General

Intermediate

Updated 1/15/2025

What is

Blockchain Resilience?

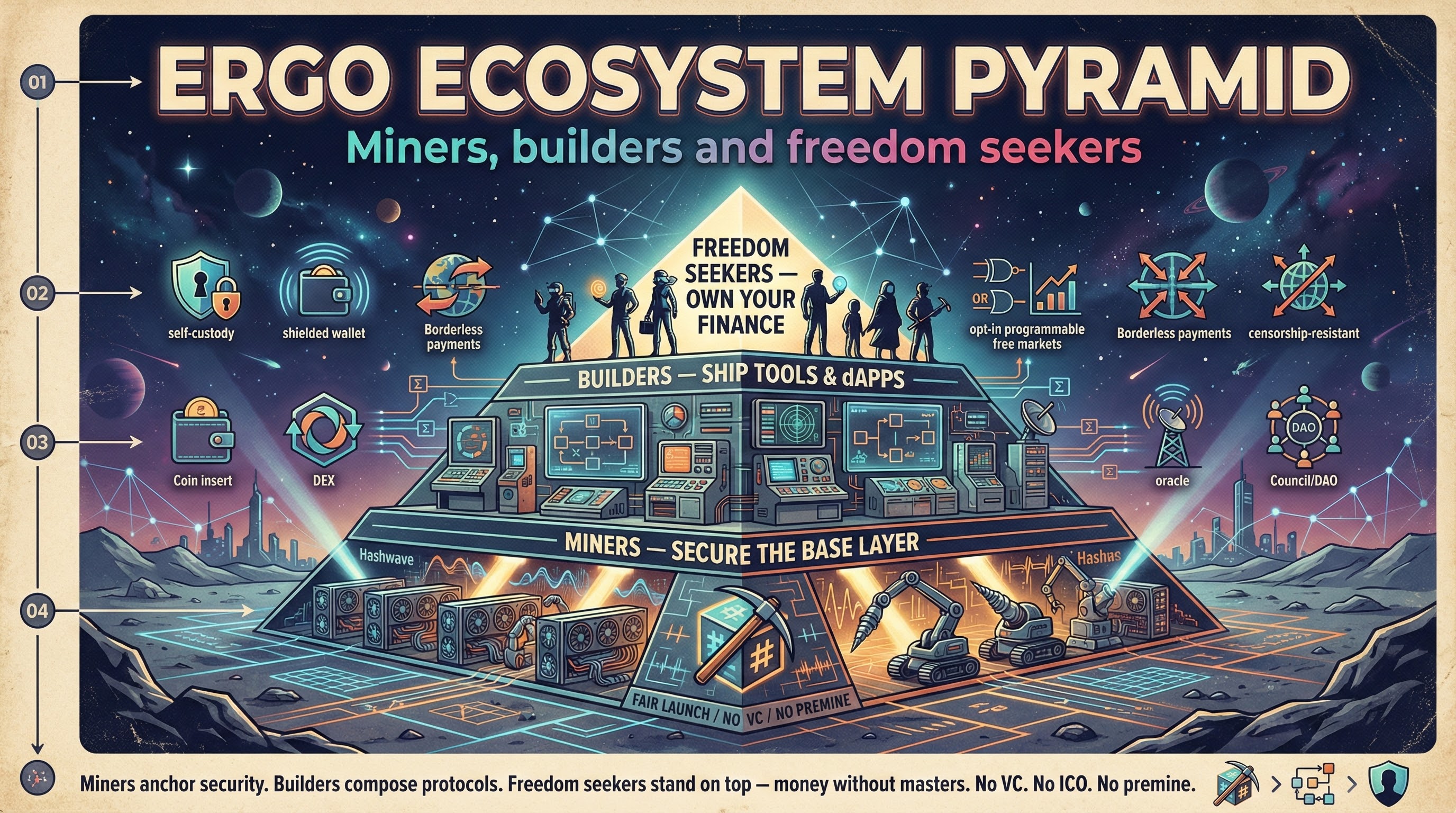

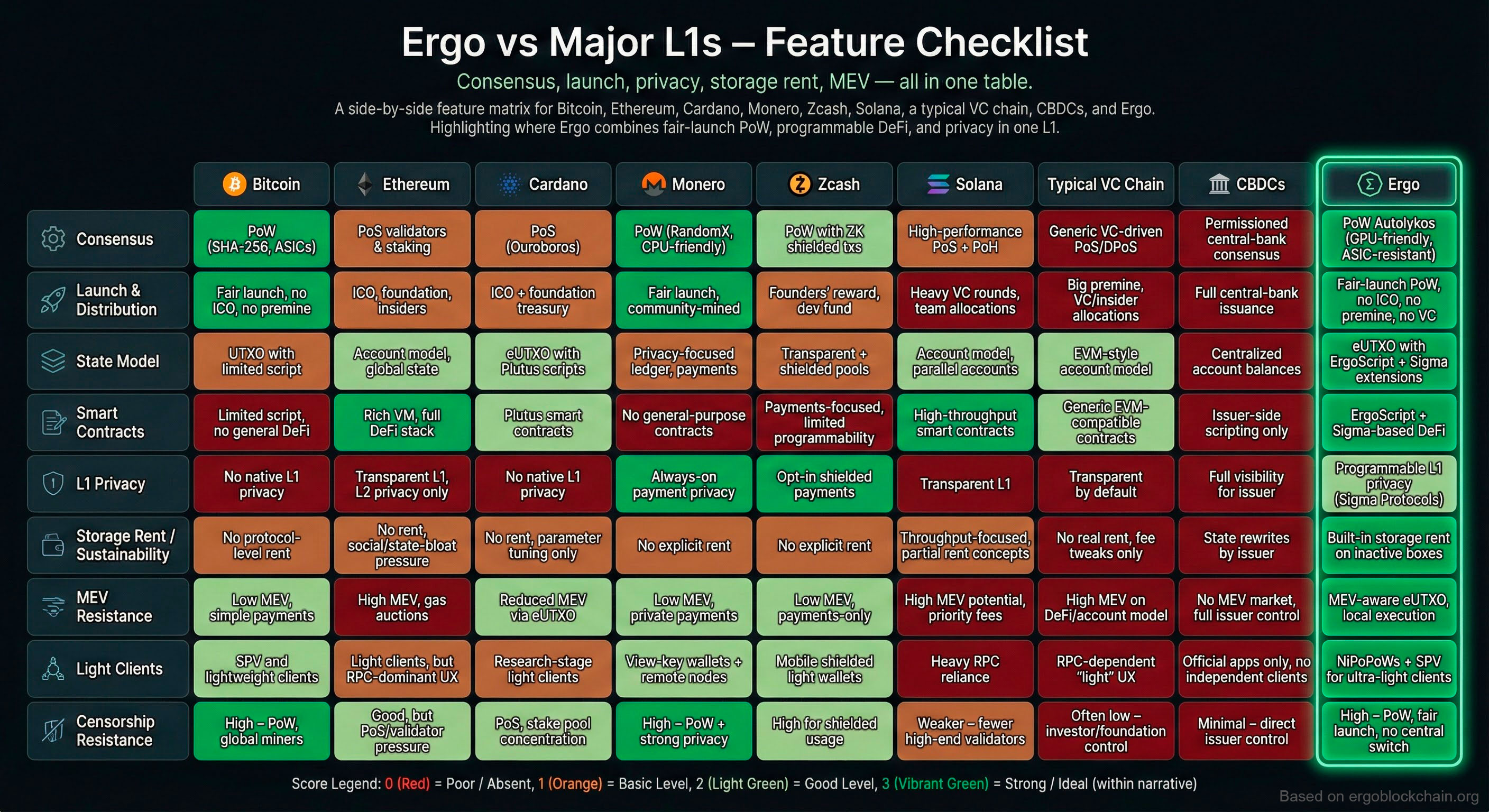

A blockchain's ability to survive attacks, network partitions, and economic pressures. Ergo achieves resilience through PoW, decentralization, and sustainable economics.

Blockchain resilience refers to a network's ability to continue operating correctly under adverse conditions - including attacks, network partitions, regulatory pressure, and economic stress. Ergo is designed for long-term resilience through multiple mechanisms: Proof-of-Work provides objective consensus that survives network splits, ASIC-resistance promotes mining decentralization, Storage Rent ensures economic sustainability beyond emission, and the eUTXO model prevents certain attack vectors. A resilient blockchain can survive and recover from challenges that would compromise less robust systems.

Key Points

- Ability to survive attacks and adverse conditions

- PoW provides objective, partition-tolerant consensus

- ASIC-resistance maintains mining decentralization

- Storage Rent ensures long-term economic viability

- eUTXO prevents MEV and reentrancy attacks

- Designed for decades of operation

Use Cases

1

Evaluating blockchain long-term viability

2

Understanding security design principles

3

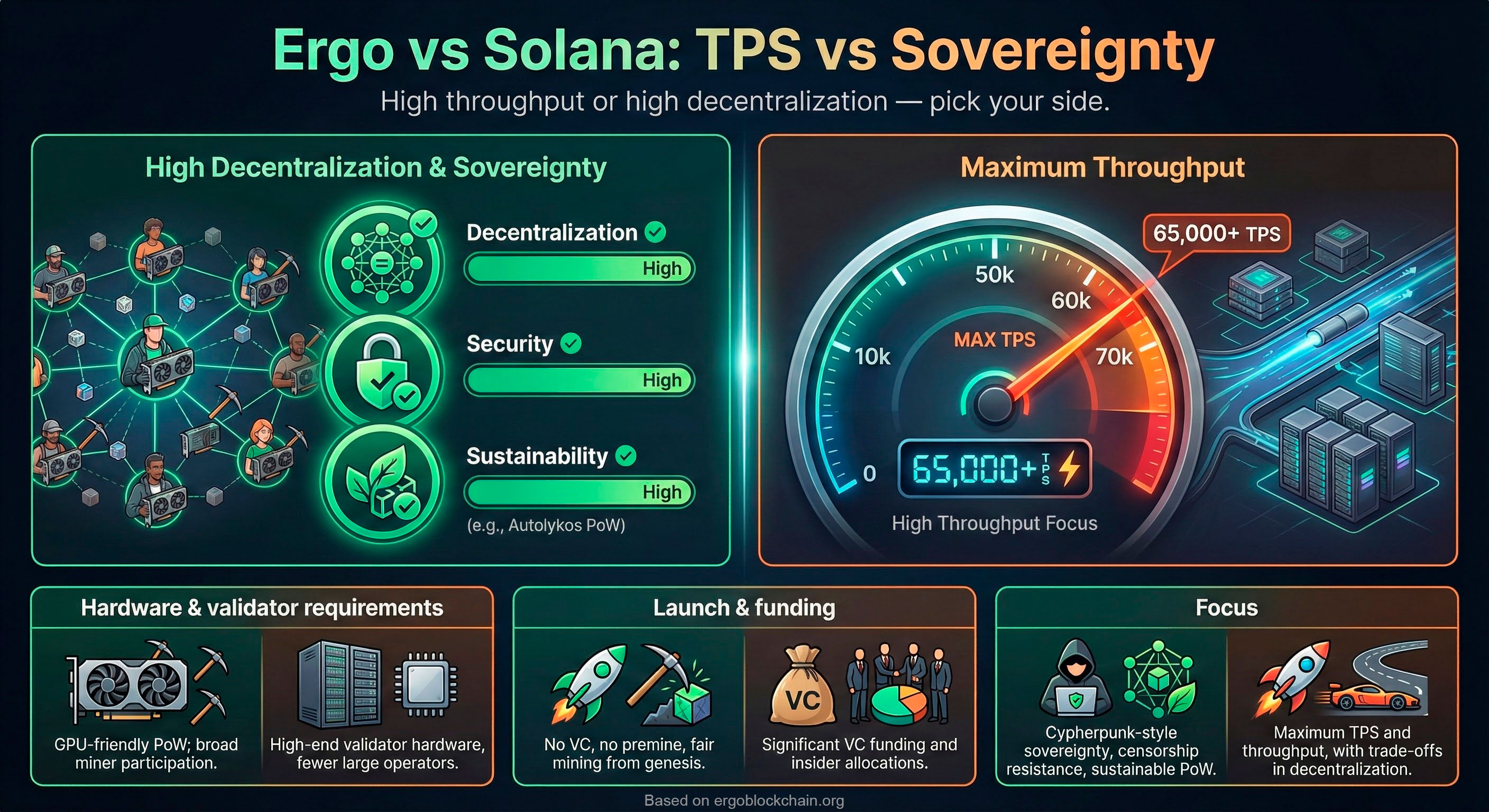

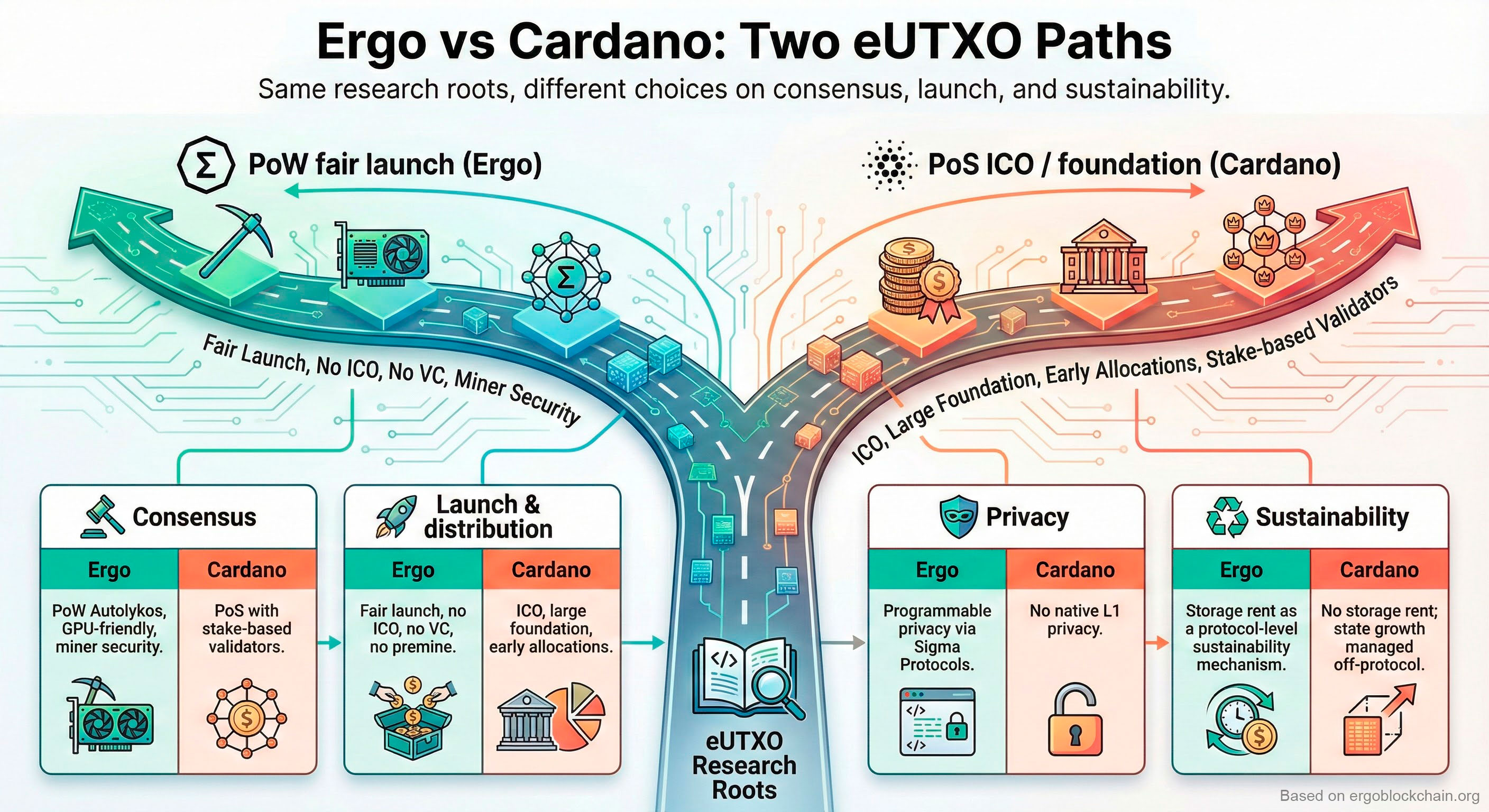

Comparing consensus mechanism tradeoffs

4

Assessing investment risk factors

Technical Details

Ergo's resilience comes from: 1) Autolykos PoW - objective consensus that resolves network splits without coordination, 2) Memory-hard mining - prevents ASIC centralization, 3) Storage Rent - sustainable fee model after emission ends, 4) eUTXO - deterministic execution preventing exploitation, 5) NiPoPoWs - enables light clients and cross-chain verification, 6) Open source - community can fork if needed.

Related Infographics

Related Articles

Frequently Asked Questions

Questions about Blockchain Resilience

Common questions about this topic

How to get started with Ergo?

Start by getting a wallet (Nautilus for browser, Terminus for mobile). Back up your seed phrase securely offline. Get some ERG from an exchange (Gate.io, KuCoin) or DEX (Spectrum). Make a test transaction. Then explore: try DeFi on Spectrum, check out NFTs, or dive into the technology if you're a builder.

How-to

Getting Started

Is Ergo a good investment?

This is not financial advice. Ergo has strong fundamentals: fair launch (no VC dump risk), innovative technology (eUTXO, Sigma Protocols, NiPoPoWs), active development, and a cypherpunk ethos. It's a smaller market cap project with higher risk/reward than established chains. Research thoroughly, understand the technology, and never invest more than you can afford to lose.

Comparison

Getting Started

What is storage rent on Ergo?

Storage rent is Ergo's mechanism for long-term sustainability. Boxes (UTXOs) that remain unspent for ~4 years pay a small fee, which goes to miners. This prevents state bloat, recirculates lost coins, and ensures miners have income even after emission ends. It's like paying rent for blockchain storage space.

Explainer

Technology

How do miners earn money on Ergo?

Ergo miners earn from three sources: block rewards (newly minted ERG), transaction fees, and storage rent. Block rewards decrease over time according to the emission schedule, but storage rent ensures long-term income even after all ERG is mined. Most miners use pools for consistent payouts.

How-to

Mining