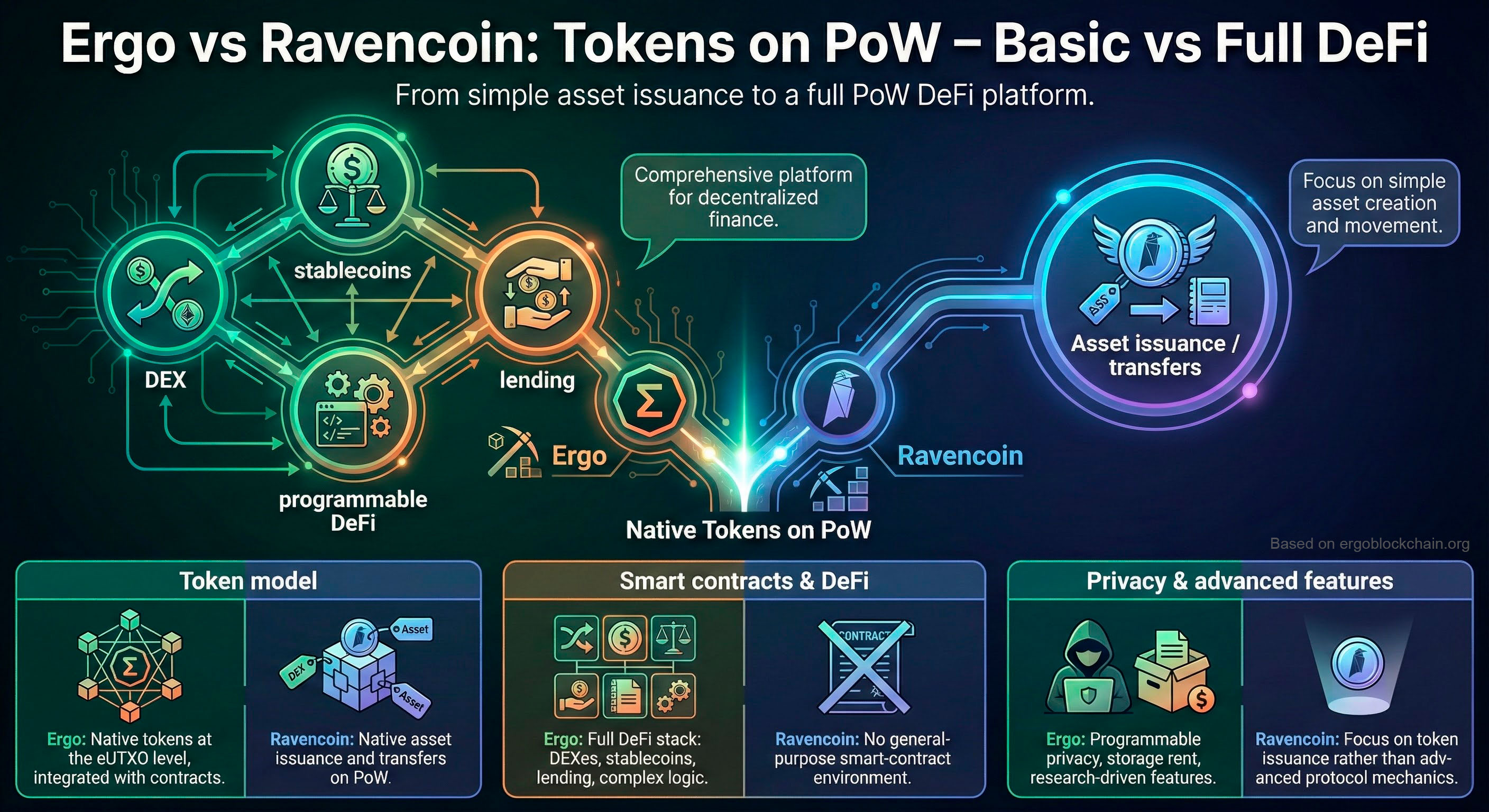

Distinguishing coins from tokens

3

Knowing what pays transaction fees

4

Evaluating blockchain native assets

Technical Details

On Ergo, ERG is the native coin stored in register R0 of every box. It's required for transaction fees and is the only asset that can pay miner fees directly (though Babel fees allow token fee payment through intermediaries). Native tokens on Ergo are stored in register R2 and require ERG for the box minimum value. The distinction matters for understanding fee structures and asset types.

Related Infographics

Related Articles

Frequently Asked Questions

Questions about Coins

Common questions about this topic

How to get started with Ergo?

Start by getting a wallet (Nautilus for browser, Terminus for mobile). Back up your seed phrase securely offline. Get some ERG from an exchange (Gate.io, KuCoin) or DEX (Spectrum). Make a test transaction. Then explore: try DeFi on Spectrum, check out NFTs, or dive into the technology if you're a builder.

How-to

Getting Started

What is storage rent on Ergo?

Storage rent is Ergo's solution to state bloat. Boxes (UTXOs) that remain unspent for 4+ years can have a small fee deducted by miners. This incentivizes cleaning up unused state, provides long-term miner revenue after emission ends, and keeps the blockchain sustainable. Lost coins eventually return to circulation instead of being locked forever.

Explainer

Technology

Is Ergo a good investment?

This is not financial advice. Ergo has strong fundamentals: fair launch (no VC dump risk), innovative technology (eUTXO, Sigma Protocols, NiPoPoWs), active development, and a cypherpunk ethos. It's a smaller market cap project with higher risk/reward than established chains. Research thoroughly, understand the technology, and never invest more than you can afford to lose.

Comparison

Getting Started

How to use Spectrum DEX on Ergo?

Connect your Nautilus wallet to Spectrum Finance, select tokens to swap, review the rate and slippage, then confirm. Spectrum uses AMM liquidity pools for instant trades. You can also provide liquidity to earn fees. All trades are atomic - they complete fully or not at all, with no front-running possible.

How-to

DeFi